Punch Card Investing Is a Mistake (Unless You Are Warren Buffett)

And we are not Warren Buffett

“If you were given a punch card with 20 ticks on it when you graduated, and those were the only investment decisions you could make throughout your entire career, how would you use them? You would likely be very selective, and probably very rich. This type of mentality will force you to be patient.” - The Buff Dawg

This quote from the Oracle of Omaha is smart. It was made during the 1990s, an era when day trading was wildly popular and the buy-and-hold approach espoused by Buffett was losing momentum.

Despite this, I will argue it is not applicable to 99.9% of investors. It does more harm than good.

Why? Because we are not as smart as Warren Buffett. We need more shots on goal.

I am not advocating for day trading. Day trading (especially with options) is simply deciding you want to light money on fire.

What I am talking about is taking the punch card mindset too far by artificially limiting the amount of investments you can make, which increases your odds of failure.

The problem with punch card investing

Punch card investing — giving yourself a strict limit on the amount of stocks you can buy — sounds like a great idea. Only buy your best ideas and your returns will be superior, right?

We even have an investor, Norbert Lou, who has a whole fund called Punch Card Management dedicated to this idea. Lou is a great investor who we have covered in our Superinvestor series.

But we are not Norbert Lou or Warren Buffett.

Punch Card Investing has one fatal flaw: it assumes the investor will correctly identify the can’t-miss stocks prospectively with minimal whiffs. I think a properly trained investor with calm emotional temperament can become good at this, but they will not be flawless like Buffett when he swung at the fat pitch.

(As an aside: read the recent book Buffett’s Early Investments and decide whether a young Buffett would still employ the punch card approach today. Watch what I do, not what I say…)

If you only have five stocks in your portfolio, you are severely decreasing your odds to finding a multibagger. Finding multibaggers is how you beat the market.

More shots on goal

Only a select few stocks produce market crushing returns over a 10+ year period. Most stocks go nowhere, slowly fade to zero, or collapse as frauds.

Are you confident you can identify this small sliver of stocks ahead of time with only a few “punches” in your punch card?

I am not. Or, I’d rather not take that risk, because it doesn’t materially change potential portfolio returns.

Let me use examples to illustrate.

Investor A only purchases 10 stocks over a 10 year period. Of those 10 companies, five go nowhere and one goes to zero. Those are about the averages you might expect. In order to get an adequate return (3x - 4x your money over a 10 year period) this investor will likely need at least one of the four remaining stocks they bought to be a 10 bagger. The other three need to be big winners too. Not impossible, but you leave little room for error.

Investor B owns a portfolio of 12 - 15 stocks but cycles through new investments at a regular pace, buying between 50 - 100 stocks over a decade but never having an overly diversified portfolio because you consistently dump the losers.

Like Investor A, half of these stocks are losers. Of the others, I think a reasonable investor can find a few winners that turn into multibaggers. These big winners will drive your portfolio returns.

Investor B describes my mindset. It is about getting an adequate amount of shots on goal to make sure you find some winning investments and then letting those winners ride, while at the same time not overly diversifying.

Let your winners ride and dump what isn’t working.

Of course, the risk is that you dump the multibagger as a mistaken “loser” when cycling through new stocks.

It is — in my humble opinion — significantly easier to separate the winners from the losers after owning a stock for at least a year. The winners will prove themselves in business performance and stock price appreciation. The losers will show the opposite. Keep the select few winners and cut bait from the losers and buy something new.

In the last twelve months I have made investments into Mexican airport operators, The Real Brokerage, Oscar Health, Interactive Brokers, and Airbnb. I will likely make some more investments by year’s end. It is unclear today which of these companies (if any) will emerge as my multibagger that I should hold for the long haul. But five years from now, I would bet most of these stocks are actually out of the portfolio, because most stocks are losing investments and should not be held.

Those are just the odds of the game. The majority of stocks are going to be losers, so let’s not delude ourselves into thinking our portfolios are somehow special or immune to these averages. Trying to be overly precise in what we buy by mimicking a savant like Buffett can actually be harmful if you pick up zero multibaggers in a decade.

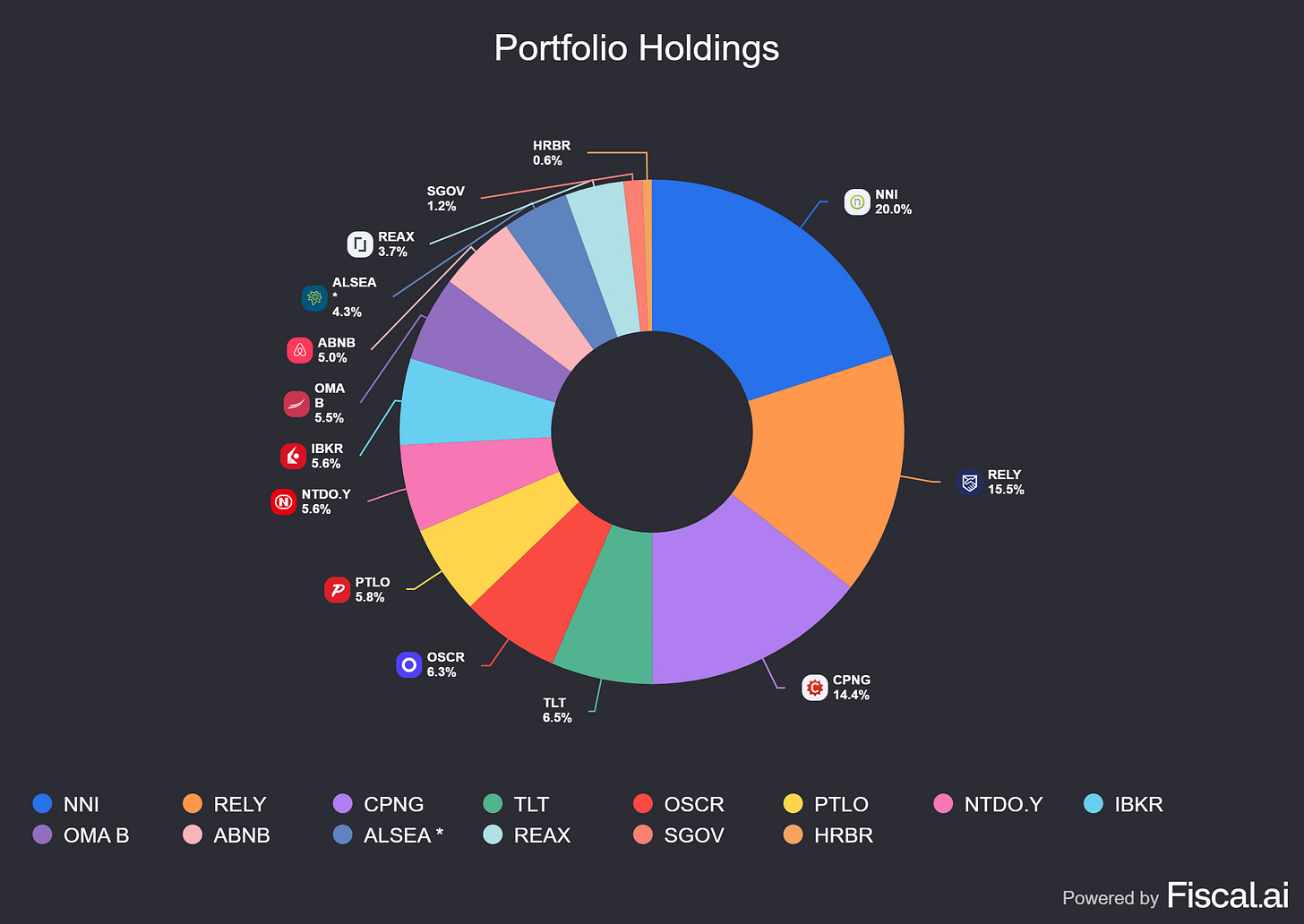

Here is my current long portfolio, courtesy of Fiscal.ai:

Of the 12 stocks I own, I could see myself easily selling five of them by this time next year. Maybe more. Financial performance will dictate what stocks these will be. But, there will a few that emerge as potential multibaggers, like I think Coupang and Nelnet have started to turn into. As long as these businesses keep proving themselves, I will never sell them unless they get overwhelmingly overvalued.

Don’t be afraid to trade. Don’t let it make you feel “icky” or that you are letting down the value investing legends (laugh, but that is how people think) by increasing portfolio turnover.

Finding multibaggers and sticking with them is what will increase your wealth. But you can’t stick with the multibaggers if you don’t build a strategy to optimize having them in your portfolio in the first place.

Agree or disagree with this mindset? Where are the flaws in this strategy? We would love to have more discussions on portfolio management philosophy on the podcast and in our chat community.

-Brett

Let’s Connect. I love your content Brett.

The AI narrative is powerful, but I believe the real winners will be those who combine innovation with durable economics. I wrote about this in my recent review — showing how thesis-driven investing captured both AI and energy transitions. Happy to share here

https://thesisrationale.substack.com/p/annual-investment-review-20242025?r=48cf8j&utm_medium=ios

I agree. Oftentimes I think advice from successful fund managers (I’m thinking most of investment books) cannot be applied to individual investors, at least not literally. In this case the mental model, don’t swing at every idea, would be valuable. But how one can make wealth with 20 stock picks, perhaps, starting their learning journey parallel to their daily job, by trying to invest few hundred bucks a month? 🙂 You have to have mistakes, preferably early in your journey. One is the mental capacity of such guys will not be reachable by most of us and time spent on idea will be significantly smaller than full time investor. Second, the “trade less” idea maybe comes from the time when each trade was expensive and possibly incurred taxes for each transaction. Did large funds had tax deferred accounts and less than dollar transaction fees even 10-15 years ago? Third, as you know, running fund often comes with limitations on turnover, as you have explained in recent episodes, including trouble raising cash for new purchases that maybe require sale of reasonable return stock for a hope of better return.