Why I am Shorting Speculative Stocks In 2026 (PLTR, RGTI, OKLO + More)

There is a bounty of investment opportunities for those with the courage to take the plunge

Today, paid subscribers to Emerging Moats receive a piece on my shorting strategy, current short portfolio, and watchlist for 2026. Expect one to three of these articles a year.

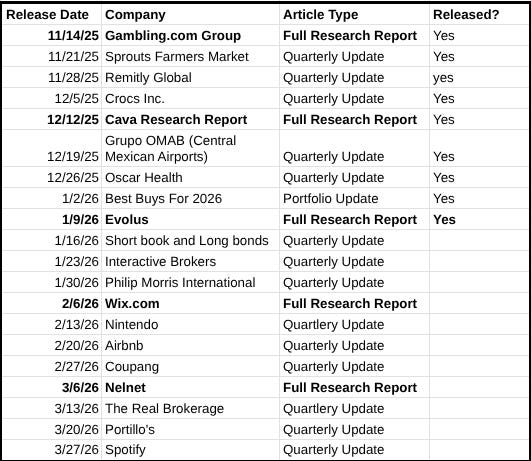

Below is the Q1 schedule for the newsletter. Notice that I have made one change: Wix.com has replaced MercadoLibre for the upcoming full research report. MercadoLibre is covered extensively in the newsletter community, and I believe Wix.com could be highly interesting trading at below 10x free cash flow.

Other articles will go through existing portfolio + watchlist stocks, staggered to occur after quarterly earnings are released. We will begin next week with Interactive Brokers.

Many people will tell you not to short stocks. The responses are almost scripted:

“A stock can only go down 100%, but can go up by infinity.”

“Over the long term, the market goes up, making it much harder to be short than long.”

“The market can remain irrational longer than you can remain solvent!” (HR Karen voice)

“What about the risk of a short squeeze?”

And on. And on. And on.

The average stock will be down 10 years from now (especially in real terms). Statistically, most stocks perform poorly. That feels like a good pond to fish in. I believe people are afraid to short stocks because it is easy to look foolish, does not “feel” good, goes against the crowd, and is villainized by the media. Profiting on short sales is misunderstood.

(Here is an explainer on how short selling works. Or, ask your local LLM.)

I write articles for the Motley Fool. They publish hundreds of articles a day, and not one will speak positively about shorting. If I were to pitch an article titled “3 Stocks To Short in 2026” it would likely not get approved, because they don’t want readers to short a stock, make a mistake, and blame them. I understand; it is simply the nature of their business.

In my personal portfolio, I am free to invest how I want. As I see it today, we are in a great period to short stocks.

My shorting strategy is simple. Look for stocks that are wildly overvalued, use heavy diversification, and make it a small percentage of the overall portfolio (I am typically aiming for 10% the size of the long book).

There are a plethora of these stocks out there. Use a simple screener on Fiscal.AI: market cap above $100 million, P/S ratio above 100 (exclude Biotech). That just returned 71 results. Fun times we live in, huh?

I do not care about catalysts. Any stock with the risk of a 10x increase will be sized appropriately, allowing me to safely ride the volatility rollercoaster.

The short book currently makes up 5% of the portfolio. Performance has been acceptable for a raging bull market, and I now want to add to my positions. My goal is to build out dozens of small short positions over time.

The benefits of the short portfolio are multifold:

Absolute returns. I believe there is an opportunity for strong absolute returns in shorting, especially in speculative pre-revenue stocks.

More funding for longs. Many novices do not appreciate that long/short means you take the cash proceeds from your short sales and buy something else. As long as your long positions outperform your shorts + funding costs, you make money. The best short is sometimes the stock that goes nowhere.

Hedging for market downturns. My goal as an investor is to maximize absolute returns over the long term. One way to do this is by minimizing drawdowns. The size of my short book will not eliminate drawdowns, but it will give me much more flexibility to “tune” the portfolio through the market cycle.

Let’s dive into the existing short portfolio. If you have any short candidates, please email or DM me on Substack, and a year of Emerging Moats Research will be granted if your idea is selected for the portfolio.

Keep reading with a 7-day free trial

Subscribe to Emerging Moats Research to keep reading this post and get 7 days of free access to the full post archives.