Portillo's: Moving the Goalposts? (Q2 2025 Earnings Update) $PTLO

Investors hate this stock right now. Should I sell my position?

A restaurant needs comparable store sales growth to match or outpace inflation. Otherwise, over the long-term, its profit margins will collapse.

This year, Portillo’s management estimates it will have 3% - 4% inflation on its input costs, spread across food and labor. Its comp sales are not projected to match these increases:

“We are currently forecasting our comp sales for the full year at the low end of our 1% to 3% range. To address inflationary cost pressures, we increased menu prices by approximately 1.5% in January, 1% in April and 0.7% in late June. Our effective price increase for the third quarter is estimated to be approximately 3.3%. We will continue to assess pricing in relation to our costs, the competitive environment and our value proposition to our guests as the year progresses” - CFO Michelle Hook, Q2 2025 Earnings Call

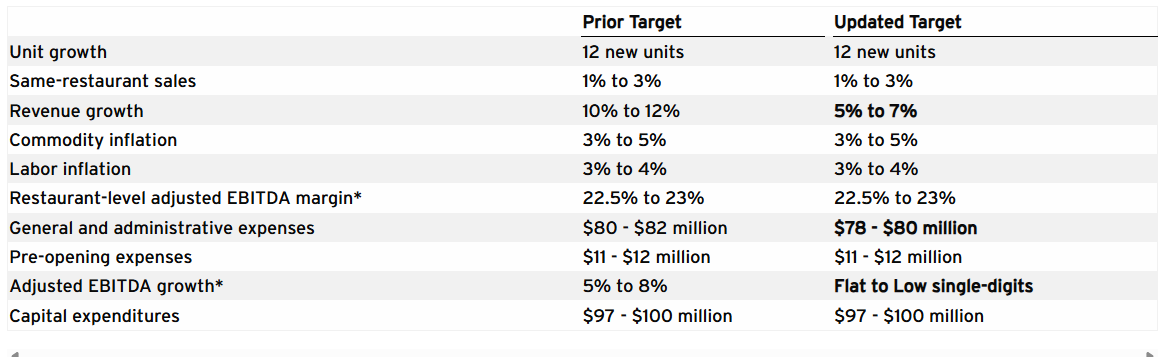

Meager comp store sales led to a disappointing quarterly result yesterday, causing Portillo’s stock to plummet 20%. To pile on, new Portillo’s locations not in the comp base (locations open less than 24 months) have underperformed expectations, leading management to sharply reduce its revenue growth guidance for 2025:

Specifically, new locations in Texas are not performing up to par:

“As we grow, we're continuing to refine our new market playbook. We saw early traction in Dallas, and Houston has been a little bit slower to ramp up. In hindsight, we probably overcorrected at times in Texas to manage volumes and maintain service. We've since learned the importance of sustained marketing investment and have beefed up our efforts to accelerate awareness and drive revenue in Texas, which includes multichannel campaigns and new local field marketers on the ground to lead grassroots efforts” - CEO Michael Osanloo

One of the key insights to learn from Peter Lynch is finding a nationally scalable retail concept. The idea being that a brand needs to prove demand in at least two — if not more — distinct regions before you can have confidence the brand can scale nationally. Some brands are just meant to stay local.

The market now fears that Portillo’s will not properly scale outside of Chicago. Is Mr. Market correct? If he is, then the thesis is broken and I should sell my position. My number one fear heading into the investment was tepid demand with new Sun Belt restaurants combined with macroeconomic headwinds for restaurants. Both may be happening in 2025.

But what if Mr. Market is incorrect? The stock would look mighty cheap at a depressed EV/EBITDA of 14 for a brand that could quadruple its ~100 or so locations in the next decade:

Here is what management told investors in regards to the weak demand in Texas:

Over-marketing the initial Dallas location caused them to subsequently undermarket the last few quarters. This is an easy fix.

Portillo’s locations have performed well financially in Arizona for a decade, it just takes time to build local awareness. They are also doing well in Florida and other Midwestern markets that show success is possible nationally.

Restaurant openings have been delayed to the back half of 2025, which also impacted revenue growth guidance.

Cash-on-cash returns and restaurant-level EBITDA margins remain strong

The flip side of the coin is, Portillo’s has worked hard the last few quarters to optimize its restaurants by implementing kiosk ordering, speeding up the drive-thru, and launching a loyalty program. While there is still room for incremental progress on efficiency (not to mention the cheaper restaurant layouts for future openings), I would have thought that Portillo’s could accelerate its comp store sales growth to at least match inflation:

After reading through the conference call and spending the day thinking about the results, I am willing to hold my Portillo’s position. For now. No dip buying will be done today.

Comp sales growth is better than a lot of restaurants in the current environment (Chipotle’s dipped 4% for reference), the restaurant base is still generating best-in-class EBITDA margins, and we have a long runway to expand nationally.

There is no reason to panic sell because the stock plummeted. However, I am getting weary of management continuing to move the goalposts with their long-term goal of 10%+ revenue and adjusted EBITDA growth. If this keeps getting delayed, we will not see an inflection in free cash flow and the stock price will go nowhere.

Interim delays have brought me tremendous opportunities (look at Sprouts Farmers Market’s stock chart) while also falling knives like (Match Group). I am willing to wait a few more quarters at risk of holding a Match Group to make sure I do not miss another Sprouts Farmers Market, which I believe is still a decent probability for Portillo’s.

-Brett

I would add that restaurant level customer ratings suggest that the Florida and Arizona stores are just as loved as the Chicago ones. Ratings are a bit lower for the Texas ones those.

Hello Brett, Can you please do a discussion regarding the LLC B Shares for Portillo’s. I have been watching the B Share reduction which is found in Note 12 of the annual report. None of the institutional analysts ask about it on the conference calls but Michelle Hook did say in the last call that it was down to 5.2% from the 60% at the IOP. My question is how is Portillo’s reducing this Class B Share ownership. I don’t think it is all done with A share replacement there have not been enough A shares created to replace 60% of the company. Is Portillo’s making cash payments to Class B holders for their shares or is it 100% dilution of the A shares? And if Portillo's is paying cash will this help the cash flow statement once the B Shares are eliminated? The two main points holding PTLO back are comp sales and cashflow. Is there a future positive cashflow position once the B Share are eliminated? Just trying to understand this strange B share process.