Remitly Global: Is It Truly That Bad? (Ticker: RELY)

Updating after Q3 earnings. My thoughts on what will make the stock work over the next three years

Today’s newsletter discusses Remitly Global (Ticker: RELY). Before we get into the meat of things, I want to surface a recent announcement from the founder/CEO of Gambling.com Group:

When insiders are buying at the same time as you, it is a signal that you are onto something. This tweet greatly increased my conviction in Gambling.com Group stock. Here is a link to the full report if you missed it:

And now, to the main event.

Remitly Global went public in September of 2021, selling shares at a price of $43.

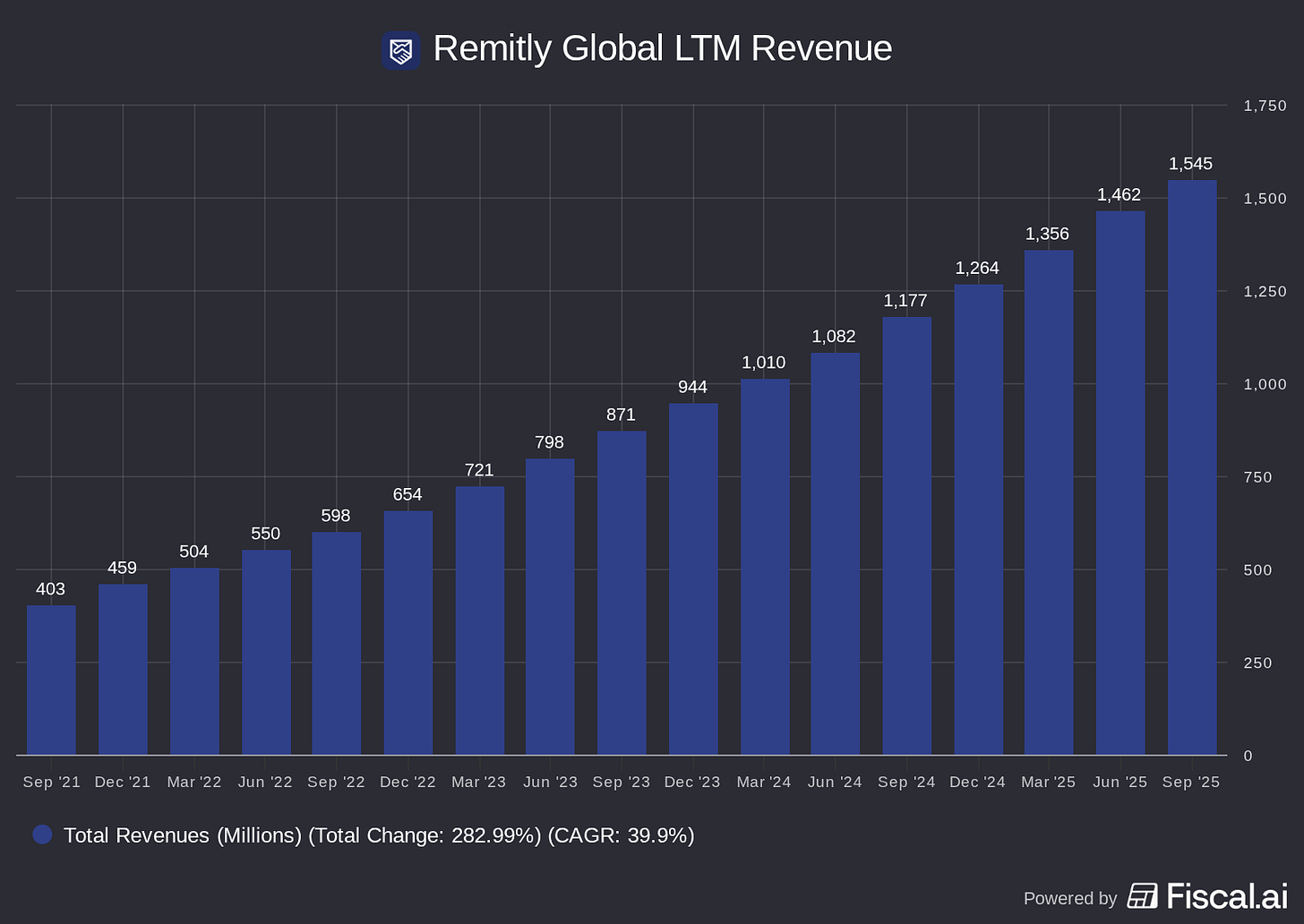

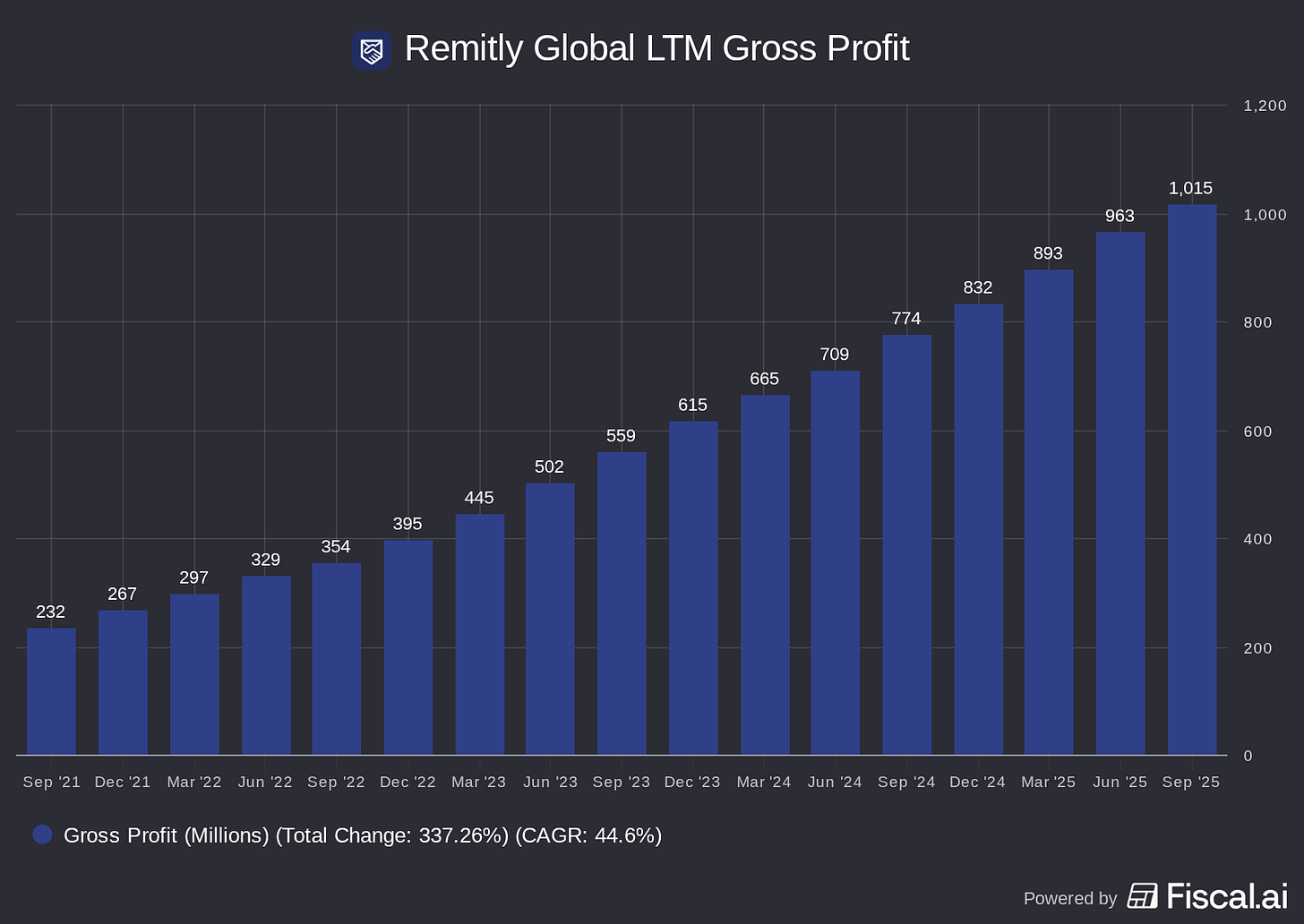

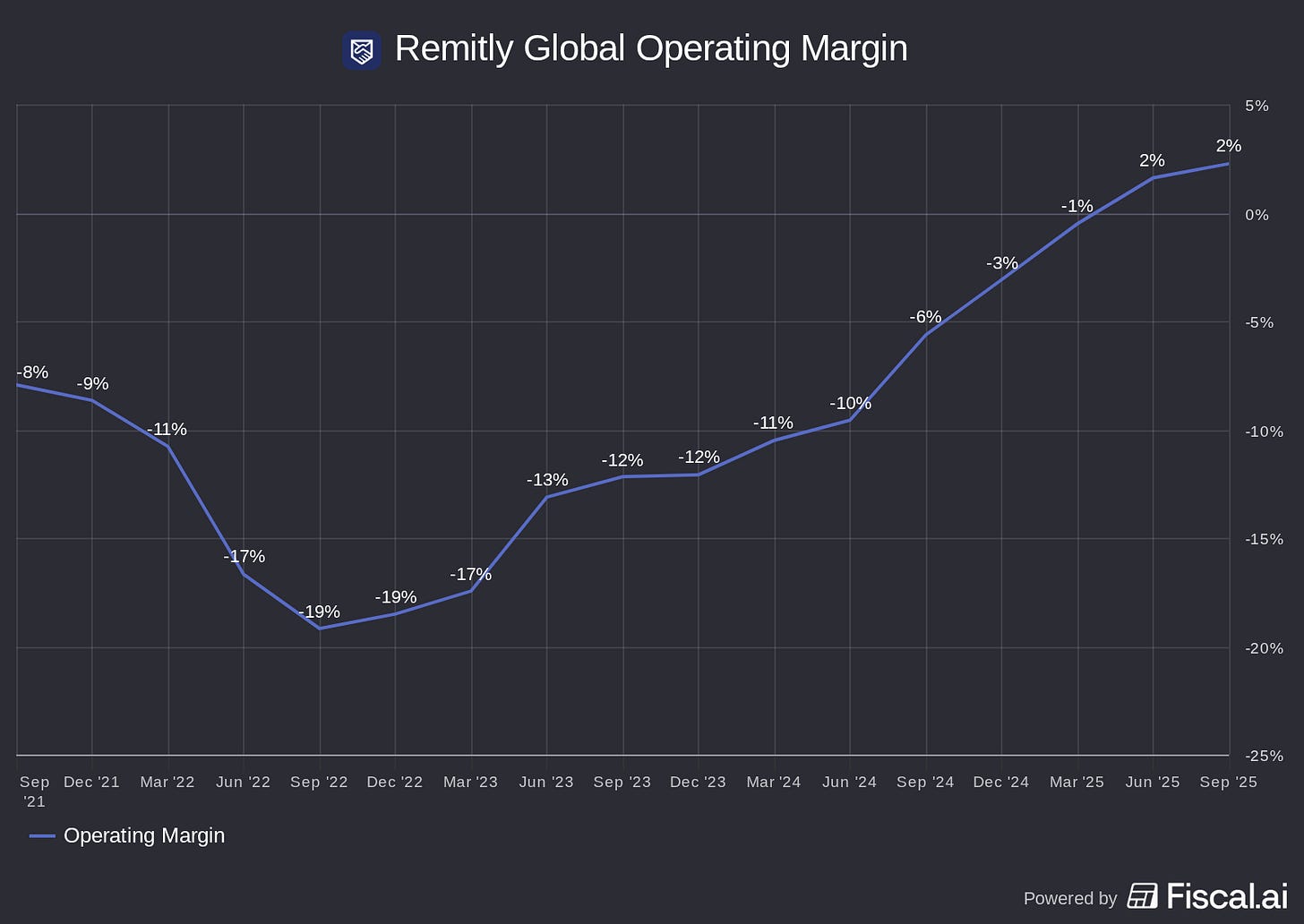

Since then, its LTM revenue is up 283%, a 40% compound annual growth rate. Gross profit is up 338% (over 44% compounded). Operating margin has flipped from negative to positive. All of its KPIs have moved in the right direction.

Its share price? Down 73% from all-time highs, to $13.08 as of this publishing on November 28th, 2025.

Investors are (again) bailing on Remitly. I cannot figure out why. The stock now trades at just 2x gross profit, the business is expected to keep growing in the double-digits, and management is starting to accelerate repurchases.

We are getting an Investor Day on December 9th. Your author will be watching diligently (and praying for speaker brevity). This newsletter is coming before the Investor Day in order to get my analysis out on the business before management spoonfeeds it to Wall Street. When a business is temporarily misunderstood – as I believe is the case with Remitly today – then an Investor Day can spark a rapid re-rating if everyone gets on board. Take a look at Adyen’s stock price chart two years ago as an example.

Here are my thoughts on Remitly’s Q3 results, valuation, and managing my position at a pivotal moment in the company’s history.

For a full introduction to Remitly’s business, I’d recommend reading my report and listening to our podcast from 2024:

Dissecting the Q3 results

Remitly reported on November 5th. The core KPIs were solid:

Keep reading with a 7-day free trial

Subscribe to Emerging Moats Research to keep reading this post and get 7 days of free access to the full post archives.