Why I Bought Oscar Health Stock (Portfolio Update)

Adding to OSCR is a good risk/reward here

As a part of the expansion of the newsletter, Ryan and I will begin regularly updating subscribers on our portfolio changes.

We will always act ethically when disclosing trades. This simply means we will disclose what we will be doing before doing it. No front-running.

Today, I made Oscar Health (Ticker: OSCR) 5.8% of my portfolio. As I disclosed in my research report from last week, I believe the stock is undervalued right now and decided to buy shares:

A roughly ~5% position was chosen because of Oscar Health’s risk profile. Not too big to blow up the portfolio if I am wrong, but not too small that it will be meaningless if I am correct and the stock is a ten bagger.

To fund the purchase, I sold a tiny position in Gravity & Co and used my existing cash pile. Gravity was a starter position that was never written up on the newsletter.

Here is what my long portfolio looks like after today’s trades, courtesy of our friends at Fiscal AI:

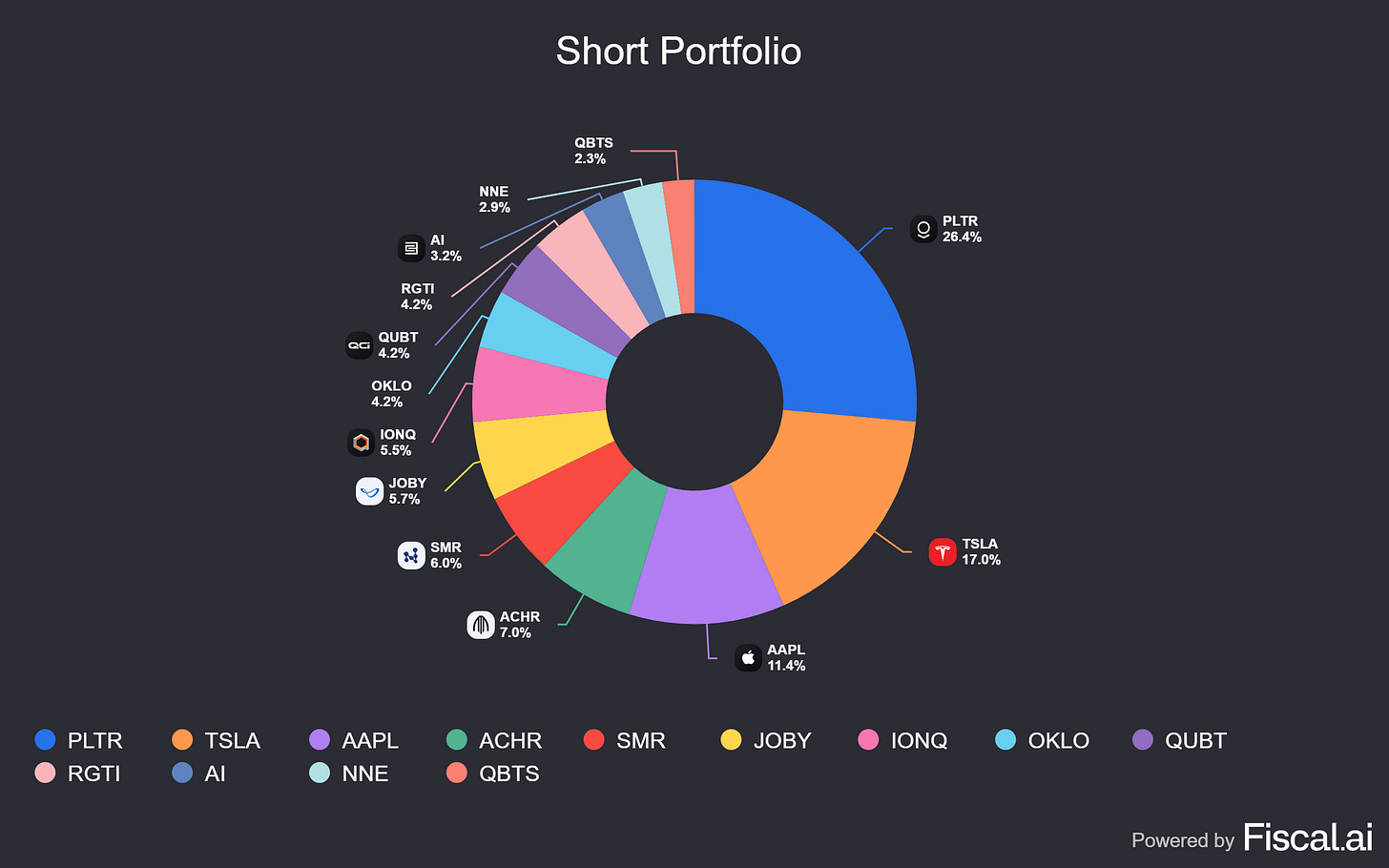

As a full disclosure, here is what my short portfolio — which is under 5% the size of my long portfolio — looks like as of the close today:

Again, these shorts are a small % of the portfolio and I remain heavily tilted net long. I am thinking of providing more in depth thoughts on my shorting philosophy and why I decided to start adding this to my investing strategy now, but today is not that day and I do not want readers to think I have a massive short on Palantir that will drive my entire portfolio’s returns.

Regardless, give the Oscar Health report a read! I am proud of the finished product and think any investor will appreciate the analysis.

Here’s to remaining a shareholder for many years.

-Brett

Thanks for the clear disclosure and detailed update. I appreciate the disciplined approach to position sizing—5% in Oscar Health strikes a sensible balance between conviction and risk management. Using a small starter position in Gravity to fund the buy shows prudent capital allocation.

I also like that you’re upfront about the short book being small and a complement to your long bias. That kind of transparency helps readers understand your overall risk posture without overhyping any single trade.

Looking forward to your deeper dive on shorting philosophy when you’re ready—short strategies are often misunderstood but can be powerful tools when used thoughtfully.

Keep sharing these solid, data-backed insights. That’s how investors build real, lasting portfolios.