Remitly Global: Taming The Narrative (Q2 Earnings Update) $RELY

Why I felt confident adding to my position this week.

Great investments steadily scale the wall of worry. Mr. Market believes a certain story that plays telephone across the internet (i.e. a bunch of misleading posts on fintwit), which presents a buying opportunity for investors who truly understand the business.

In 2025, two dueling narratives have taken hold of Remitly Global: stablecoins and deportations. The stock went from close to $30 to $16 in half a year. Yikes.

Remitly is trading as if your abuela in Hermosillo uses USDC to trade Solana on margin (watch her YouTube Shorts for the next memecoin she is going to pump and dump on her followers!). Plus, didn’t you hear, no immigration will ever happen again? Ever. The borders are shut permanently.

Take a look at Remitly’s actual business results, and the true story gets revealed. One of rapid market share gains and product innovation.

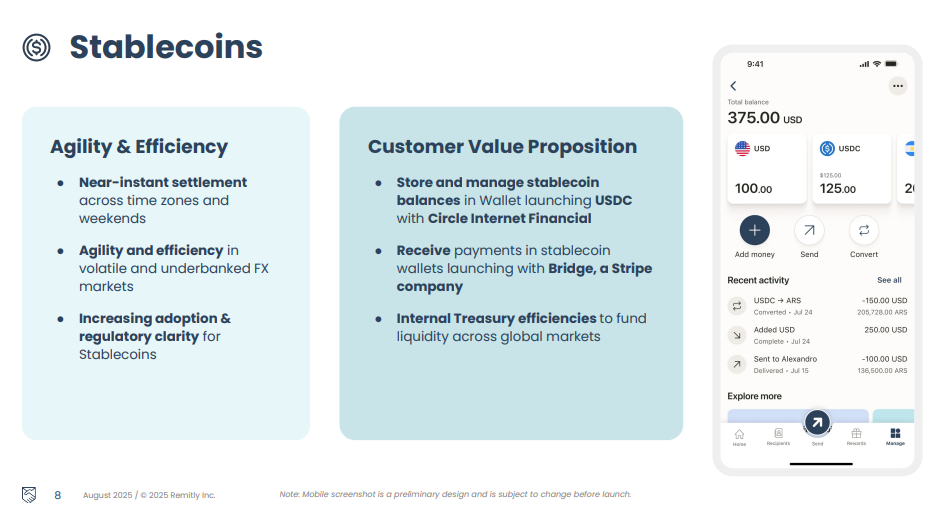

“Together, these stablecoin initiatives enable us to modernize cross-border money movements firmly positioning us at the forefront of stablecoin innovation in cross-border payments.” - Founder and CEO, Matt Oppenheimer.

Later this year, Remitly will start enabling stablecoin functionality on its remittance platform. Management believes stablecoins like USDC will enable international finance users and remittance payers to easily bridge between currency transfers. For example, it can help a Remitly user who doesn’t want to hold a rapidly depreciating currency such as the Turkish Lira.

Instead of a threat, stablecoins will be a tailwind for Remitly as the leading digital remittance provider. A company like Western Union is nowhere close to enabling these services.

But what about the core remittance customers? Didn’t everyone get deported to Mexico?

Far from it.

Here are the highlights from Q2 2025:

40% send volume growth to $18.5 billion

34% revenue growth to $412 million

24% active customer growth to 8.5 million

16% adjusted EBITDA margin and positive GAAP net income

Remitly is now generating consistent free cash flow and just initiated a $200 million share buyback program compared to a current market cap of under $4 billion.

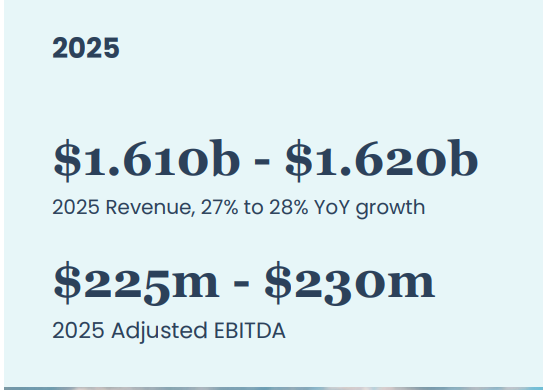

Guidance for 2025 calls for $1.61 billion in revenue:

As the company keeps taking market share, there is room to hit $2 billion, $2.5 billion, and eventually $3 billion in revenue by the end of this decade (if not sooner). GAAP operating margin can hit 20%, meaning there is $600 million in earnings potential within the next few years.

Again, compared to a market cap under $4 billion today.

More details on the valuation from my research report a year ago:

Remittance volume from the United States to Mexico declined year-over-year in June. Despite this, Remitly’s business in Mexico grew faster than overall revenue growth. It is rapidly stealing market share from Western Union and other legacy players.

Remitly is becoming globally diversified. Revenue in corridors outside of North America has grown at close to 100% year-over-year since 2019 and is now 24% of overall revenue.

(Shout out to our friends at Fiscal.ai for this KPI chart. Use our link and get 15% off any paid plan!)

We can make a lot of money owning Remitly if they simply steal share in remittances. However, the company is much more ambitious than that.

First, it has now specifically built products for small and micro businesses sending money internationally. This is a much larger market than you might assume. From the Q2 call:

“We're really excited now that we've actually optimized our product for small businesses. We believe we can continue to kind of move upmarket over time. I think that we can add the features that initially micro and small businesses require. And then over the medium to long term, I think that we can continue to serve a wide range of businesses because, as I mentioned, it's 10x the overall TAM, increasing our TAM to $22 trillion”

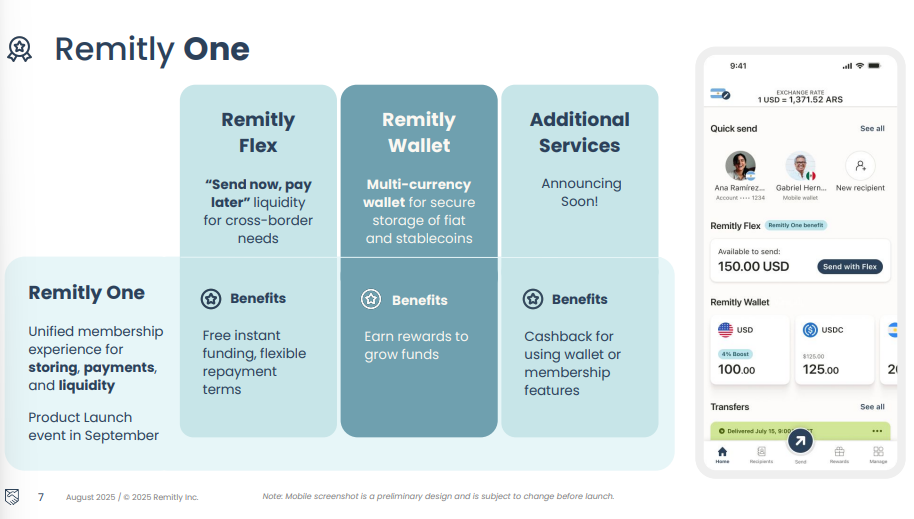

Later this year, Remitly is launching Remitly One, a membership program for its target customers:

Instead of just sending money, Remitly will now offer services such as storing money. This greatly increases the revenue generating potential per active customer. Stepping on the toes of Wise, REmitly is copying its products for digitally native customers and small businesses looking for cheap international transfers. With plenty of room for two players in this space (or more), I think Remitly has a clear product market fit with these ancillary services and millions of existing customers it can easily upsell them to.

I believe Remitly has tenbagger potential and trades at an undemanding valuation. This risk/reward gave me confidence to increase my position in July and hold the stock at north of 15% of my portfolio today.

-Brett