SoFi: The Perfect Middle Ground (Ticker: SOFI)

SoFi is in the perfect position to grow its deposit base.

In recent years, SoFi has emerged as one of the leading “neobanks” in the United States.

In what can feel like a commoditized industry, they’ve attracted millions of members and continue to earn more from those members every year.

Today, we’re going to look at why SoFi has been able to succeed and whether or not I’m buying the stock.

How did we get here and what does SoFi offer today?

SoFi in the early days didn't really look anything like what it is today, so I won’t spend a ton of time on the history. However, it’s worth looking back just to understand the actual magnitude of the progress.

The company was founded in 2011 by 4 co-founders who met at Stanford Business School. None of these guys are involved in the business anymore, nor are they significant shareholders. The genesis for the idea was to provide more affordable lending options for the student loan refinancing market.

The way they did this initially was with a $2 million loan pilot program. They got 40 Stanford alumni to put up a combined amount of $2 million for this program, and then they used that $2 million to give student loan refinances to 100 students (~$20k each).

In 2012, about a year after the company was founded, SoFi raised $77 million in its Series A (that’s wild). And that funding helped grow their student loan refinancing operations. Over the next few years, they continued to pull in all sorts of funding (debt, credit lines, VC funding, etc.) and expand their operations. By 2015, SoFi had financed $2 billion in student loans. However, it was also getting there by using some questionable tactics. Their marketing was misleading (according to the FTC), and management did not seem to be running the company professionally.

The CEO was accused of sexual harassment, and in September of 2017 he was forced to step down. This also coincided with an FTC investigation around misleading marketing practices, and at the time, SoFi was thought of as a troubled fintech company. However, in January of 2018, they hired Anthony Noto which I think is probably the most transformative moment in the company’s history.

Now I tend to be more of a believer in the “prove it” attitude when it comes to management teams, but it’s hard not to appreciate Noto’s resume. COO at Twitter, Head of Global TMT Investment Banking at Goldman Sachs, CFO of the NFL. Impressive across the board. But what really stands out to me (beyond SoFi’s growth since his hire) is that it seems to have brought a sense of professionalism to the company and brand. I think he deserves a lot of credit for making them into the full-blown trusted bank that they are today.

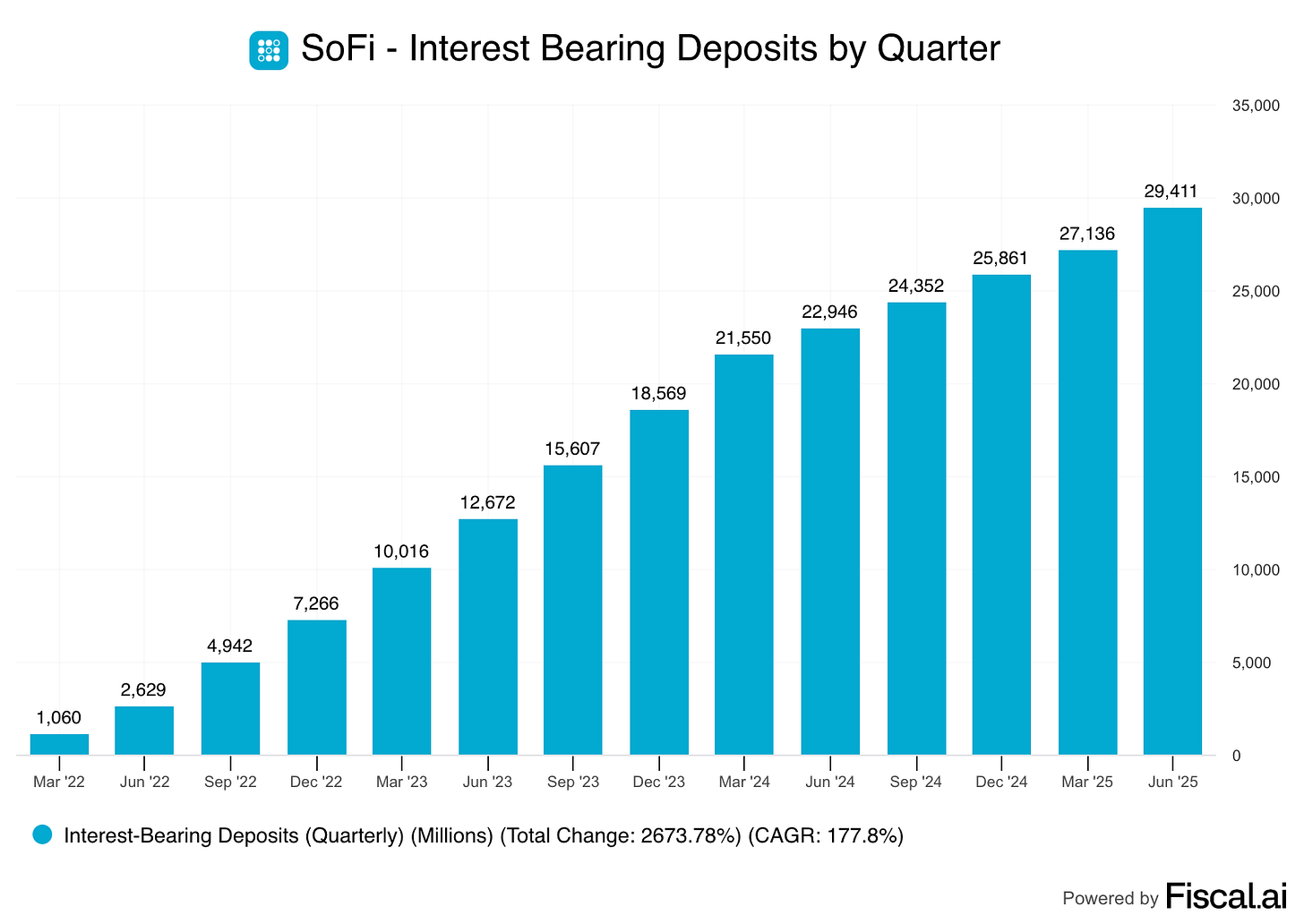

Two more milestones worth mentioning. They went public in June 2021 through a SPAC, which was remarkable timing. They raised ~$2 billion in the transaction. And in 2022, they bought Golden Pacific Bank. The bank itself was sort of trivial ($22M acquisition), but it allowed SoFi to apply to become a bank holding company, which they were approved for. This gave them the ability to hold the loans for themselves and also fund the loans with direct deposits, and deposits have grown rapidly.

That takes us today. SoFi is now an all-in-one financial app that offers credit cards, savings accounts, stock trading, home loans, and more. They’ve come a long ways from their roots as a simple P2P student loan refinancing operation.

How did they get to 11.7 million members?

Before diving into any sort of competitive advantages, let’s talk about what this number actually means.

A “member” is anyone who has interacted with SoFi in some way (borrowed money, opened an account, linked an external account, or even signed up for SoFi’s credit score monitoring service). Importantly, this does not mean that SoFi is the primary bank of all of its members.

To put this number in context, SoFi has $29 billion in deposits today, and ~90% of those are direct deposits, so call it $26B in consumer deposits. If you imagined that every existing member used SoFi as their primary bank, that would mean that SoFi has an average customer deposit account value of roughly $2,000. That would be extraordinarily low. For reference, Ally Financial has an average customer deposit value of more than $43,000. Long story short, not all of SoFi’s “Members” use them as their primary bank. If you’re a SoFi shareholder, you could view that as a good thing because there’s some low-hanging fruit in growing share from existing members.

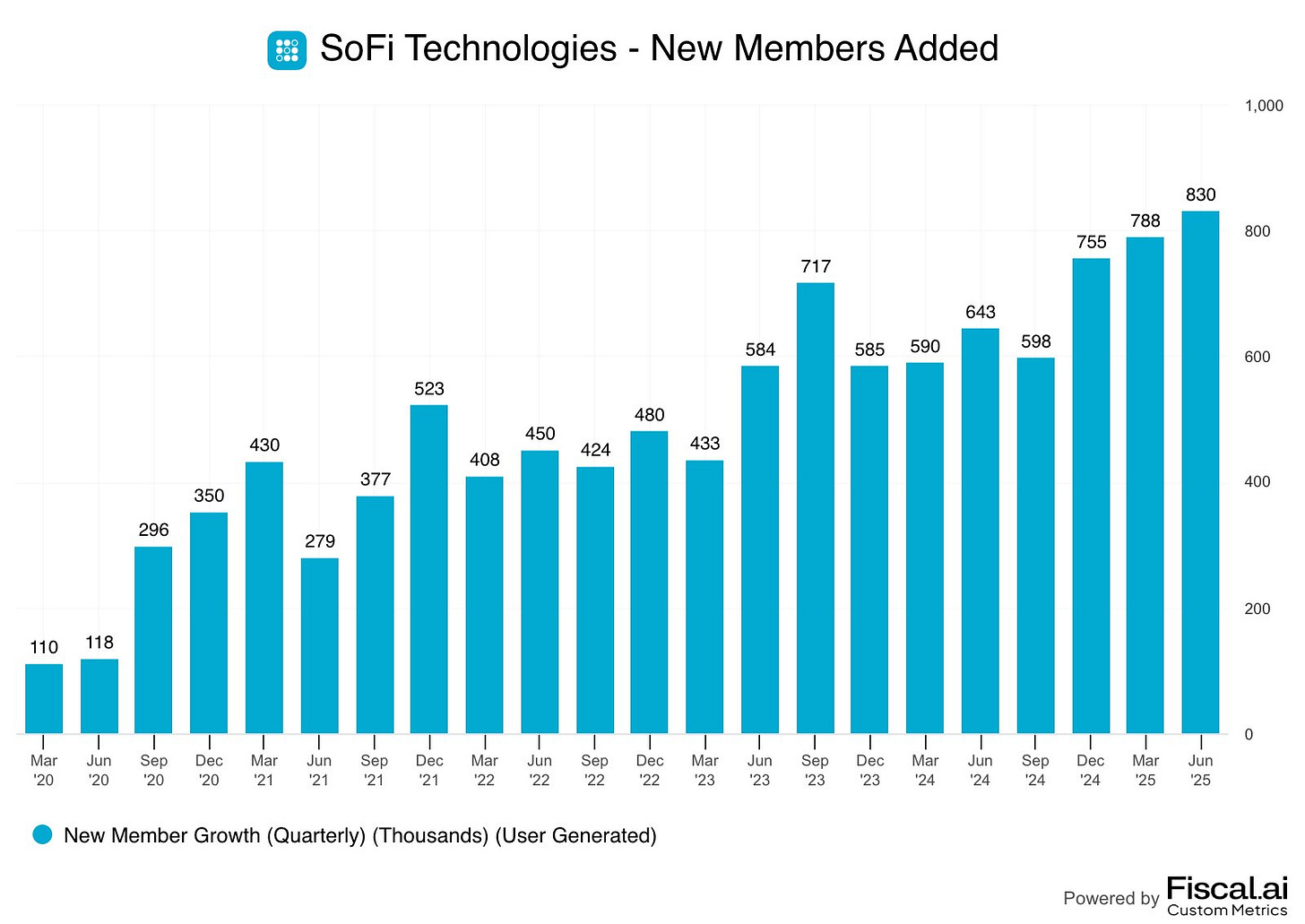

Nonetheless, they are adding members (and most importantly, deposits) at a rapid rate. Today they have 11.7 million members and are setting records for new member acquisitions with each passing quarter.

In the last year alone, SoFi has added 3 million new members, equivalent to Ally’s total customer base. Even if 10% (~300k) of those members are using SoFi as their primary banking app, that is solid growth compared to most banks.

Where is this success coming from?

From what I can tell, there are a few things really driving their success.

Counterpositioning:

As an online-only bank, they save a lot of money compared to traditional banks by not having to support branches. This means that they are able to return those cost savings to customers in the form of higher savings rates. This is a huge attraction and draws people away from legacy banks. Right now for example SoFi offers 3.8% APY on their savings accounts (4.5% for SoFi Plus members at an introductory rate). For comparison, Chase Bank offers 0.01% on their savings accounts.

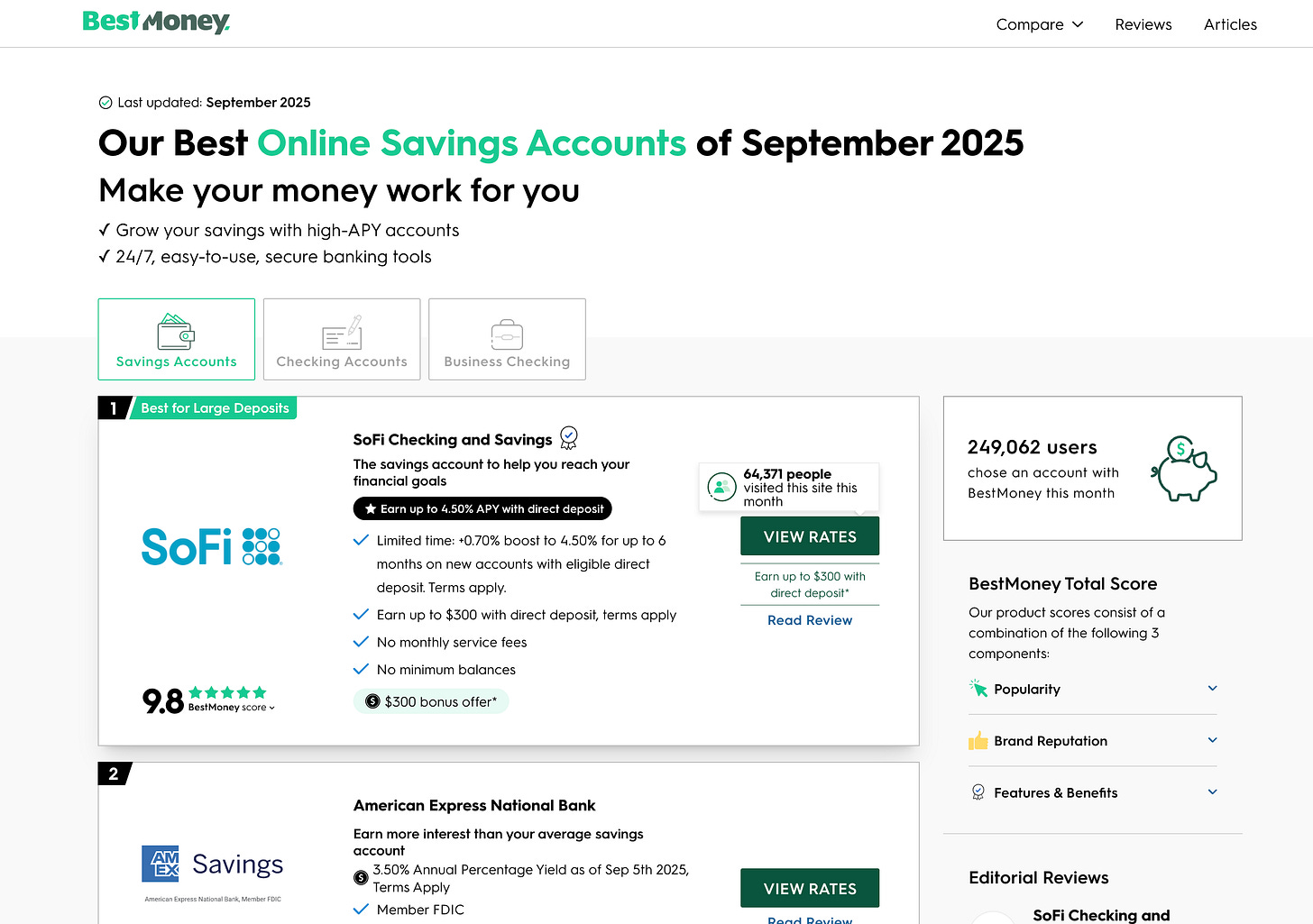

Compare this to your typical regional bank and chances are SoFi is going to be far more attractive. This also means that SoFi is going to show up in every ranking article. If you look up “Highest APY Savings Account”, you will find dozens of lists and pretty much each one will have SoFi ranked at the top.

Most legacy or traditional banks have absurd tech debt. They have systems built decades ago on-premise by people that are probably no longer there and now they’re having to revamp their apps, websites, or internal systems, and debug old crap.

It’s probably an absolute nightmare being on the dev team of some regional bank. The de-bugging of old systems wastes so much time, and it’s why a company like SoFi, which was a built a decade ago natively on the cloud, can ship products and features at such a faster rate.

These are the kind of things that are hard to measure, but they are massive advantages relative to incumbents.

Marketing:

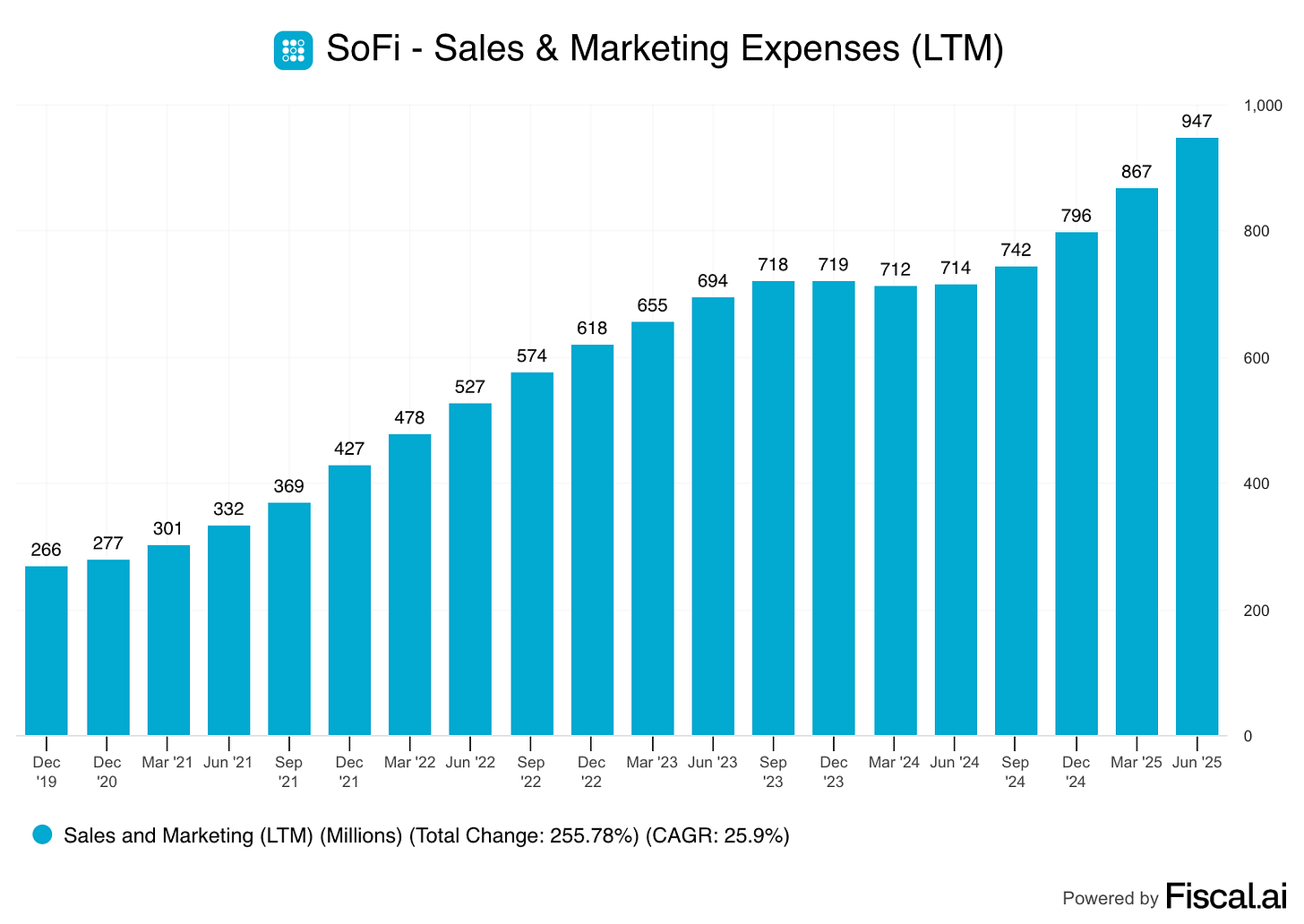

This isn’t really a differentiator versus the big banks, but it sure is compared to other neobanks. They timed their SPAC really well, and raised nearly $2 billion from the transaction. This allowed them to double their marketing budget in less than a year. They now spend just under $1 billion on sales and marketing each year. That’s among the largest budgets for all neobanks. Chime, which is another neobank, spends about half that.

Based on member and deposit growth, I’d argue they’ve done an excellent job with marketing. One example is the stadium. I don’t typically like stadium sponsorships, but for a consumer fintech app, it makes sense. They spend about $30M per year on a 20 year deal, and even though it’s tough to measure, “SoFi Stadium” has certainly brought them a ton of name recognition and some sense of credibility. Additionally, there are big upsell opportunities with a fintech app for people actually at the stadium (25% cashback on eligible stadium purchases, SoFi member lounge, priority entry, etc.)

It’s always hard to say what specifically is working about a marketing budget when you’re not inside the company or don’t have specific ROAS (return on ad spend) figures, but the numbers speak for themselves. Over the last five years, Members have grown tenfold, while Sales & Marketing has grown fourfold.

Being competitive across the board:

Banking is in many ways a commodity. You want to open a savings account? There are thousands to choose from. So how does a bank stand out?

Oftentimes, you’ll see a bank do one or two things well (high savings rates, great credit card rewards, great lending rates, best-in-class customer service [First Republic]), but then they will lack in other areas, often intentionally. The big banks are a great example of this. They’ve got locations you can go and visit which makes for a nice customer experience, but they offer next to nothing on their savings accounts in order to boost net income margin.

SoFi is competitive across the board:

✅ Savings rates

✅ Credit Card (2% unlimited cash back, no annual fee)

✅ Stock trading (no commissions)

✅ Competitive Lending Rates

I could go on.

It is clear that when they enter a new market, they try to be as competitive as possible either on price or with feature parity. I think this helps attract more members because they rank well in so many different categories. For example, try googling “best personal loan provider” or “best savings accounts”. They’ll be at the top.

But is there a competitive advantage?

Maybe.

They have a lower cost structure (online-only), which allows them to offer more attractive rates relative to incumbents.

They’ve reached a level of scale that other neobanks aren’t at which allows them to invest more into new customer acquisition.

They’re also a legitimate bank which lowers their cost of funding relative to other neobanks.

They are in a sweet spot for growth. As an innovator they can offer more attractive rates than incumbents, but they are also big enough to offer more features than other neobanks. This is why I call it the perfect middle ground.

SoFi Lending Breakdown: What do they offer today? How much could they earn in the future?

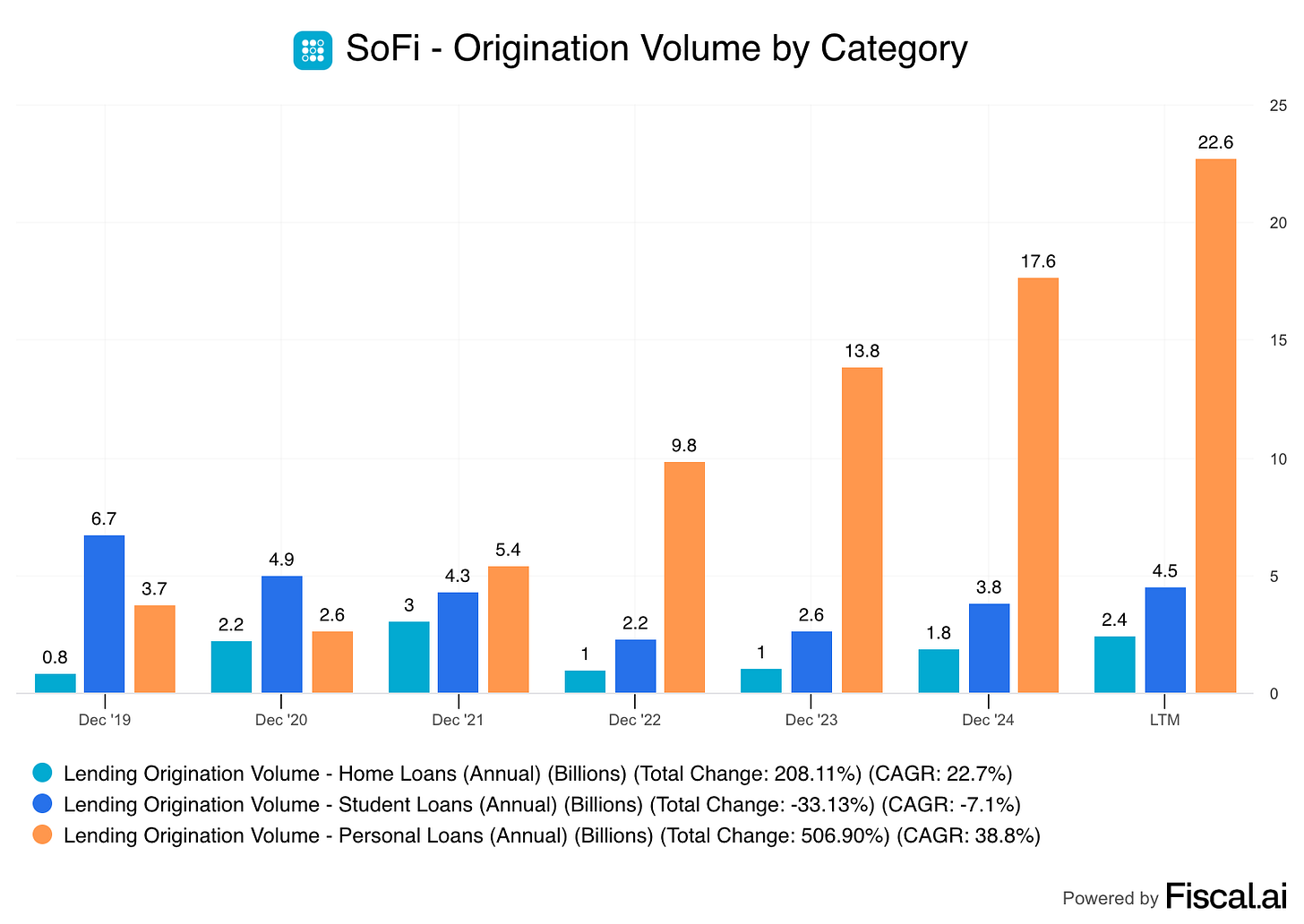

SoFi offers a number of different loan types to its customers, fitting into three categories: Personal loans, Student loans, or Home loans.

When SoFi writes a loan, they can do one of a few things with it. Either A) hold the loan on their own balance sheet, B) sell the entire loan to an asset buyer (aka a whole loan sale) or C) securitize it and sell to an asset buyer (Package up a bunch of loans to spread out the risk profiles and institutions can buy them based on however much they want to allocate).

Holding the loans themselves is a straightforward process, but the selling of loans presents accounting complications. First, when SoFi originates a loan they tend to hold that loan on their own balance sheet temporarily even if the plan is to sell it. While it’s on the balance sheet, they’re collecting interest income. Based on whatever risk appetite investors are seeking, SoFi will sell a pool of loans into a securitization trust. Investors will then buy bonds filled with these loans. If the loans are bought at a premium price to the value SoFi holds them on the balance sheet, SoFi records a gain on sale (which boosts earnings).

SoFi makes money on its lending operations in four ways:

Origination fees (upfront, paid by the borrower, sometimes waved)

Interest income (straightforward, they collect interest while they hold the loans)

Gain on sale (shows up under “noninterest income” when the securitization is sold).

Servicing fees + occasional residuals (they still usually service the loans after the sale and sometimes they’ll hold partial ownership of the loans).

This is important to understand because this income accounts for ~85-90% of SoFi’s revenue. Also, it helps provide some additional context for a listener question that was asked in preparation for this research episode:

“What are the Pros and Cons of using fair value accounting? Specifically, how vulnerable is SoFi when delinquencies rise – since that would trigger negative fair value adjustments, leading to lower, or even negative net income? This would also reduce the value of assets on the balance sheet. If that happens what impact would that have on their CET Ratio?”

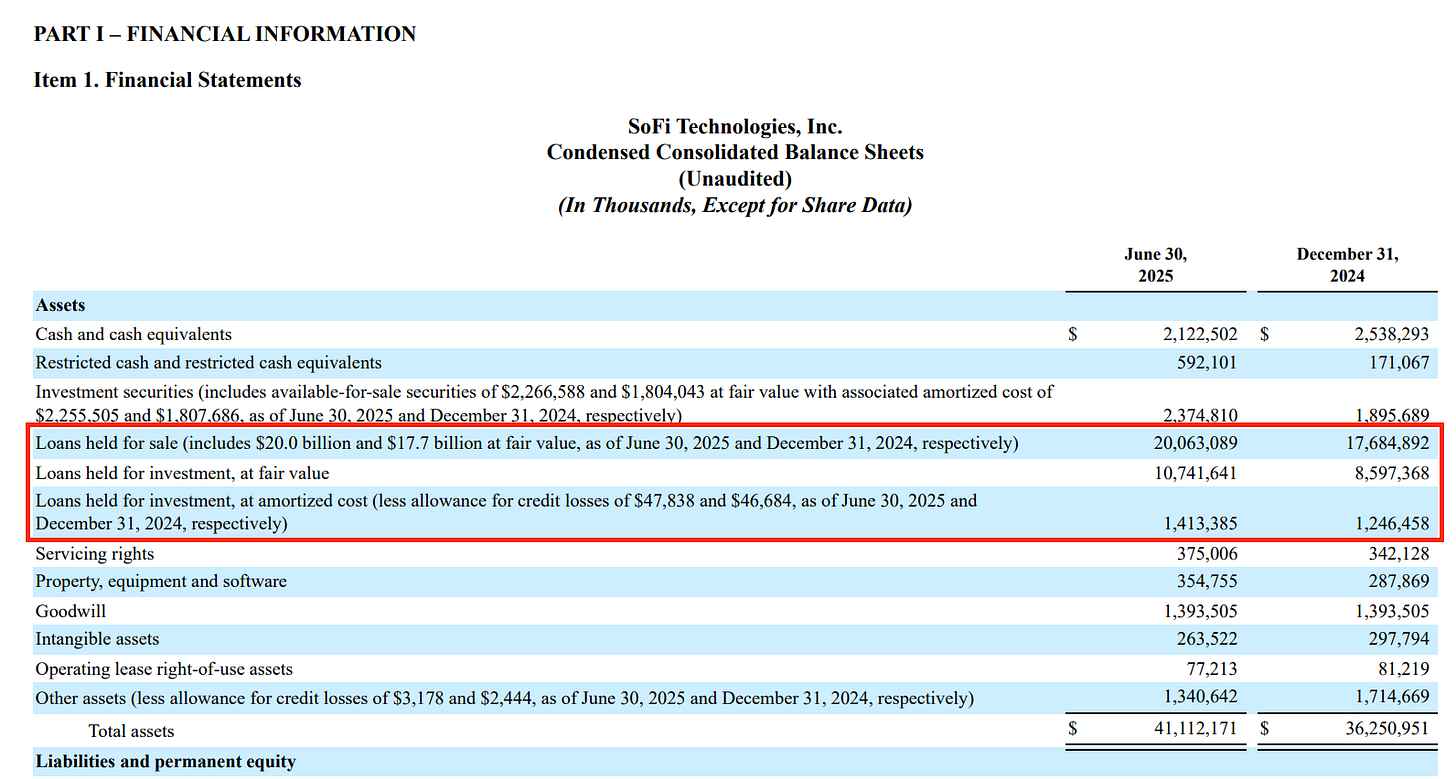

SoFi uses fair value accounting for most loans. Typically, banks use this form of accounting for loans that are being Held for Sale (HFS), but SoFi also uses fair value for most of the loans it holds for investment.

What’s the difference? Fair value accounting marks the loans to their current market value, meaning what they could be sold for today. That requires some assumptions on default rates, but means the loans change quicker in value as rates move. This impacts SoFi’s reported net income.

What happens if delinquencies or rates rise? Any time you hold long duration loans, whether they’re Held to Maturity (HTM) or Held for Sale (HFS), a rise in delinquency rates or spike in interest rates can negatively impact their value. But with fair value accounting, that’s reflected on the income statement sooner.

On the other hand, when you use amortized cost accounting, the losses aren’t accounted for until they’re actually recognized. We saw this in a big way with Charles Schwab a couple of years back when they issued a bunch of long-dated HTM loans at record low interest rates and almost paid the price for it.

Problems could arise because if SoFi does want to sell these loans and rates have risen, investors would be looking for higher yields, so they might be tough to get rid of.

With that in mind, let’s look at SoFi’s actual loan portfolio. Roughly 2/3rds of SoFi’s loan portfolio is personal loans. They are ~80% of new origination volume, so at this point, you can think of SoFi as a personal lender.

These are unsecured personal loans, meaning no collateral required. Debt consolidation loans, home improvement loans, medical expense loans, travel and events, you name it. These loans typically range in value from $5,000 all the way up to $100,000 and have durations ranging from two years to seven years.

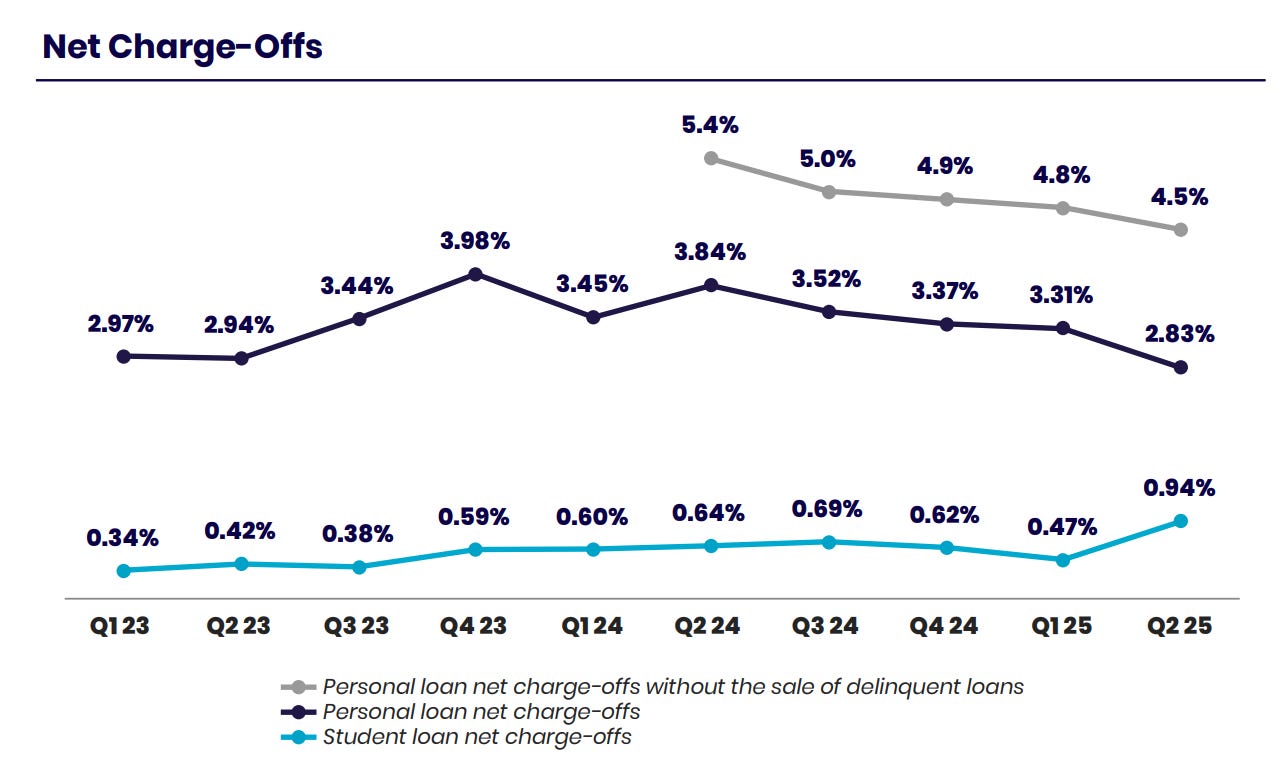

Right now, these loans are performing well. Net charge-offs last quarter were 4.5% which has continued to come down over the last 12 months. The average coupon rate on those loans is about 13%. Quite a good spread.

My general belief is as long as deposits grow, the loan portfolio should work itself out over time. This isn’t a newfound risky lending operation, they’ve been writing personal loans for more than a decade and have gone through some challenging economic environments (COVID + ‘22/’23 Rate Hike).

From what I can tell, they follow standard underwriting procedures. They use a FICO score, they use debt-to-income ratios, employment history, education history, etc. And if you bank with them, they have access to your banking data.

Valuing SoFi: Do I want to own the stock?

Valuing SoFi is challenging — as are all banks — because you’re forecasting out net interest margins and the reality is, nobody (and I mean nobody) knows what net interest margins for a bank are going to be five years from now. Especially one that uses Fair Value accounting because it’s entirely dependent on prevailing interest rates.

So what can we do? We can try estimating earnings based on various Net Interest Margins, but the real value here, and what’s going to determine the outcome for SoFi as an investment, is going to be the deposit growth.

I think SoFi is in the sweet spot for growth. They’ve reached scale, are on the right side of the innovator’s dilemma, and are willing to be aggressive. I suspect they will be able to grow deposits quickly over the next five years, let’s ballpark it at a 20% CAGR after this year (2025 will be higher).

I’m doing some very rough math here, but I assume 20% deposit growth from 2025-2030 and I test out 5% net interest margins, 5.8% (current), and 6%.

If I use that middle ground of 5.8% (which is about their average over the last 2 years) they would be earning ~$6 billion in earnings before operating expenses in 2030. Operating expenses matter and they will grow but the pace of growth has slowed and I think should continue to slow relative to revenue.

Let’s assume they grow operating expenses at 10% annually. They’d have just over $4B in operating expenses. That means total earnings of ~$2B in 2030.

Today they trade at a market cap of $28.9 billion, so roughly 13x 2030 earnings.

Keep in mind, that math I just did could be way off. I gave very little effort in trying to be precise, because frankly, I think any attempt at guessing their net income margins five years out is a waste of time. Nonetheless, that does give me rough numbers to work with.

For me to assume a bank is going to grow deposits by 20% a year, a 13x 2030 earnings multiple feels… not that attractive. For that level of deposit growth (which to be fair, they could beat), I would’ve wanted to be paying single digit earnings multiple 5 years out.

-Ryan

Nice assessment/write-up Ryan. Many thanks!

A question to ponder... what value are you assigning Galileo & Technisys? These two acquisitions can't be zeros. They acquired Galileo in 2020 for $1.2 billion, which will more than likely pan out for them even though it probably cost them more given how they financed the deal. The jury is still out on the Technisys acquisition. Very costly acquisition.

Full disclosure: Long SOFI, the largest position tied to my net worth, and shareholder since 2021 with opportunistic purchases along the way (single digit share price cost basis).