Oscar Health: Undervalued or Overhyped? (Ticker: OSCR)

Taking a thorough look at this fast growing health insurance stock

Thank you to Fundasy Investor for helping with research on this report! Check out his write-up on Oscar Health here

“No manual work on anything, no friction getting in the middle, no delays in any processing.” - Founder and CTO Mario Schlosser

On March 23rd, 2010, the American healthcare system was changed forever with the passing of the Affordable Care Act (ACA).

The ACA allows for broader Medicaid inclusion, exchange markets, and financial help for people to afford healthcare plans. Since its passing, the percentage of uninsured Americans has been cut in half, from around 15% of the population to 7.5% in 2023.

Today, we are going to focus on he ACA exchange markets. It is their growth from both individuals and employers that has garnered investor excitement around Oscar Health, our stock of interest today.

ACA exchange marketplaces are state-by-state, either run by the state itself or through the assistance of the federal government. Marketplaces are where people who do not have insurance provided by an employer can buy insurance, with the theory that a centralized exchange will foster competition and reduce costs.

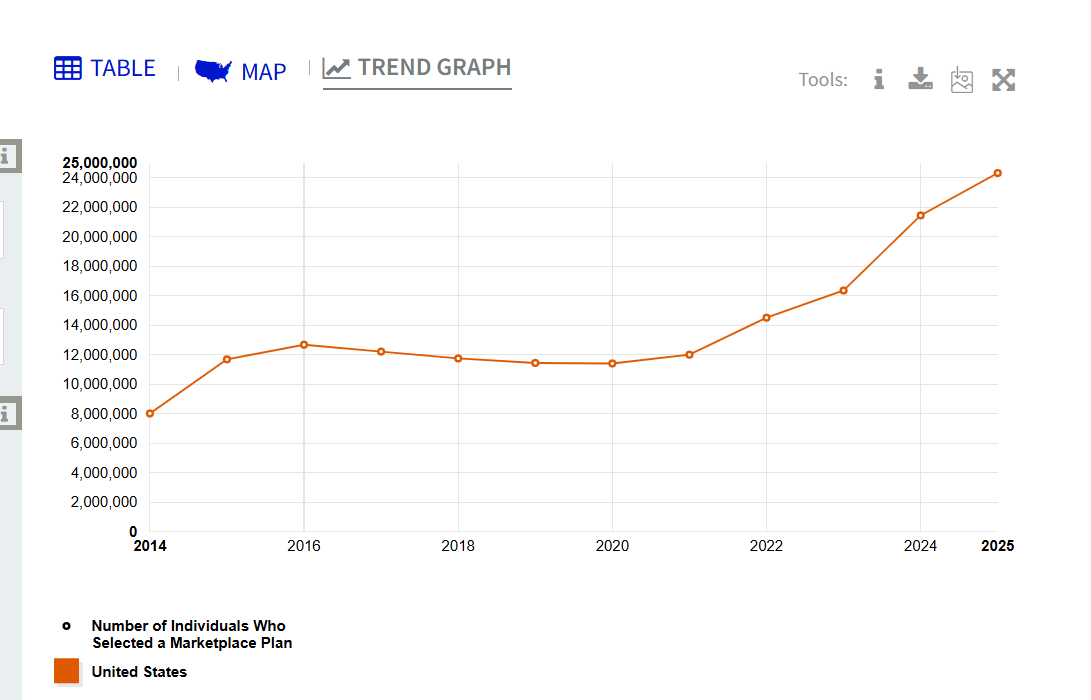

Enrollees in ACA marketplaces have soared since 2020 due to discounted coverage during the COVID-19 pandemic, extended by the Inflation Reduction Act. As of this writing, the government assistance is expected to expire next year.

Restrictions set by the ACA make the plans available somewhat commoditized. You cannot deny people coverage, or exclude them due to preexisting conditions such as diabetes. Plans can only discriminate by age, location, family size, and tobacco use. No other considerations can be made. Plan pricing goes through a formal review process every year.

Profits are also commoditized:

“In the individual and small group markets, insurers must spend at least 80% of their premium income on health care claims and quality improvement efforts, leaving the remaining 20% for administration, marketing expenses, and profit.”

Or, the Medical Loss Ratio cannot be under 80%.

Medical Loss Ratio (MLR): The percentage of health insurance premiums spent on claims every year.

Insurers on the ACA marketplace have a strict MLR ceiling and are bound by the strict rules around coverage access. They have to make estimates on what future claims will be, set pricing for plans for the upcoming year, and target an 80% MLR. Not as easy as it sounds. You need scale and good foresight.

Where can an insurer differentiate and maximize profits? Through user experience, customizations, and technology.

Oscar Health’s History And Business Strategy

After getting frustrated with the initial roll-out of the ACA, Oscar Health founders Mario Schlosser, Joshua Kushner (yes, you made the correct connection with this name), and Kevin Nazemi started the company in 2012.

As the story goes, the trio wanted to leverage digital tools to build a better health insurer. We all know how it is to deal with legacy insurance providers, a group that seemingly wants to grind you into submission and frustrate you until you give up.

Oscar’s first insurance offering was launched on the New York exchange in 2013. It then expanded to other states such as Florida and is currently in 18 states as of 2025. Expansion has included small businesses, with some major lumps along the way. It exited California and Medicare Advantage because of profit worries (including a partnership with Cigna).

From a standing start, Oscar Health has grown to 2 million total members. Its members have grown at a 51.5% annual rate since 2019.

(The chart below is from Fiscal.ai. Use our link and get a 15% discount on any paid plan!)

Some of this growth can be attributed to the broad tailwind of individuals adopting ACA plans. Most is due to Oscar stealing market share.

“We’ve grown our ACA market share from 4% in 2021 to approximately 7% today”

“Iowa is a bit of a different story. This is one where we’ve had more of a consistent growth trajectory over time. We entered there with an exclusive provider, network partner, and we’ve steadily expanded with them across the state to merely statewide in the state of Iowa. With this, our name has become synonymous with access to a reputable provider in very rural parts of the state. And now we moved from 4% market share in Iowa to 18% today.” - 2024 Investor Day (June)

Why are people switching to Oscar Health plans? It comes down to the customer experience, technology backend, and branding.

Oscar has:

An easy-to-use mobile application for scheduling and communication (4.9 stars on the App Store)

A “Care Team” that helps you find the best local providers for your situation

$0 virtual care included with your membership

Plus much more. Oscar wants to save you time when dealing with health insurance while legacy players (at least, from my experience) try to waste your time. Net Promoter Scores significantly higher than industry averages quantify this customer appreciation.

With 2 million members and 25 million potential ACA enrollees that could keep growing over the long-term, the addressable market for Oscar Health is large. If it can expand nationally and achieve he same ~15% - 20% share of the ACA payers in its existing base, that could help double its total members over the next 5 - 10 years.

Bertolini and improved insurance processes

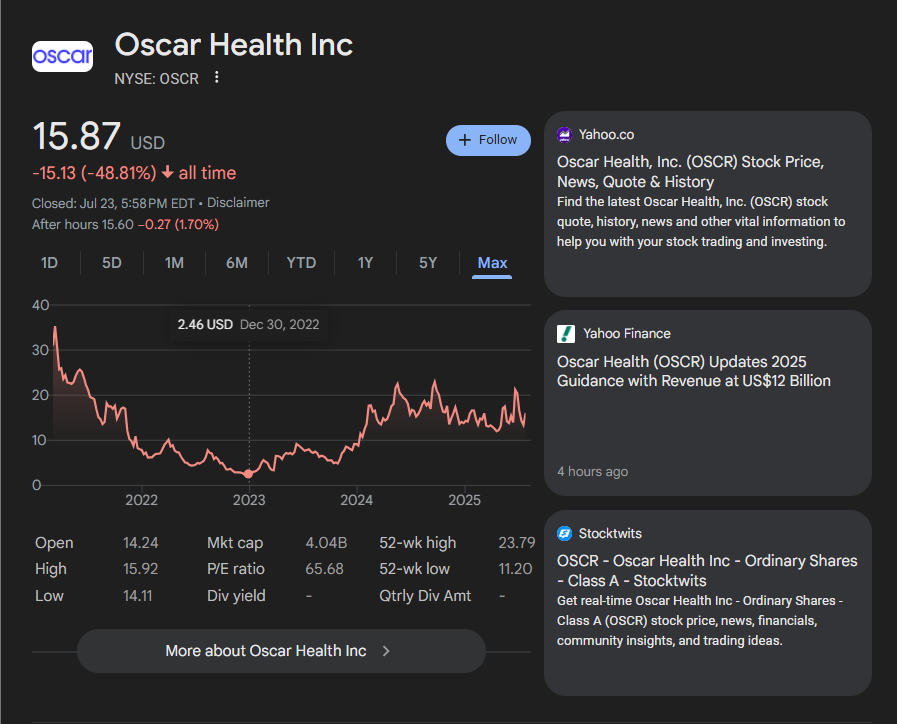

Along with the other insurance technology disruptors, Oscar Health’s stock price collapsed in the 2022 bear market, going in a 90%+ drawdown from $30 down to around $2.

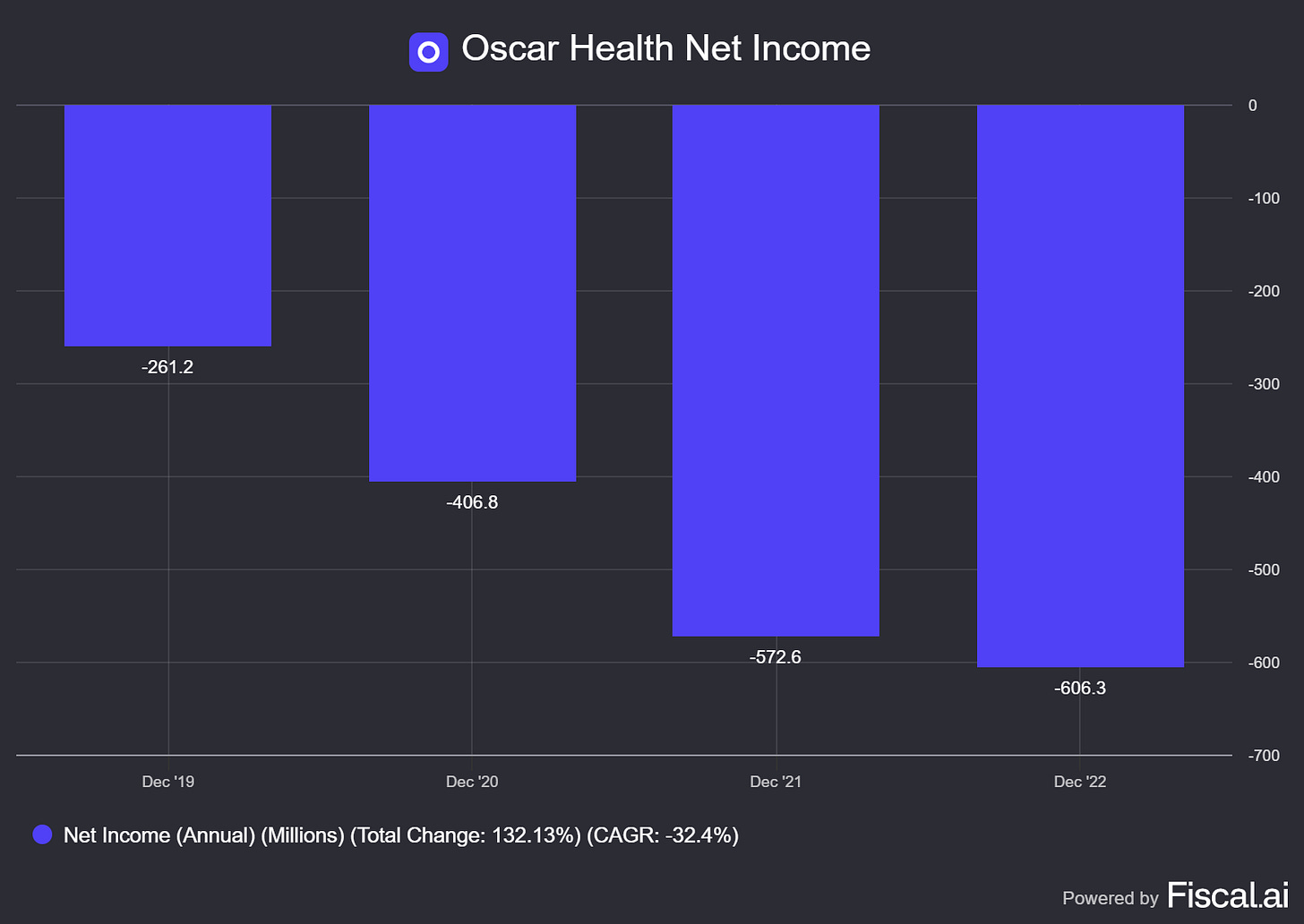

You can understand why investors were nervous when you see the net income figures. From 2019 - 2022, net income steadily got worse until it hit $606 million in 2022.

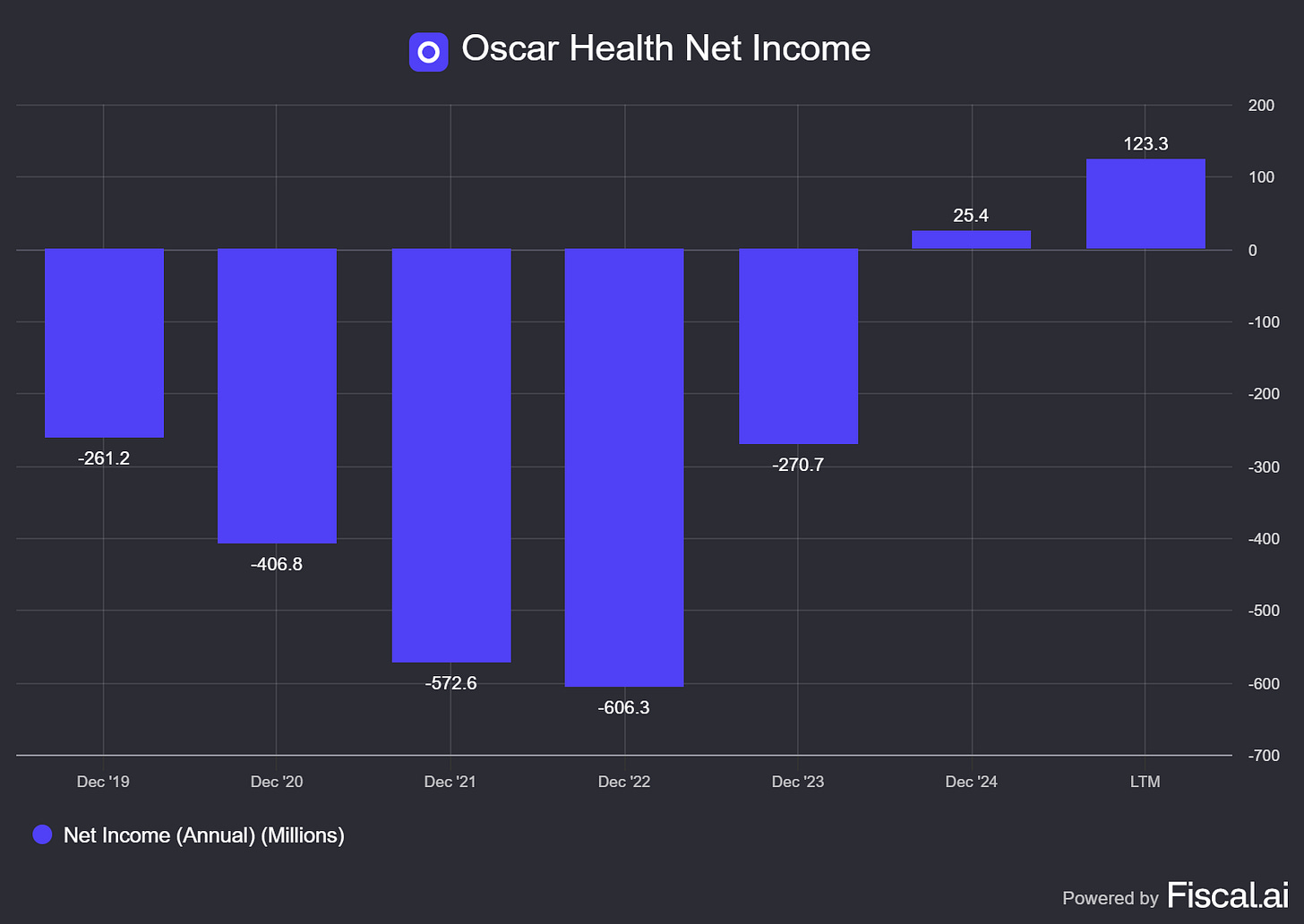

In March of 2023, Oscar Health made a decision that might have saved the company: hiring Mark Bertolini.

Bertolini is an experienced insurance executive who was the previous leader of Aetna. At Aetna, he produced a 27% IRR for shareholders over 8 years before selling to CVS in 2018.

With the management change, Schlosser is now head of technology and product, while Bertolini is the CEO. Bertolini is tasked with running a profitable insurer, while Schlosser is in charge of building technology/digital tools to improve customer experiences and save on costs.

When joining the company, Bertolini was asked if there was any low hanging fruit to pick up and improve operations. He responded saying there were “Watermelons rolling around on the floor.”

Net income has made a quick recovery:

Bertolini has performance stock units tied to the share price hitting $11, $16, and $39. The current share price is around $15. At 68 years old, I believe Bertolini was brought on to get Oscar Health consistently profitable before passing the baton.

According to the proxy filing, he has ~2.4% of the outstanding stock when including options/PSUs, which would be worth around $250 million if Oscar’s stock reaches $50 a share.

Voting is not controlled by Schlosser but Joshua Kushner and Thrive Capital, which have 70%+ combined voting power. It is a software and technology venture capital firm. Oscar Health is likely one of its big winners, and eventually, it will want to return capital to its outside investors.

I like the skin in the game. The founders control the company, Schlosser is in charge of the technology, and Bertolini is incentivized to build a profitable insurer and make hundreds of millions of dollars. Incentives are aligned with minority shareholders.

Oscar Health’s market opportunity (and competition)

One purpose of the ACA was to provide tax breaks for individual payers if they fit below annual income levels. For example, if you are at a % of the poverty line, you pay zero or a minimal monthly premium for health insurance in order to get you in the network and help with your healthcare costs that you otherwise couldn’t afford.

The COVID-19 stimulus package and follow-on Inflation Reduction Act gave out enhanced subsidies for health insurance premiums bought through the ACA marketplaces. More people could afford health insurance, so more people bought it.

Next year, these subsidies are set to expire unless the government intervenes (note: ACA payors from Republican states have grown significantly). This will increase premiums, which on the whole will lead to people downgrading or foregoing insurance altogether.

This is a looming headwind for Oscar Health. It is clearly hurting the stock, as we will see in the valuation section. However, uncertainty can be an opportunity for investors, especially if your time horizon is longer than 18 months. Increased costs may lead people to switch providers and consider Oscar Health.

A potential tailwind for Oscar Health is the growth of Individual Coverage Health Reimbursement Arrangements, otherwise known as ICHRA.

The majority of health insurance in the United States is paid for by employers. Health insurers like United Health will sign deals with businesses, and then give employees options for health insurance plans.

Inherently, nothing is wrong with employee-sponsored health insurance. However, the incentives can and have gotten misaligned. Employees don’t care about their health insurance costs. Insurance providers lock-in these large corporations and raise prices while individuals potentially overutilize insurance benefits on stratified plans.

ICHRA plans break this model. With these plans, employers give employees cash benefits in a specific bank account that they can use to buy insurance on the ACA market.

This would benefit Oscar Health immensely, which is why the company is pushing heavily to grow these plans. It would unlock an estimated 75 million new payers and potentially hundreds of billions of dollars in annual premiums paid.

This could increase Oscar’s potential payer TAM significantly. There are 25 million ACA payors today, which will shrink next year. 75 million people employed by companies with under 1,000 employees greatly expands its target audience.

Which brings us to Oscar Health’s competitors and the current health insurance landscape.

During the COVID-19 pandemic, the health insurance companies hit record levels of profitability. Why? People underutilized healthcare benefits because of crowding out for COVID needs. Now, this is normalizing and increasing costs.

Oscar Health is facing this headwind, but not some others that the legacy health insurers are in the middle of. First, are changes to Medicare Advantage that have hurt insurers like United Health. Second, is increased scrutiny around costs/claims practices. Just today, United Health confirmed the Department of Justice is looking into its Medicare practices to bolster payments on diagnoses.

Oscar Health is not immune to the macroeconomic factors hurting health insurers right now. In 2025, it now expects an operating loss of $230 million due to actuarial assessments on paid claims submissions so far in 2025. The company plans to take “appropriate pricing actions for 2026” to get back in the black. Its MLR is expected to be 86% - 87% when in reality it needs to get closer to the 80% ACA ceiling.

2025 will not look great financially (even though revenue is soaring), but there is no reason why the company cannot reprice with the normalization of the market next year. This is why the Bertolini hire looks so promising: my confidence in the company’s navigation of this pricing volatility would be much lower with technology people running the company.

On the whole, I think Oscar Health has solid counterpositioning vs. competitors today. In the core ACA market it has differentiated itself as best as possible through technology/customization of plans. It will benefit if more people switch to individual plans. The other health insurers are bogged down by DOJ investigations, Medicare, and employee-sponsored plans. They have major technology debt.

More succinctly: Oscar Health has a clear path to keep gaining market share in ACA health insurance.

Moonshot: +Oscar

While it will not impact the financials anytime soon, I would be remiss if I didn’t talk about +Oscar. This is the third circle of its intricate venn diagram from the 2024 Investor Day and is clearly a priority for the technology team (nice job by the intern here).

+Oscar takes Oscar Health’s software and outsources it to third-parties. Currently, this does not include other health insurance companies (you don’t want to give away any competitive edge) but does include doctor’s offices and hospitals.

Using its unified data integration, +Oscar will connect everything together for a patient.

+Oscar has the chance to boost Oscar Health in two ways. First, it can be another source of revenue. This is obvious. What is not obvious is how it can help further differentiate Oscar Health from the health insurance competition.

If more healthcare providers are using +Oscar, they are more likely to work with Oscar Health insurance. More providers means a better value proposition for users, which will work seamlessly with Oscar’s software, making it a better customer experience. If all these providers are connected to Oscar through its software, that makes it a much better partner than a United Health for both the insurance payor and the healthcare providers.

This is why I call it a moonshot. Because if Oscar Health can build momentum with +Oscar (a big if) it has a chance to build a distinct advantage vs. other health insurance providers.

Valuing a health insurer

I see a lot of investors valuing Oscar Health on revenue figures. This is not the proper way to value an insurance provider (or any company, for that matter). It does not matter how fast revenue is growing. What matters first is underwriting profitable insurance. Oscar Health has struggled with this and will struggle again in 2025 because of it.

We also cannot subtract out – at least too much – of the company’s cash balance.

Last quarter, Oscar Health had:

$3 billion in cash and short-term investments

$1.87 billion in long-term investments

But, it also has:

$1.47 billion in benefits payable

$1.95 billion in risk-adjustment transfer payable

$300 million in long-term debt

There are cash requirements to be held at the state level and potential increased claims usage like what is happening in 2025. If the company wants to expand into new markets, they will likely start out unprofitably. I think the balance sheet is well capitalized, but surprises happen in the health insurance market all the time. It is best to stay ultra-conservative.

Like other insurers, Oscar Health will see earnings from this excess cash from interest income, which was $189 million over the last twelve months. Not bad compared to a market cap of $4 billion.

So, how do we value Oscar Health? There is higher uncertainty compared to a typical business. It is not everyday you go from a $200 million+ operating income guide to a $230 million operating loss guide in one quarter. MLR guidance went from 81% to 87% with one actuarial assessment. Yikes.

From its 2024 Investor Day through 2027, Oscar Health expects to grow its revenue at a 20% annual rate and reach a 5% operating margin. This is assuming the enhanced ACA subsidies end.

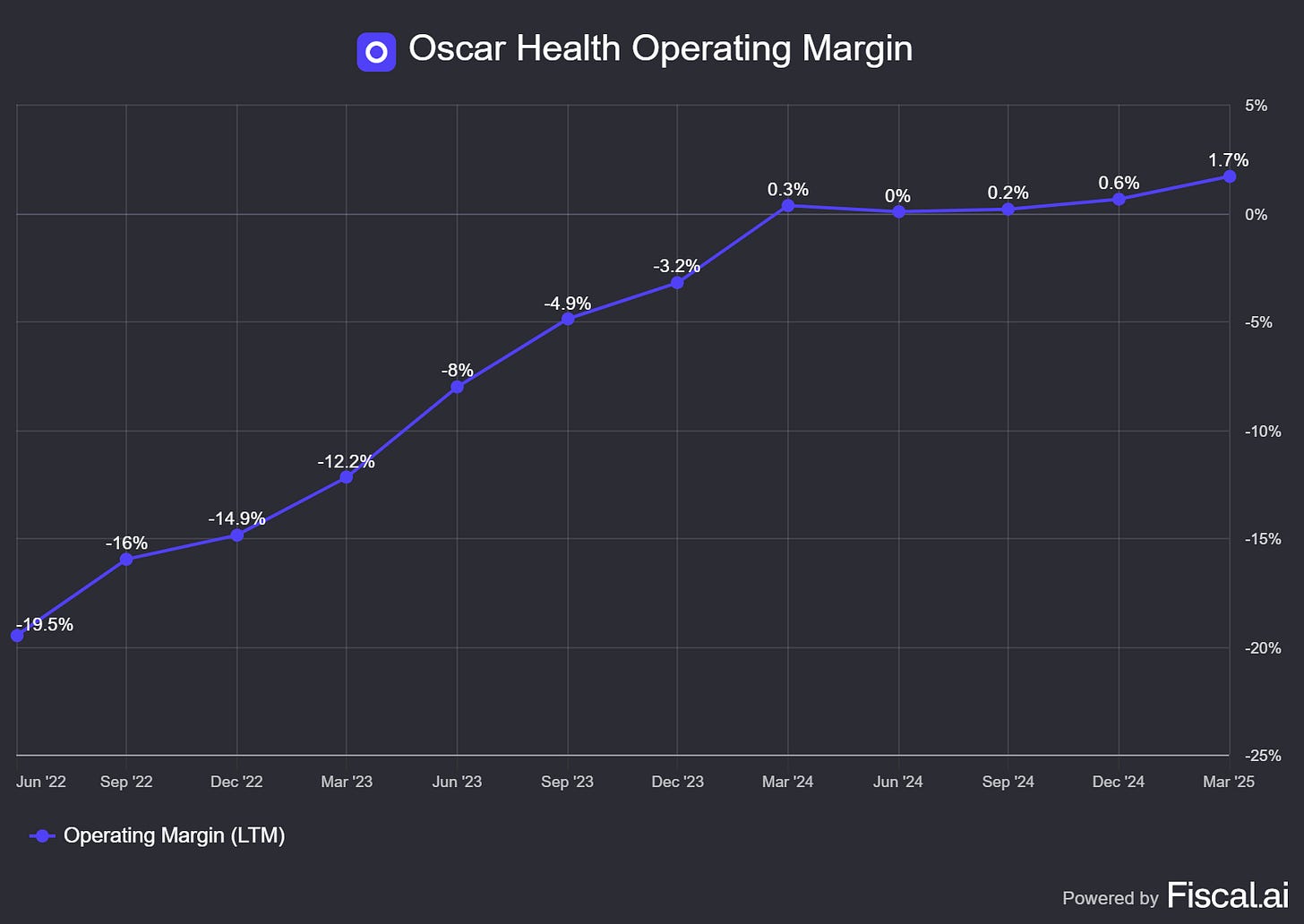

For reference, Oscar Health’s operating margin has climbed to 1.7% over the last 12 months. This will dip again in 2025 because of the increased utilization and need to reprice in 2026, but we can see clear progress in getting operating leverage over administrative, customer support, and marketing costs to clear a spread between the MLR and overhead.

At the time of the Investor Day, revenue was $6.5 billion. It has grown at a much faster rate than 20% in 2025 but will fall in 2026 due to the ending of the subsidies.

Assuming 20% revenue growth for three and a half years, Oscar Health should be doing between $12 billion and $13 billion in revenue in 2027. This is subject to change if healthcare inflation is high.

A 5% operating margin on $13 billion in revenue is $650 million in operating income. Or, a 6x multiple compared to the current market cap of $4 billion. The company has a lot of net loss carryforwards and should earn consistent interest income that will drive net income higher than operating income in 2027. A nice cherry on top.

Clearly, the Mr. Market does not believe that Oscar Health will reach its goals. But do I believe it can? And is the upside juicy enough to warrant taking on these health insurance sector risks?

At today’s price, I believe we are. Oscar Health has a track record of gaining market share and a clear path to take more share of ACA payors. There is major long-term upside from ICHRA plans and +Oscar. Scale is important to diversify risks in health insurance, and I see no reason why Oscar Health will not be able to gain operating leverage on its overhead once it gets a little larger than today. In fact, I would bet it can beat the traditional insurers in efficiency since it built a cloud-based system from the ground-up.

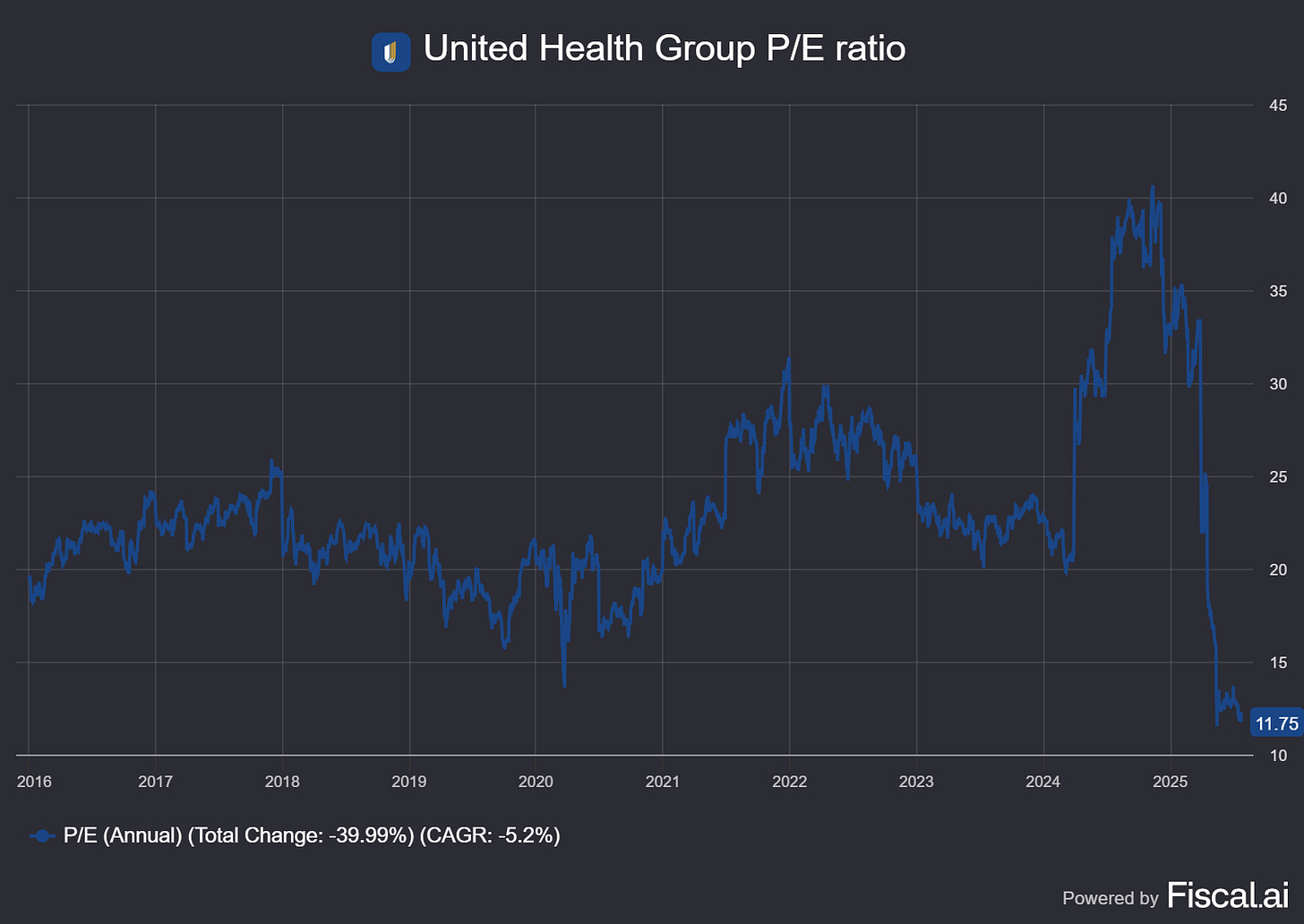

Historically, United Health traded at a P/E between 20 and 30. Now, it is down to a P/E of 11.8 because of its huge issues.

If Oscar Health hits its targets and trades at a P/E of 20, the stock is likely a 4 bagger in just a few years, and maybe a 10 bagger farther out if market share gains continue. That is a lot of upside to make up for the risks of subsidies ending and the uncertainty of health insurance profitability.

Does this company have an emerging moat?

Some investors may argue that Oscar Health has a competitive advantage because of its technology. I do not believe this is a moat, but it does give them counter positioning vs. the traditional health insurers, as well as a bit of the innovator’s dilemma. It is similar to the neobanks competing with technology built at Chase and Bank of America in the 1970’s.

What does lead to a competitive advantage in health insurance is scale. You need:

Scale to diversify claim risks across demographics

Scale in network providers to provide a suitable value proposition

Scale to get a profit over your large fixed cost investments

I think Oscar Health is on its way to reaching enough scale. Is that 3 million members? 4 million? It is definitely in a better position than any insurance technology upstart.

On both sides of the competitive equation (other disruptors vs. traditional players) Oscar Health has an advantage. As it gets more scale, it will slowly build a lasting competitive advantage.

After researching the company, I do believe Oscar Health has an emerging moat.

Am I Buying Oscar Health?

As I have written this article, Oscar Health’s market cap has slipped from $4 billion down to $3.6 billion. If it gets some level of positive operating margin in 2026 and 2027 and its membership doesn’t collapse, the stock is dirt cheap.

I have read many concerning articles on Oscar Health not hitting its 2027 earnings per share (EPS) guidance. Frankly, I could care less about this and do not even know what this guidance is.

As Druckenmiller says “find what will make the stock go up.” EPS targets will not get the stock up.

Here’s what will:

Continued market share gains through 2026

Recovered MLR and operating margin in 2026

I think the market share gains are highly likely in 2026. A recovered operating margin is likely, but still has some uncertainty. Plans will reprice in 2026, subsidies may not get eliminated, and the government-mandated profit spigot will return. More likely than not, this is the world I envision happening.

Downside will occur if Oscar Health cannot get the wheels turning on operating leverage in 2026. A sputtering engine probably means the stock trades in place as expectations are quite low right now. Of course, a total insurance blow-up could occur, but I think the likelihood of this is small given how regulated the ACA market is.

To sum it up, we have:

10 bagger upside potential

Limited downside at current prices if we are wrong

Small chance of a blown up stock

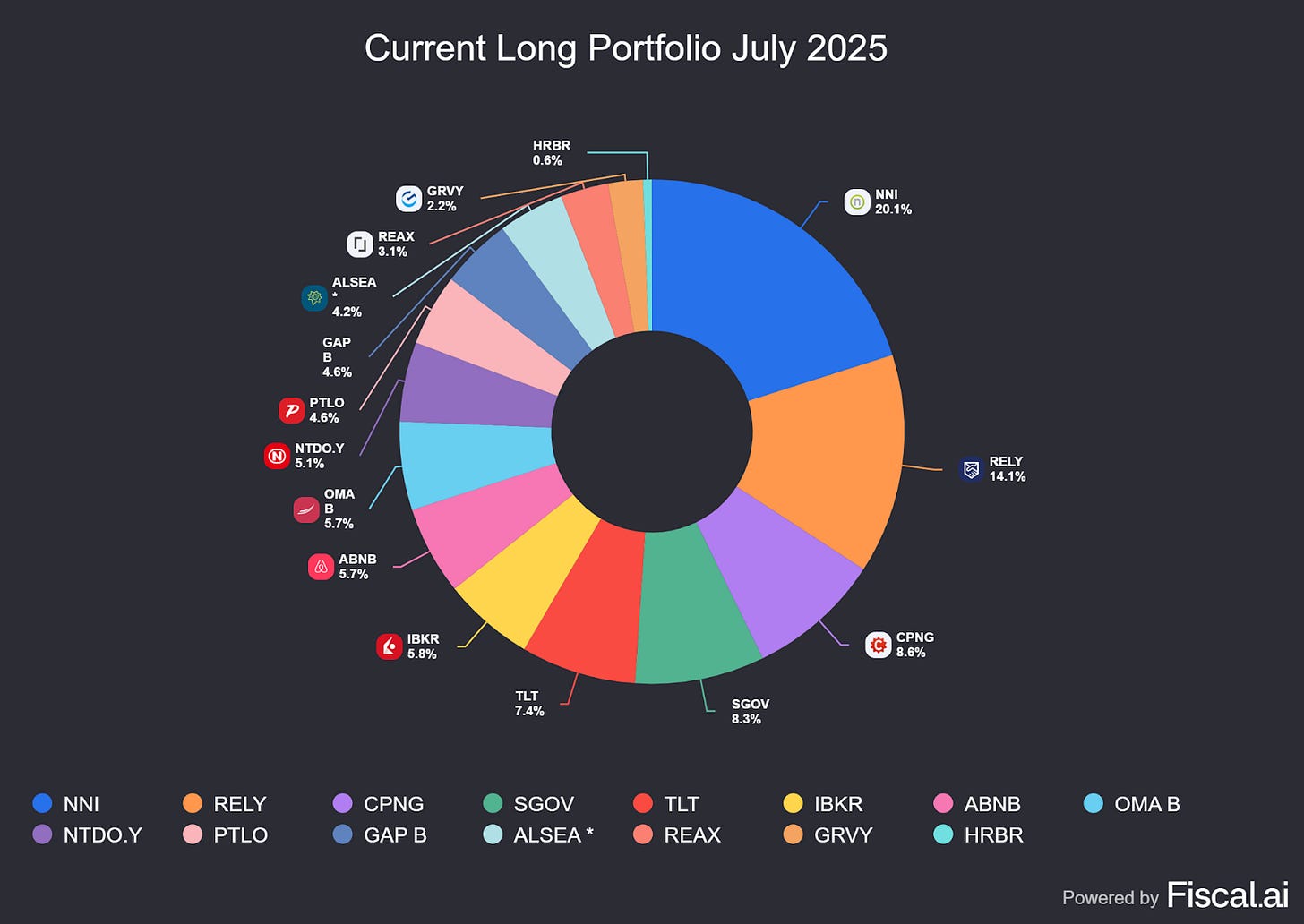

I should own Oscar Health. The risk/reward matrix makes a lot of sense today. I think it deserves a 5% position in my portfolio.

What do I fund it with is the next question.

Here is my portfolio today:

(SGOV is cash, and TLT is a long-term bond ETF).

My plan is to keep my cash position and sell some of my least favorite holdings to fund the purchase. Alsea Group comes to mind. Its valuation is getting stretched and I don’t love the business. Gravity is a net-net play that I am not in love with. Portillo’s is close to the chopping block if it doesn’t show a turnaround this quarter.

That alone + new cash inflows should be plenty to fund a 5% purchase of Oscar Health.

I plan to buy shares of Oscar after this newsletter is published on Wednesday, July 30th. Subscribers will get an update on the new portfolio when the trades have been completed.

-Brett