What Would American Semiconductor Manufacturing Company Look Like?

The west needs an ASMC. Yesterday.

“Intel Corporation today announced it has entered into a series of agreements with ASML Holding N.V. intended to accelerate the development of 450-millimeter (mm) wafer technology and extreme ultra-violet (EUV) lithography totaling €3.3 billion (approximately $4.1 billion)…To achieve this, Intel is participating in a multi-party development program that includes a cash contribution by Intel to fund relevant ASML research and development (R&D) efforts as well as equity investments in ASML.” - July 9th, 2012

In order to bring extreme ultra-violet (EUV) lithography to reality, ASML was funded by customers such as Intel. 13 years later, it dominates the high end lithography market.

It is time for ASML to return the favor.

The United States government and the big technology players do not want to rely on Taiwan Semiconductor Manufacturing Company (TSMC) as the sole chokepoint for advanced computer chips.

Relying on one company to pump out advanced semiconductors is risky on its own. But the fact it is based in Taiwan? Western economies (including Japan, South Korea, etc.) are playing with fire.

As Mostly Borrowed Ideas and Liberty’s Highlights (two newsletters you should subscribe to immediately) have discussed, TSMC is the backbone of the technology giants. No TSMC, no AI revolution. No cloud.

Without TSMC, years of economic progress would be wiped away. Tens of trillions in market value could evaporate, a wealth destruction event unrivaled in history (wiping away the value of your 401k account, I may add).

We cannot let that happen. Regardless of the cost, it is in our best interest for the United States and her allies to have a robust semiconductor manufacturing supply chain. Whether for economic prosperity or national security (or both), it is the logical thing to do.

The current strategy is not working, either. We need a new solution. A homegrown solution. American Semiconductor Manufacturing Corporation (ASMC).

And it needs to happen yesterday.

Spin Off And Funding

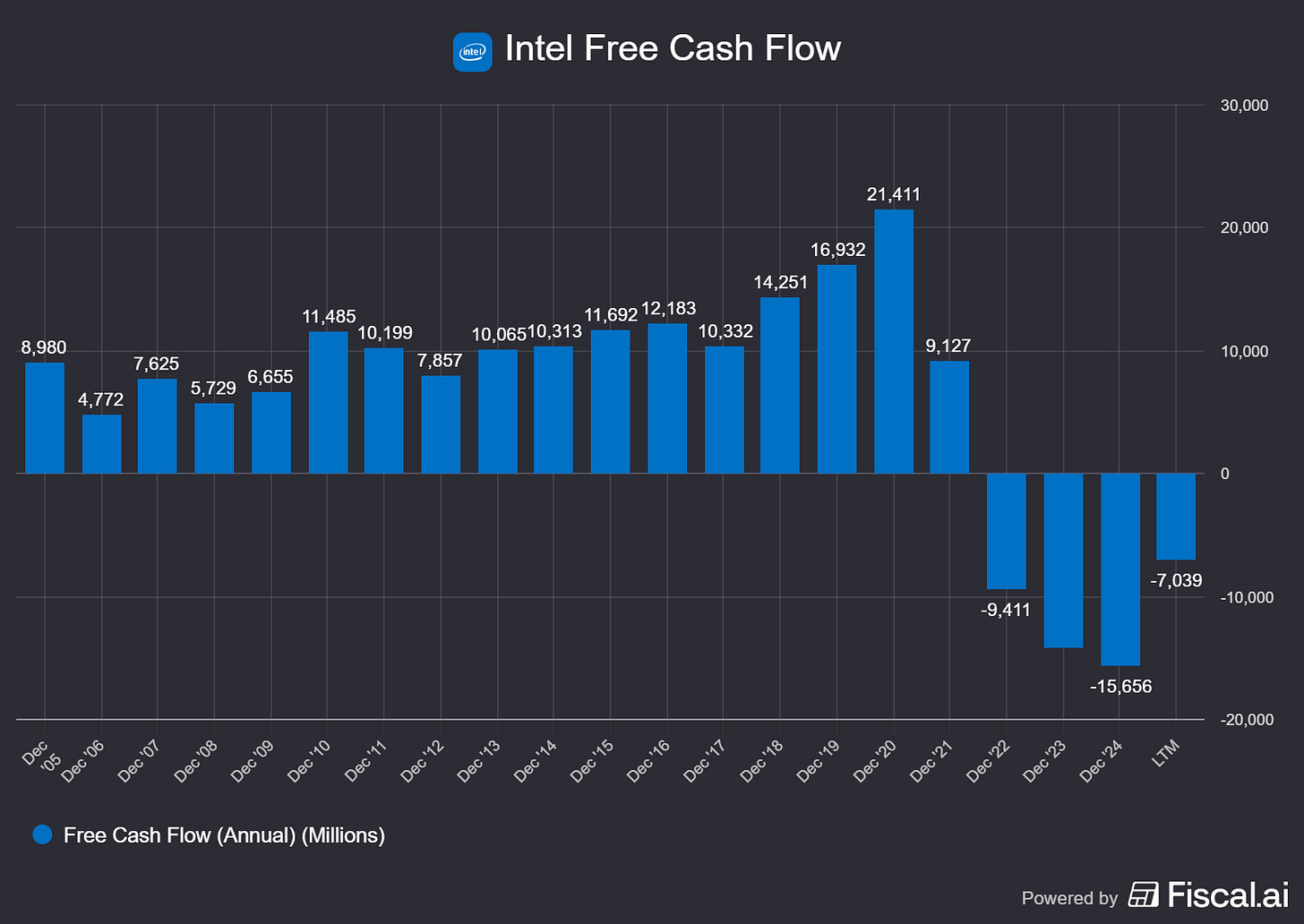

The only scaled computer chip manufacturer in the United States — Intel — keeps falling behind TSMC. Each year, it gets less and less relevant and is rapidly losing market share in datacenter/cloud.

Combining chip design and chip manufacturing (well, this is at least one of its problems) does not work in the modern semiconductor world. Intel has built its own foundry to compete directly with TSMC, but who wants to work with a direct competitor? If I was Nvidia or AMD, I would be hesitant to have Intel build my computer chips while also competing to win contracts.

The model doesn’t work. TSMC disrupted it.

The United States government understands this, but unsurprisingly is pursuing a strategy destined to fail: extorting Intel for an ownership stake in return for promised funding grants. A “whopping” $11.1 billion of the U.S. government’s money will be invested in Intel, most replacing previous CHIPS Act grants.

Not only will this deal heavily dilute shareholders and make you skeptical about the future of free markets in the United States, it is not nearly enough money.

Intel is planning to spend $100 billion to build new manufacturing facilities. This figure will likely triple before it is all said and done.

$11.1 billion barely covers one year of cash burn. It’s not enough.

(This chart is from our friends at Fiscal.ai. Use our link and get 15% off any paid plan: fiscal.ai/chitchat)

Intel does not need government meddling in its operations, extorting its equity for little funding in return. This will not work.

It needs breathing room to invest for a decade. That means $100 billion in commitments — maybe $200 billion — and separating the computer chip design and computer chip manufacturing into two different companies.

Software design can remain Intel. That is the brand the consumer knows, and what will be sold to datacenter/PC makers. It now has the freedom to pursue its own design framework and even work with TSMC if it wants.

The manufacturing spin would be American Semiconductor Manufacturing Company (ASMC).

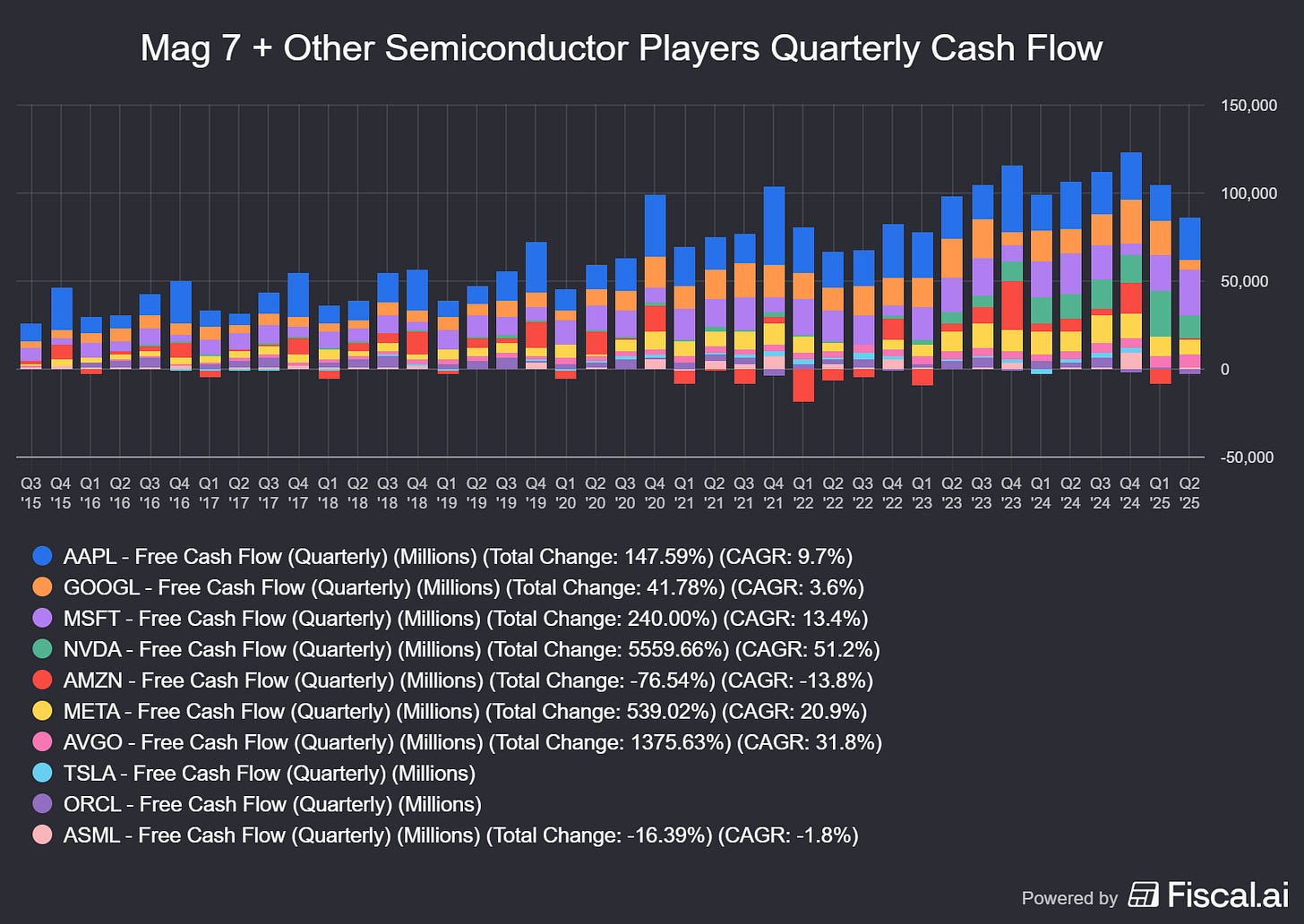

But how would it get funded? It’s simple: look to the major buyers of computer chips. They are flush with cash.

Below is the cash & equivalents positions of the largest technology companies. All of them except ASML are customers of TSMC. ASML is still reliant on the business as a supplier of semiconductor equipment.

A little bit of a whacky chart (had too much fun using Fiscal.ai), but it illustrates clearly that the answer to Intel’s troubles are sitting right there on the balance sheets of these computer chip buyers.

Combined, these companies have over $200 billion in liquid cash. This cash should be used to fund the spin-out of ASMC from Intel.

Wipe the slate clean. Give Nvidia, Amazon, Alphabet, and Microsoft 10% stakes in the spinco based on how much they invest. Say $20 billion each over a five year period. Others with lower cash balances can invest less.

That’s nothing to these companies. Combined, they generate close to $100 billion in free cash flow every quarter. A number that has actually declined recently due to the AI capex supercycle. Funding ASMC wouldn’t even register on the financial statements.

The answer is right in front of Intel. Will it make the right decision?

One can hope.

-Brett

Interesting ideas. Implementing them could be a bit challenging but I think it is worth a look. After Nvidia just jumped in bed the ball is rolling….

Have you read Chip Wars by Chris Miller?