[PODCAST] We Force Ranked Our Portfolio Holdings

An annual exercise every investor should go through

YouTube

Spotify

Apple Podcasts

Today, we published a podcast episode where Ryan and I individually force ranked our personal portfolios. This is an annual exercise that helps us figure out what stocks we like the most and which stocks we should consider selling or replacing with new ideas.

We think it is helpful for all buy-and-hold investors to go through this exercise at least once a year.

Below, I will go through my forced ranking list of my stock holdings.

Don’t worry, we have a lot of stock research episodes in the hopper that I think you will enjoy on MercadoLibre, Nu Holdings, and S&P Global. We also have the weekly Power Hour podcast you can watch on YouTube or listen to on whatever podcast player of choice.

My forced ranking list

My process for forced ranking is a bit wonky. I have a list with 25 slots, but usually own around 10 companies. So, some spots are going to be left empty.

Looking at my existing holdings, I slot in each company based on how attractive I think the stock is at the moment. A #1 ranking means I am pounding the table and think it is a home run opportunity with minimal downside. #25 means I should have sold it yesterday.

Here is my current list:

N/A

N/A

Coupang (CPNG)

N/A

Remitly (RELY)

N/A

North Central Airports (OMAB)

Pacifico Airports (GAPB)

Nelnet (NNI)

N/A

Portillo’s (PTLO)

Mexican Stock Exchange (BOLSAA)

N/A

N/A

Nintendo (NTDOY)

Philip Morris International (PM)

N/A

GoGo (GOGO)

N/A

Harbor Diversified (HRBR)

N/A

N/A

N/A

N/A

N/A

After making this list simply off of a gut check, I go through each holding and write down why it deserved the ranking it got. Then, I decide whether to take any action with the portfolio to match my allocation with these rankings.

#20 Harbor Diversified

A microcap currently untradeable for individuals but trading well below its net cash position. I am optimistic on the position but we do not need to discuss it since there is nothing actionable to be done until they get current on annual report filing with the SEC. It will stay at #20 until this changes.

#18 GoGo

This is what I wrote in my personal journal as to why I bought GoGo stock in 2024:

“It is the only company with licensed exclusive spectrum, giving it an advantage over any copycat in North America. Along with the high switching costs of equipment on private jets, this has allowed GoGo to maintain a dominant market share of private jet internet services in North America.”

“Once 5G and GoGo Galileo (LEO) go live, it will further widen its moat by increasing the customer value proposition (faster internet speeds) and expanding the customer base. LEO competitors like Starlink are currently only workable in larger jets (what Elon Musk flies) and do not have the ATG capabilities in North America like GoGo.

There is no reason an existing GoGo customer would switch to Starlink, as long as they get 5G and GoGo Galileo out in a reasonable time. Plus, this market is too small for someone like SpaceX to prioritize.”

I still believe this to be the case. However, late in 2024 GoGo acquired Satcom Direct for cash and stock:

“Gogo paid $375 million in cash and issued five million shares of Gogo stock to SD ownership at close and could pay up to an additional $225 million tied to realizing performance thresholds over the next four years. The transaction, including fees, was funded with $250 million of debt and $150 million of cash from the Gogo balance sheet”

I am unsure as to the quality of Satcom Direct’s business. GoGo’s 5G + Galileo business seems to be doing fine, but there is still uncertainty here. A lot of uncertainty with this whole stock.

We get earnings later this week. This is an annual report I will be paying a lot of attention to, as I need to get a grasp as to whether I want to own what is essentially an entirely new business.

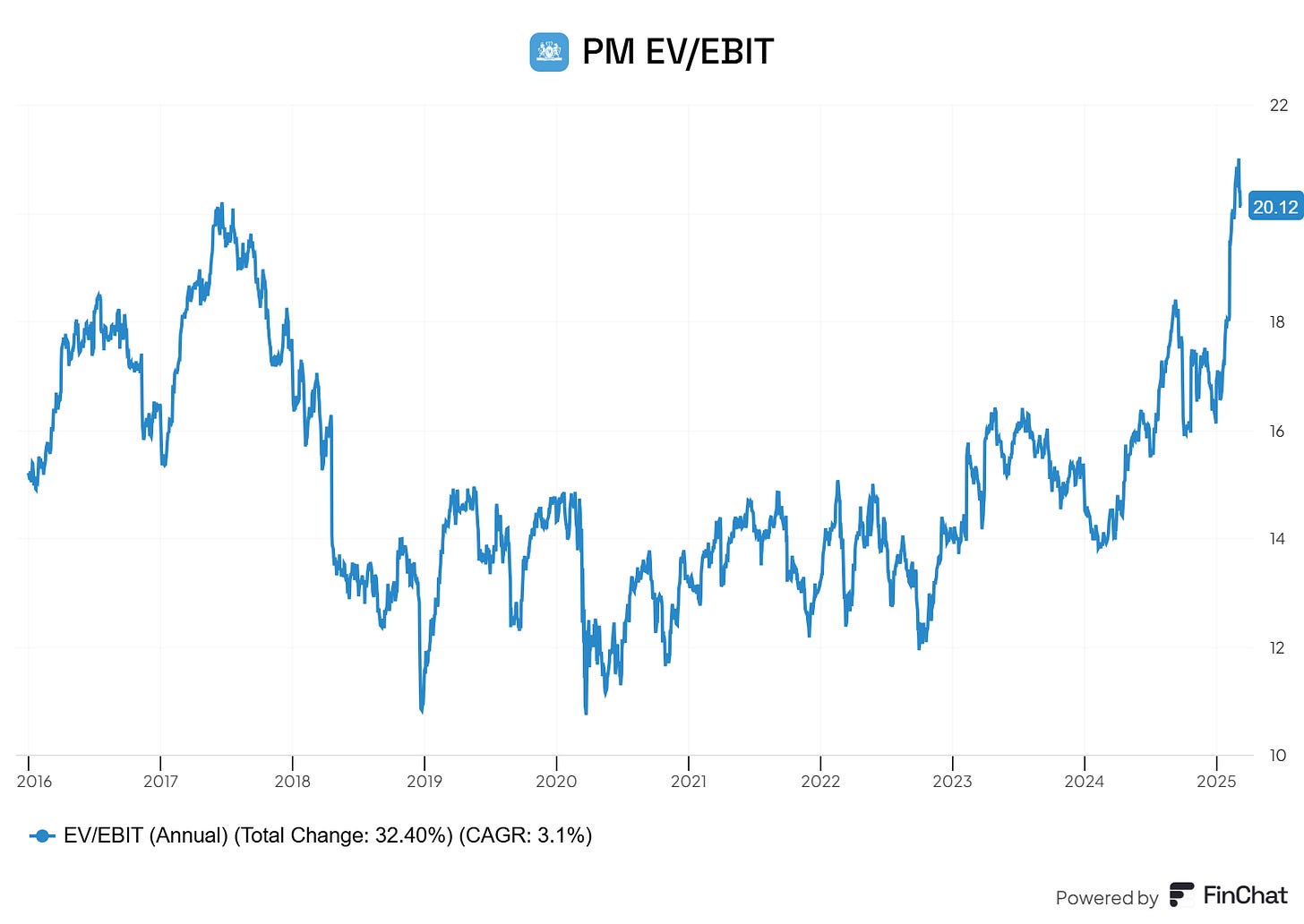

#16 Philip Morris International

I like the PM business but it has become a big winner and I am unsure on valuation.

According to our friends at Finchat, the stock trades at an EV/EBIT of 20, which is close to a record high. EV/FCF is 28.9. I do not think this is a crazy level for a company I believe can grow EPS at a 10%+ rate for the next five years, but it isn’t dirt cheap anymore.

I would not buy or sell PM stock here. It remains in limbo.

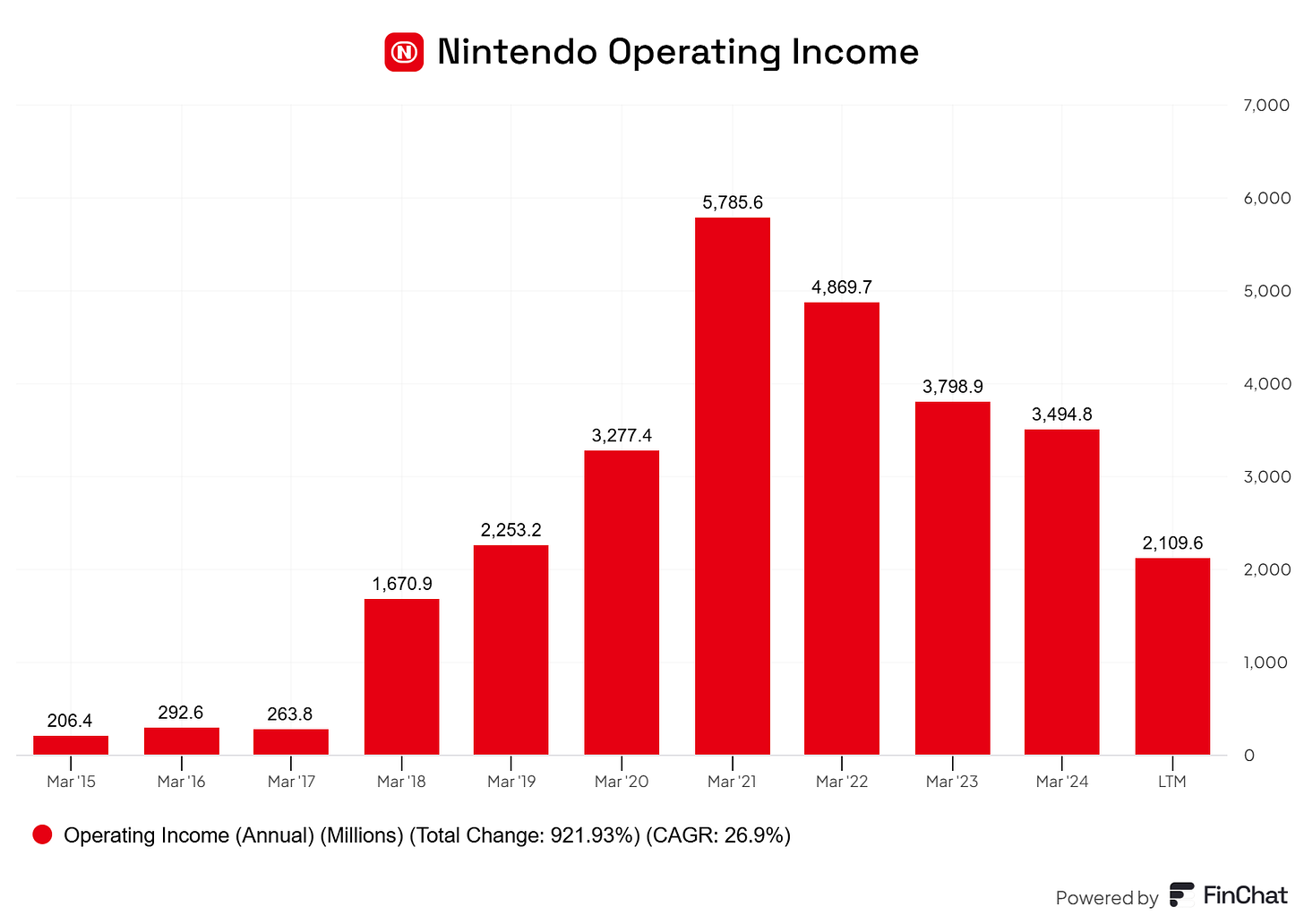

#15 Nintendo

Nintendo stock is falling fast on this tariff news, so maybe it is cheaper than I am assuming. However, this is another one that has been a winner due to some multiple expansion. There is anticipation ahead of the Switch 2 announcement that is coming within a month.

Today, Nintendo’s enterprise value is approximately $70 billion, give or take how you value everything on the balance sheet + its hidden assets. I don’t believe this business will generate much more than $5 billion - $7 billion in annual earnings over the next five years after the Switch is announced.

I do believe the stock is cheap and I am not anywhere near selling, but it is not a slam dunk buy at these levels either.

#12 Bolsa Mexicana De Valores

This is the Mexican stock exchange (I recently did a pitch on the stock on the podcast).

The thesis on the Mexican Stock Exchange is simple. It is a monopoly that will be able to grow its earnings through pricing power + counteracting inflation if Mexican stock trading activity remains flaccid. However, if Mexican stock trading picks up and listings start reappearing due to the reshoring boom, we could see a home run investment.

Bolsa revenue grew 6% in 2024. Operating income was up 7% in FY 2024 and up 16% in the fourth quarter.

We are still at a dividend yield of 5.8% (on my cost basis around 6.5%). There are no reasons to sell. I want to see how my thesis lays out over the next few years.

#11 Portillo’s

Portillo’s is still trying to “turn around” its business. Comp sales are moving in the right direction but we need to see more progress on this front in 2025 before I consider moving them up the list.

#9 Nelnet

As covered in the Nelnet review episode, I think the stock is cheap here but not overly cheap. We still have risks as they move into other operations.

#8 Pacifico Airports

The Mexican airport thesis is still playing out. Yes, we have a lot of news and noise over the tariffs, but the airports should be just fine.

In Q4, passenger traffic was up 1.4%. Aero revenues grew 10.5% and commercial revenue grew 32.7%.

In 2025, they are guiding for 4% - 6% of traffic growth and 23% - 25% aero revenue growth. Talk about a nice boost from the new MDP contract!

The company generated 15 billion pesos in operating income in 2024 and trades at a market cap of 195 billion Pesos, or 13x earnings give or take. Earnings should go up 50% - 100% over the next five years.

At a small position in the portfolio, I am considering adding to my stake with the stock falling on all this tariff volatility.

#7 Central North Airports

Same thesis as above, just slightly different and cheaper. Here is a recent research report I did on the stock.

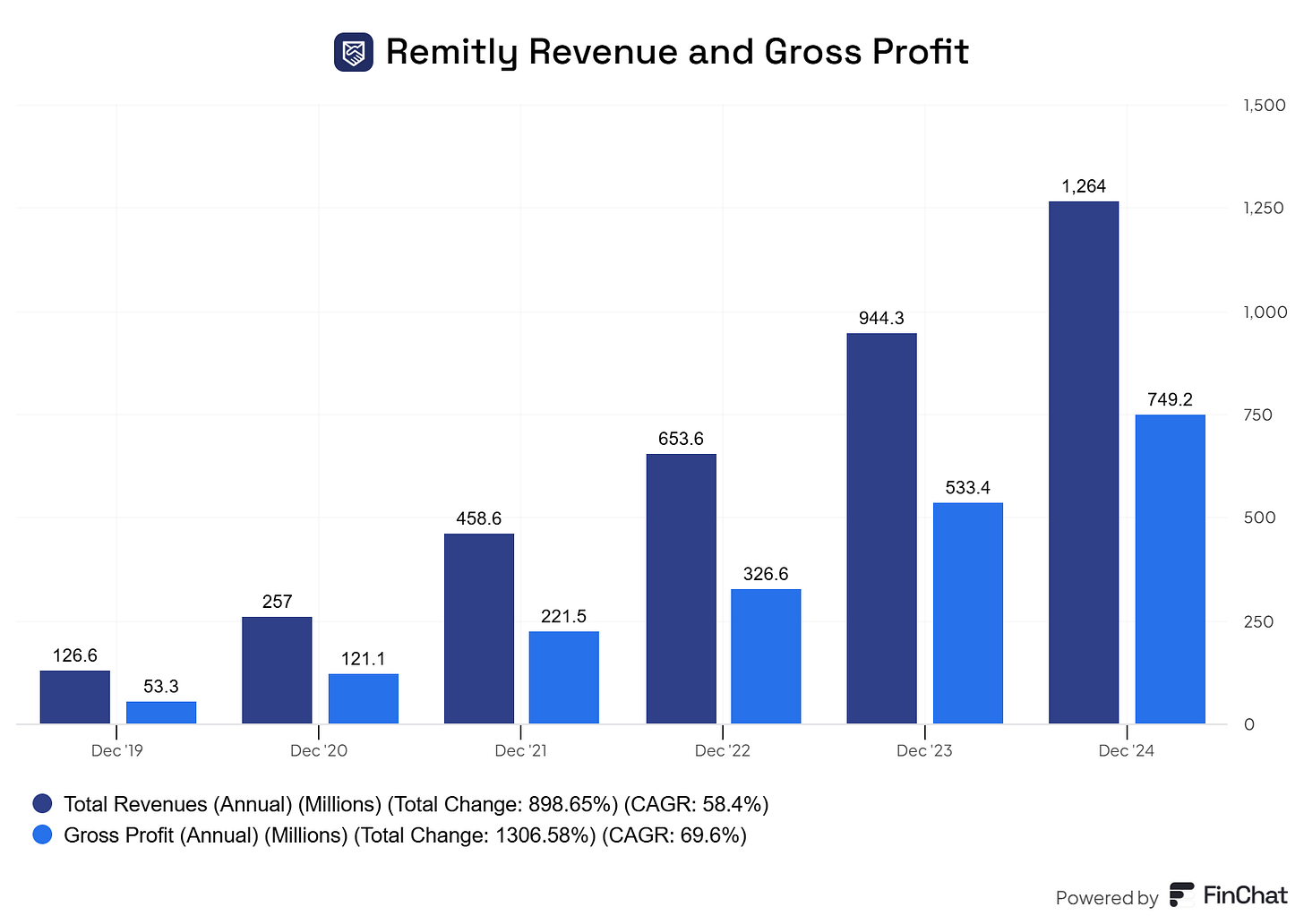

#5 Remitly

At $20 a share, I believe Remitly is a fantastic buy. It has a market cap of $4.2 billion, generated $750 million in gross profit in 2024, and has grown gross profit at a 70% annual rate since 2019.

With only a small sliver of the remittance market and plenty of share to take from Western Union and others, Remitly has a long runway to grow in the years to come.

I believe this stock has a chance to be a 10 bagger over the next 10 years. If I deposit more cash in my account, I could easily see myself adding to the position.

#3 Coupang

Coupang’s results have been nothing short of astounding, and the stock still hasn’t moved much.

At $22, we are at a market cap of $41 billion and an EV approaching $38 billion. It is cash flow positive. It is investing in Taiwan, which is seeing rapid growth. The South Korean cohorts still can spend more money on Coupang each and every year.

If Coupang reaches $50 billion in revenue vs. $30 billion today (something I think is well within reach), I think it can generate $5 billion a year in free cash flow.

The stock is dirt cheap at these levels. I plan on buying more and would not be surprised if this ended up my largest position outside of Nelnet (which is roughly 30% of my portfolio).

Here is an interview we did with Speedwell Research last year on the company.

-Brett

Chit Chat stocks is presented by:

Public.com has just launched its BOND ACCOUNT. Lock-in interest rates of 6% or higher (as of 9/30/24) by signing up today!

With as little as $1,000, the bond account allows you to buy a diversified portfolio of bonds and lock in your yield even if the Federal Reserve cuts rates.

It only takes a couple of minutes, get started today at Public.com/chitchatstocks and open up a bond fund today!

A Bond Account is a self-directed brokerage account with Public Investing, member FINRA/SIPC. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds. As of 9/26/24, the average, annualized yield to worst (YTW) across the Bond Account is greater than 6%. A bond’s yield is a function of its market price, which can fluctuate; therefore, a bond’s YTW is not “locked in” until the bond is purchased, and your yield at time of purchase may be different from the yield shown here. The “locked in” YTW is not guaranteed; you may receive less than the YTW of the bonds in the Bond Account if you sell any of the bonds before maturity or if the issuer defaults on the bond. Public Investing charges a markup on each bond trade. See our Fee Schedule. Bond Accounts are not recommendations of individual bonds or default allocations. The bonds in the Bond Account have not been selected based on your needs or risk profile. See https://public.com/disclosures/bond-account to learn more.