Kraken Robotics: Subsea Superiority (Ticker: KRKNF)

A small-cap hypergrower benefitting from the defense spending supercycle

“China is on the verge of becoming a world-class submarine power, with new technology and a bigger, better fleet that is gaining on the U.S. and its allies—spurring a new undersea arms race in the Pacific.

Rapid improvements are making Beijing’s underwater navy quieter and faster, capable of carrying more advanced weapons and better sensors and able to remain submerged for longer.

At the same time, Beijing’s military has extended its reach deeper into the Pacific, confronting rivals in the South China Sea and performing blockade and invasion drills around Taiwan, where a conflict could demand a greater role for submarines than at any time since World War II.

That is pushing the U.S.—which stations about 60% of its worldwide submarine force in the Indo-Pacific—and its allies to bulk up their own underwater fleets.” - The Wall Street Journal

The United States is not a global empire in the traditional sense. Instead of conquering and physically controlling other territory, its military controls everything except land. Airspace, outer space, the sea, and the subsea are the key focuses of control. Combined with control over currencies, communication, and culture, the United States has reigned supreme since World War II while rarely occupying physical land.

It has been an ingenious way to build a global economic order. But that is not the topic of today’s report. What we are discussing is the increasingly important domain of subsea defense for the United States military, and one stock that may benefit from this increasing importance: Kraken Robotics (OTC: KRKN.F).

Technological innovations such as unmanned underwater vehicles (UUVs) create both opportunities and risks under the ocean.

If the United States loses domination in one military domain, it loses leverage over potential combatants such as China and Russia. Over the next 10 years, the United States is slated to spend $214 billion just on submarines, mainly to maintain a subsea presence with nuclear-armed vehicles invisible to sonar and therefore untrackable by potential combatants. Given their strategic importance, the United States needs to keep a technological edge under the ocean to keep the nuclear deterrent, well, deterring.

It is clear that the United States will invest whatever it takes to make sure it maintains subsea dominance.

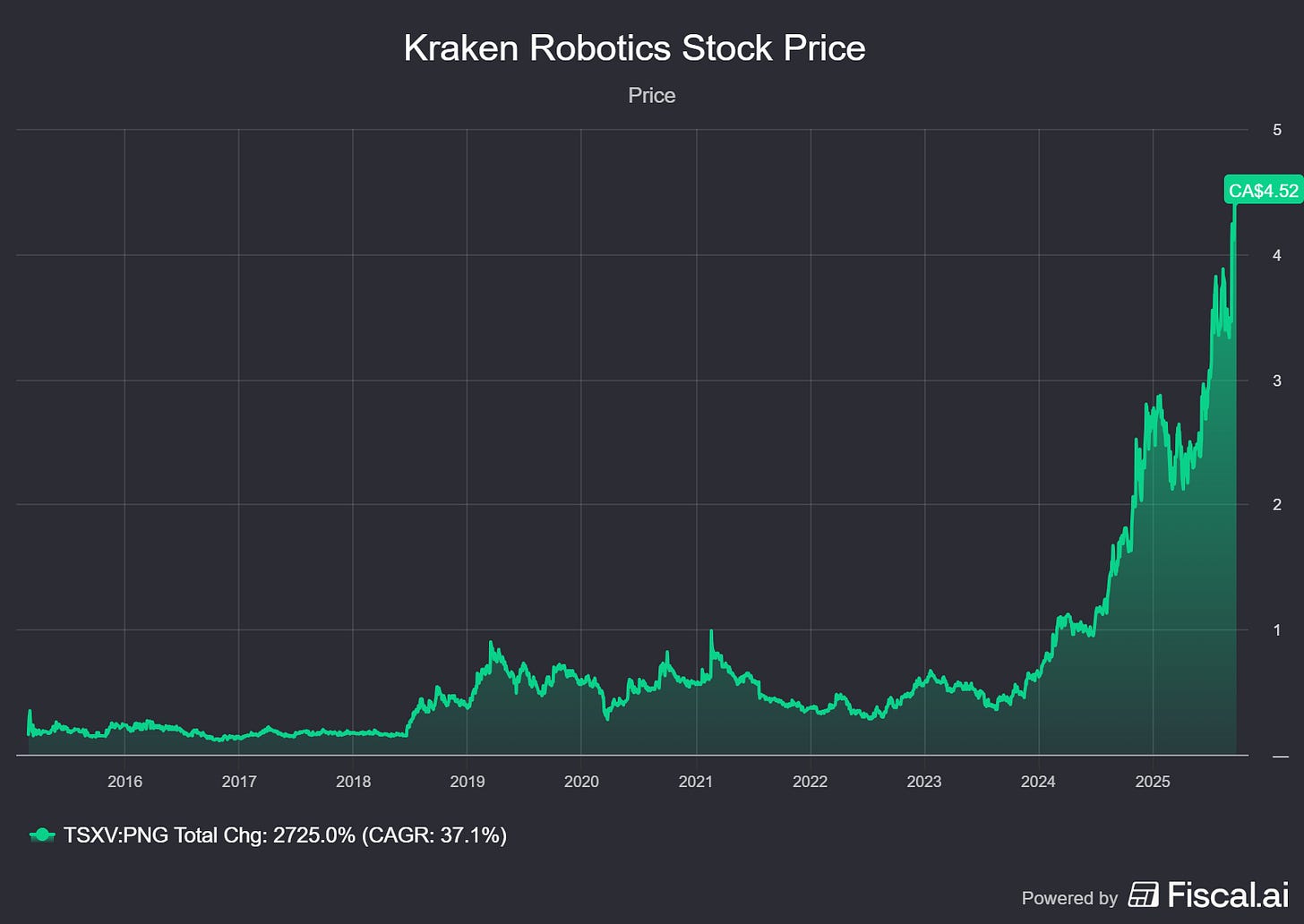

Kraken Robotics is a stock that benefitting from this incentive. Its revenue has grown at a 50% annual rate since 2015, while its stock is more than a ten bagger since going public. As a supplier of batteries, sensors, and mapping solutions, Kraken Robotics is positioned to take advantage of increased spending on advanced subsea systems.

Charts for today’s episode comes from our friends at Fiscal.ai. Use our link and get 15% OFF any paid plan: Fiscal.ai/chitchat

Why is operating underwater so difficult?

At 6,000 feet under the ocean, an object is facing more than 2,500 pounds per square inch of pressure. Read that again. For any object used to operating at totally different pressures – such as a human – this may feel a bit heavy.

If a submarine is not built properly, it will implode violently under deep sea pressure. The Titan Submarine being the most recent example:

There is also the fact the deep ocean is pitch black. Or, that it is impossible to see through, even with radar systems (which is why submarines use sound, or Sonar, to try and track objects in the ocean). The deep ocean is so mysterious, we have witnessed only two blue whale births in history. Humans know more about outer space than what goes on in the Mariana Trench.

But what if we could invent technology to circumvent these issues and fully understand and control the subsea domain? That is what Kraken Robotics, the United States military, and its allies are trying to solve.

Kraken Robotics subsea solutions

Kraken Robotics motto is to transform subsea intelligence. It has multiple products it sells to both commercial and defense customers.

First and most important are subsea batteries. Its SeaPower Batteries brand has 200% greater energy density and 46% weight reduction compared to the next best option. For anyone that knows the battery industry, energy density and weight are your killer features. It is what will win you contracts.

Using a proprietary recipe for polymer encapsulation, Kraken is currently beating any competition for underwater batteries. Improved performance means longer life under the ocean and more efficient designs for subsea vehicles. The most vulnerable time for a subsea military vehicle is when it comes to surface, meaning the longer a vehicle can stay hidden underwater, the better.

The second product category to understand is synthetic aperture sonar (SAS). Using sidescanning technology, Kraken is able to image and map underwater areas with its SAS product, with up to 2cm zoom on objects up to 200m per side. Think of it like an improved pixel rating for underwater mapping. These are used for harbor security, offshore energy, and marine life research projects.

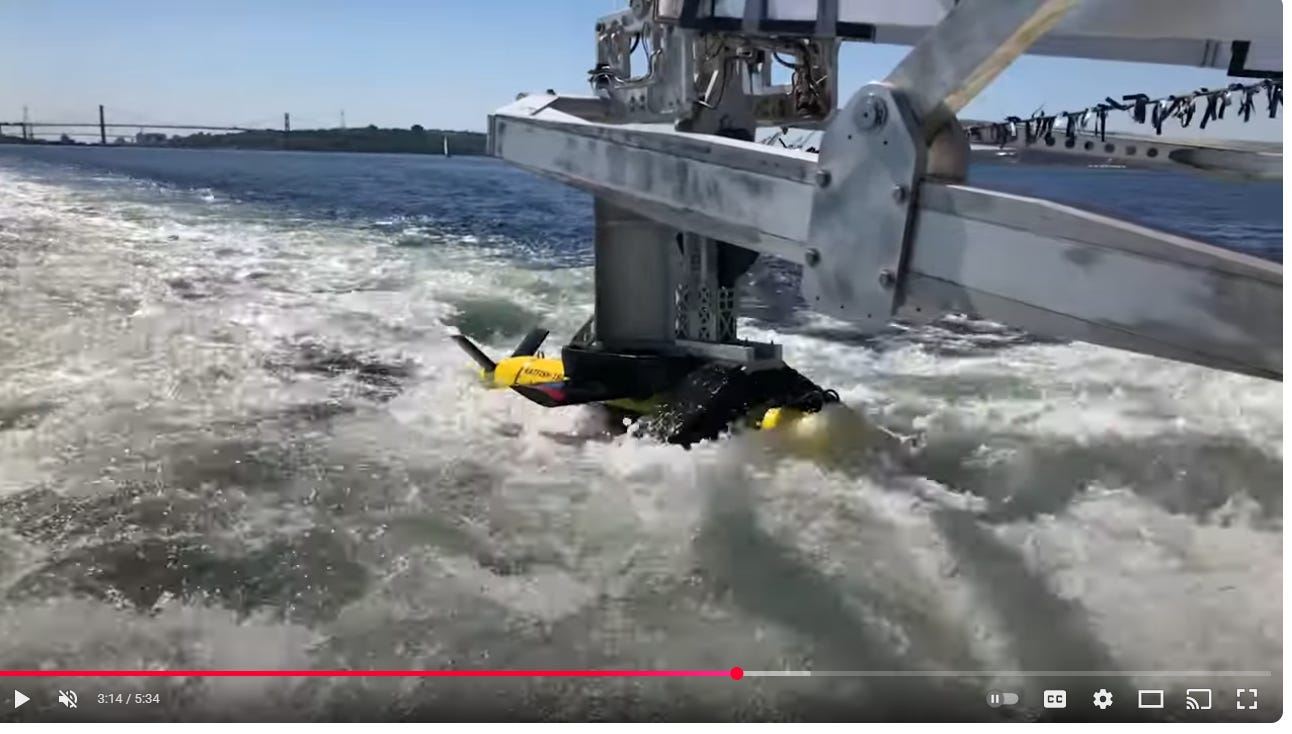

Kraken will sell SAS products directly to customers or perform mapping contracts for customers using its own SAS systems (it can also image under the ocean floor to a few meters). If you are having trouble understanding exactly what is going on here, watch this Kraken-made YouTube video.

Lastly, Kraken has a relatively new product line in 3D mapping systems (as opposed to 2D imaging). It recently acquired a company called 3D at Depth, which does LIDAR mapping underwater. This is the next step in underwater tracking, creating 3D scans of systems to help monitor what is going on under the ocean. Think of an oil company wanting to accurately monitor its offshore assets, all under one software program and managed in the cloud.

Kraken is not selling these products/services to traditional submarines. These systems have legacy contracts that will not be replaced (and are generally not powered by electric batteries). They are looking to win new contracts, specifically in the UUV space.

Like unmanned aerial vehicles (drones), UUVs are growing in popularity as a potential replacement for manned submarines.

Competition: Does Kraken Have an Advantage?

Before diving into the financials, I think it is important to look at the competitive landscape for Kraken’s three product categories:

Sonar and sensor systems

Subsea batteries

Imaging services (including 3D at Depth)

After doing so, we can take a comprehensive view of any current – or emerging – competitive advantage that Kraken Robotics has in the subsea field.

To help with my research on competition, I was able to talk with Kraken’s IR outpost Sophic Capital. Reach out to them if you have any interest in the business or further questions.

Sonar and sensor systems

Kraken has direct competition in this space, namely from Northrop Grumman and its Micro-SAS product. The system looks exactly the same as Kraken’s.

Is there a wide moat to this business? No. Kraken may have an edge in focus over a large defense contractor, but it is selling a very similar product.

However, Kraken reportedly is able to sell (or willing to sell) its Kraken SAS system at half the cost of competitors while still maintaining 50% gross margins. Perhaps there is less bloat at Kraken making it more efficient?

I would define this as a good business, but not a great business.

Subsea batteries

Batteries are a different story. Kraken’s innovations in batteries have left the competition in the dust, which is why demand is soaring:

“Our SeaPower™ subsea battery business grew significantly and had its highest quarterly revenue to date, however, this growth was offset by our sonar related revenue which declined as the acquisition component of the Canadian Navy RMDS system integration project nears completion. As in the past, quarterly revenue can fluctuate significantly due to the timing of product orders and shipments.” - Q2 Earnings Release

A single UUV such as the Anduril Ghost Shark will have $2 million worth of Kraken batteries (plus more revenue from Kraken’s sensor sales). Anduril just won a $1.12 billion contract from the Australian Navy for the Ghost Shark, which will utilize Kraken batteries. Expect other Navies to follow (for example, Argentina and Peru could surely use some Ghost Sharks to deter illegal Chinese fishing crews).

If the Australian Navy wants 25 Ghost Sharks, you know the US Navy is going to want 250. That’s just the way it goes.

This is not to say Kraken has any IP protecting its battery technology. It has simply out-innovated the competition, which cannot figure out how to copy its polymer-based sealing system.

Is that an emerging moat?

I don’t believe technological innovation is ever a moat by itself.

However, I have fairly high confidence that Kraken can maintain its edge in subsea batteries for the next five years:

Most battery makers are focused on electric vehicles, while the niche players competing with Kraken have spent years trying to catch-up with no success. Why would that change in the next few years?

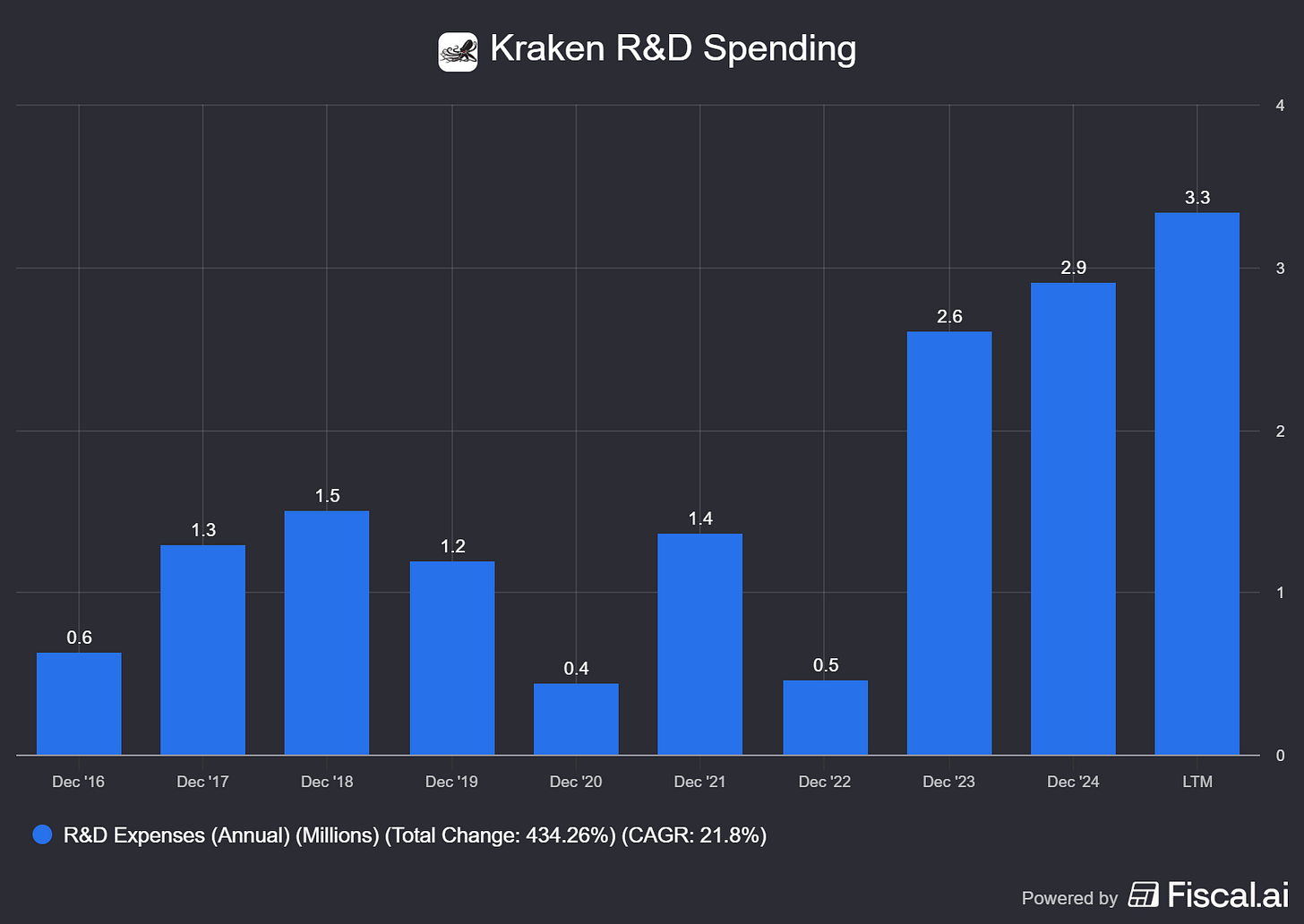

At the same time, Kraken is working to increase its R&D budget (From under $1 million a few years ago to $3.3 million in the last twelve months) which could give it the fuel to further improve its battery technology.

The moat in defense doesn’t come from technology, but getting locked into contracts with defense programs in a supply chain like Anduril. Contractors and militaries will never switch to another battery product on an existing contract, if a better was ever invented. This gives me confidence in sustained revenue growth for Kraken’s battery segment over the next three years.

Imaging services

3D at Depth is mainly used for offshore energy and other commercial subsea projects. Kraken believes it can cross-sell to military and surveillance customers, but it would not be bundled with batteries and sonar for UUVs (at least, I don’t think it will be needed for UUVs).

This does not mean it is a bad business to own. 3D mapping and cloud-based analytics for underwater systems should have similar switching costs to engineering software. Your employees get trained on the software, while data gets accumulated using the systems every year, making it more of a pain to switch the longer you use it.

Plus, it looks like Kraken got a steal of an acquisition price. It spent $17 million on 3D at Depth. According to the latest conference call, management is expecting around $5 million in quarterly revenue for 3D at Depth. I believe they are referencing that in Canadian dollars, so let’s say around $4 million per quarter in USD.

The numbers from 2024 track closely with these projections:

“The company employs 56 people and has grown revenue at a 20% CAGR over the last three years and reported 2024 unaudited US GAAP revenues of $14 million, gross profit of $8.4 million (60%), and $1.1 million of operating income.”

That is around 1x revenue for a services business with:

60% gross margins

Durable revenue growth

Cross-selling opportunities for military/defense customers.

I like the acquisition. I love the price Kraken paid.

On the whole, Kraken Robotics does not have a wide moat today. With a market cap of under $1 billion that was only $15 million before the pandemic (not a typo), I would not expect it to have a dominant competitive position.

But there is a path to building a competitive advantage over the next decade by:

Using its lead in battery technology to lock-in long-term defense contracts

Bundling batteries and sonar systems to sell to UUV systems

Developing and acquiring new subsea technologies to increase its leverage in the defense supply chain.

Future growth potential

(All figures below are in USD)

In 2024, Kraken generated $63.5 million in revenue. In 2025, it is guiding at the low-end for $87 million. Around $12 million of this new revenue will be inorganic from 3D at Depth. According to the Q2 press release, the batteries business is growing while SAS is not, so I assume the rest of the revenue growth will come from subsea battery sales.

Kraken’s future growth will rely on signing UUV contracts with the U.S. Navy and its allies. Remember, a single Ghost Shark sale to Anduril comes with $2 million worth of batteries and additional sonar/sensor sales. This market is still in its infancy.

In early September, Kraken announced a $13 million (I think Canadian dollars, it does not say in the press release) for SAS and subsea batteries:

“The orders are from customers based in the United States, Norway, and Turkey and include an order for 10 SAS from one customer. The Kraken SAS and SeaPower battery systems from this order will be integrated on four different types of uncrewed underwater vehicle (UUV) platforms, ranging in size from small-class to large-class”

Anduril, Boeing, General Dynamics, Huntington Ingalls Industries, Northrop Grumman, and Lockheed Martin are all developing UUV systems, small to extra-large. And that is only in the United States. Kongsberg, Saab, Atlas Elektronik, Exail, and others are working on UUVs in Europe.

The budget from the United States Navy on UUVs is small today – mainly focused on research. Australia has been at the forefront of the industry, signing its recent deal with Anduril. You could sense the passive aggressive tone from Anduril in the press release telling the US Navy it needs to get its act together and start building up its UUV inventory.

An inflection may be coming. Budget proposals have called for increased spending on UUVs, and while we don’t need to bore readers with the back-and-forth of reconciliation bills, what is important for Kraken Robotics is the long-term trend going higher.

With by far the best batteries, Kraken should win all of these contracts, even from companies like Northrop Grumman that it competes with in SAS.

Kraken believes it has a pipeline of potential contracts worth $2 billion.

Revenue was under $100 million over the last twelve months.

Those two facts alone should get you excited about learning this business.

Kraken is investing ahead of this growth. Today, it has maxed out capacity at its current battery plants, which can do about $36 million in revenue (USD). By the end of this year, Kraken will open up its new facilities for batteries that have 3x the capacity of current levels. Depending on pricing power (and the USD exchange rate), Kraken could have the ability to pump out $150 million worth of subsea batteries in 2026.

I imagine a world where there are thousands of UUVs used by the various militaries around the world, both large and small. At an average revenue of $2 million per UUV and a rate of 100 vehicles produced per year would surpass Kraken’s upcoming facilities expansion in regards to battery sales.

Long story short: there is a huge runway of growth ahead for Kraken in UUV batteries. And it has no relevant competition today.

3D at Depth (literally) has a blue ocean of growth to target with LIDAR mapping. The ocean has over 1.3 billion cubic kilometers of volume. That is 1.3 billion cubes of 1km x 1km x 1km. There is an endless amount of 3D space underwater to explore, map, and analyze.

This should make 3D at Depth a steady grower from its $16 million in revenue today. If Kraken can succeed in pushing 3D at Depth services to military customers, we may see even faster growth.

Thoughts on management

I have never met Kraken’s management. What I can go off of are anecdotes, track record, and the small amount of public investor relations they have done.

Given the financial performance and successful acquisitions (the battery business was acquired years ago), I am pleased with management’s capital allocation track record.

Karl Kenny founded Kraken in 2012 with the goal of commercializing high resolution sonar technology (what led to SAS). Kenny grew up in Newfoundland on the Atlantic coast and had a long history working in technology/software, making him a perfect fit to start this type of business.

Kenny retired as CEO in December of 2022. Then CFO Greg Reid took the reins as CEO. Kenny was likely having health issues at the time, as he unfortunately passed away earlier this year.

When Reid took over, Kraken had a market cap of just $81 million. Today, it is close to hitting $1 billion. The stock has compounded at an impressive rate.

From my seat, it looks like Reid has successfully graduated Kraken Robotics from a micro-cap to a hypergrowth small-cap company. He has straddled the line of rational capital allocation and innovation despite losing the founder. Acquiring the team from 3D at Depth will give them an even greater boost in R&D.

Apparently, Reid is a tireless worker and frugal. He flies coach, and the board of directors tells him they need to pay him more. Much more palatable than the average large cap mercenary from McKinsey! This is the good side of the CFO culture, and will hopefully trickle down across the organization, being realized for investors on the income statement.

I do worry about Reid’s experience leading a public company that may turn into a multi-billion dollar market cap sometime in the near future. He has plenty of experience in accounting/finance, but that is it. No large scale roles before.

Maybe they will pass the torch to a seasoned defense contractor executive and have Reid move back to the CFO role at some point? This is something I will be watching closely. Part of Kraken’s strategy is to acquire new technology in the subsea domain. They mention exploring acquisitions on the recent earnings call. More acquisitions will complicate the management of the business and add another layer of risk for Reid.

Overall, you can say Reid has done a great job capturing the growth in subsea military/commercial spending. Even though the company has funded growth through share issuance – $115 million at $2.66 in 2025, $52 million at $1.66 in October 2024, and $17.5 million in April 2024 at $0.95 in stock offerings – per share value has been created.

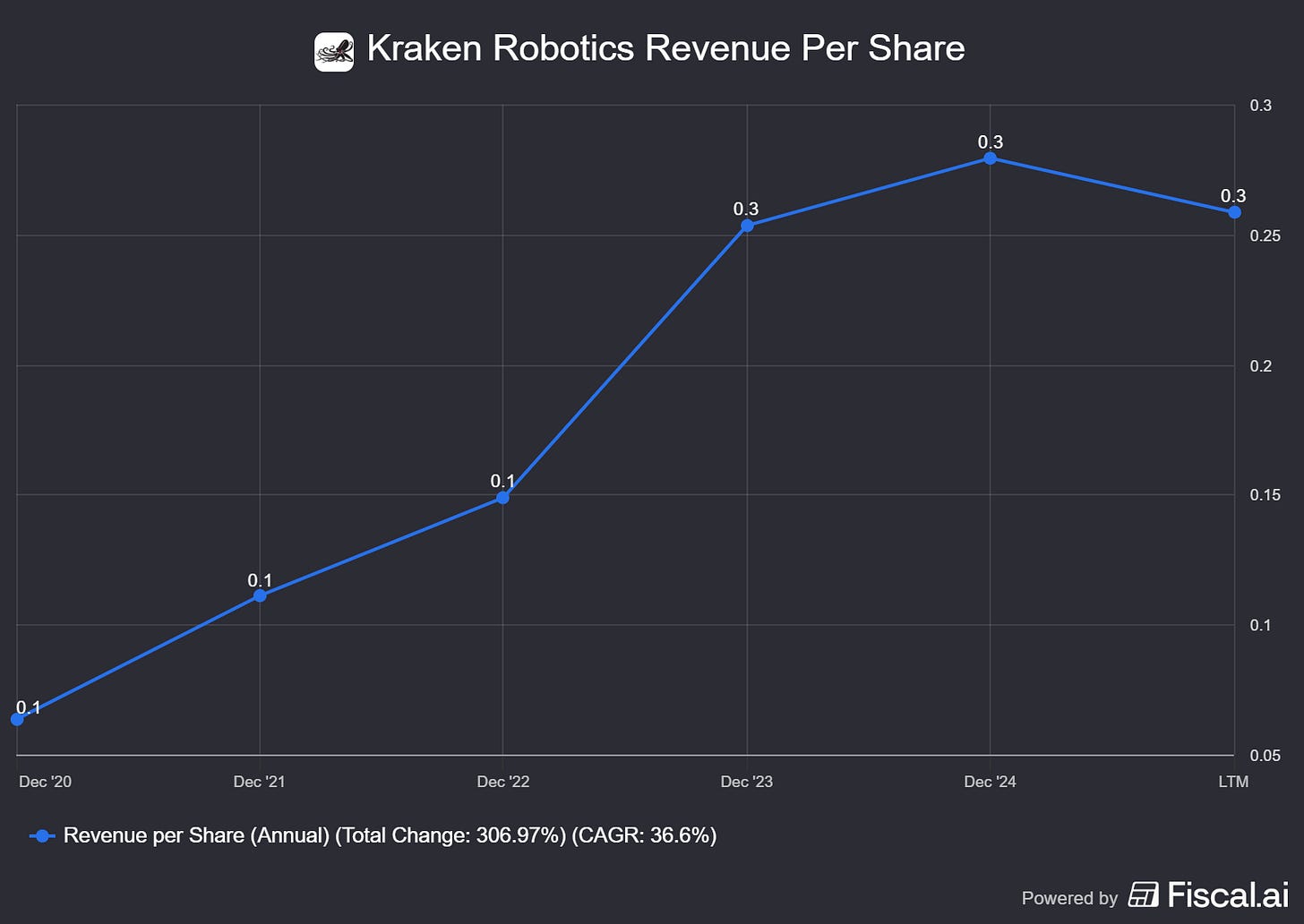

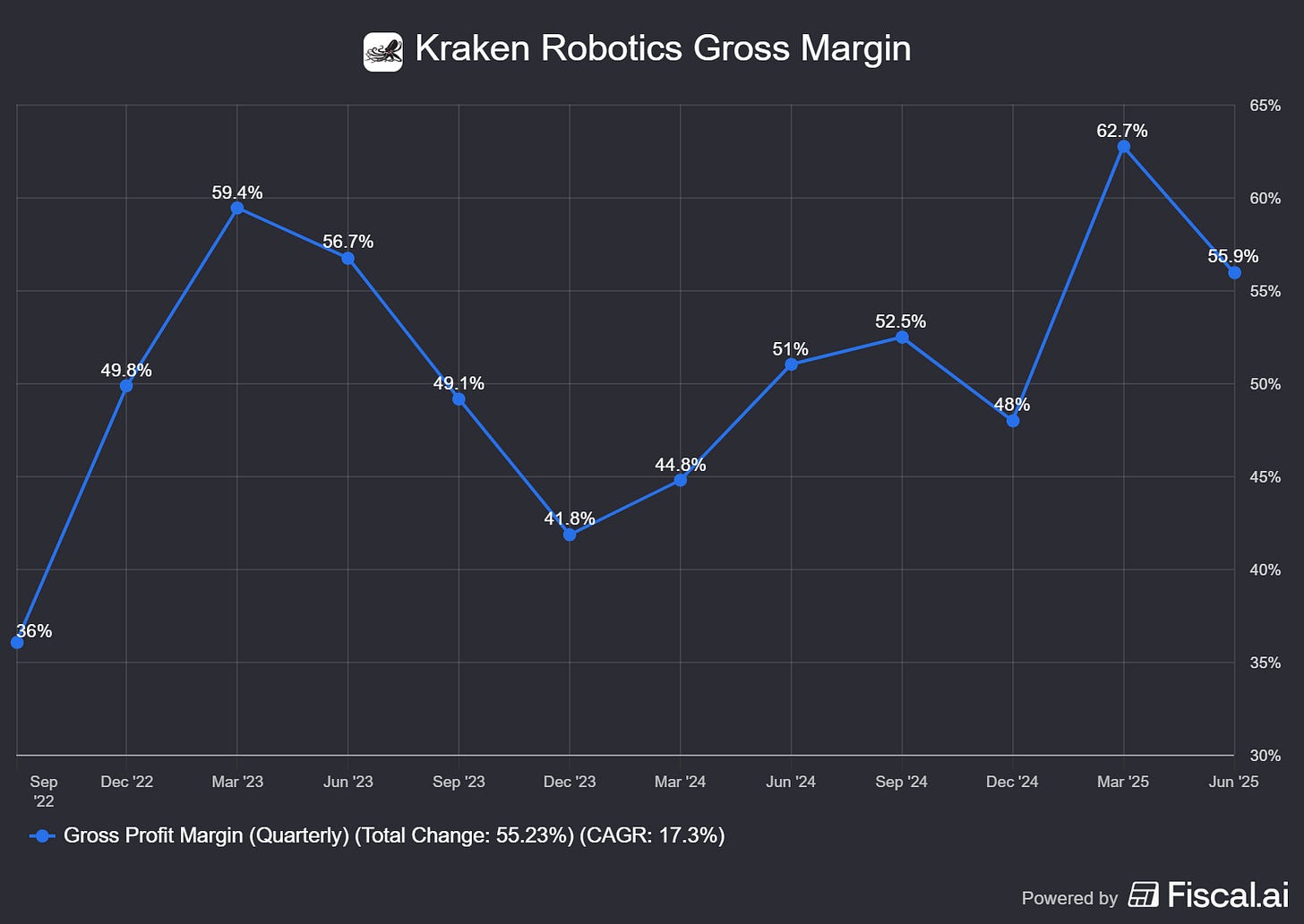

Revenue per share has grown at a 36% annual rate since 2020, per this Fiscal.ai chart below. This is understating growth, as revenue will be weighted to the back-half in 2025. Gross margins are also expanding.

The last thing I’ll say on leadership is the rounding out of the board of directors. For example, you have Vice Admiral Michael J. Connor joining the board. Here is his bio:

“In a 35-year career in which he rose to the rank of Vice Admiral in the United States Navy, Mike Connor commanded at the ship, squadron and task force levels. His assignments included command of USS SEAWOLF, a nuclear-powered attack submarine, Submarine Squadron Eight, Undersea Forces in the Western Pacific and the Arabian Gulf. He held several concurrent titles during his last assignment; including Commander, United States Submarine Forces, Commander, Submarine Forces Atlantic and Commander, Allied Submarine Command. He served as commander of U.S. submarine forces from September 2012 until September 2015. Vice Admiral Connor led the US Navy Submarine Force into robotic undersea systems, achieving key milestones including the first operational deployment and recovery of an unmanned underwater vehicle from a submarine. He also led innovation efforts that began the shift away from undersea search operations based on expensive platforms and moved toward operations based on large numbers of inexpensive vehicles. He has written extensively on the future of undersea warfare and is a sought-after speaker on undersea warfare topics. His education includes a B.A. in Physics from Bowdoin College and an M.A. in National Security Studies from the United States Naval War College. Vice Admiral Connor is currently the CEO of ThayerMahan Inc., a company he founded to accelerate the United States’ ability to effectively and efficiently monitor ocean activity using autonomous systems.”

This is a fantastic person to have in your corner when trying to win UUV contracts. I wouldn’t count out an acquisition of ThayerMahan either.

Financial modeling + Will Anduril Acquire Them?

In order to model out Kraken’s financials, I broke up the revenue into the three operating segments (sonar, 3D at Depth, batteries).

We are not given the exact revenue of each segment, but I tried to back into 2025 revenue based on what has been disclosed to investors.

In 2025, I expect:

$39 million in SAS revenue (USD)

$36 million in batteries revenue (current capacity in USD)

$12 million in 3D at Depth revenue (Guiding for $16 million USD ARR, only acquired for ¾ of the year)

This adds up to the guidance of approximately $87 million in total USD revenue at current exchange rates.

I made a rough revenue projection out to 2030. Based on potential growth outlined above for these three product categories, I expect:

15% annual revenue growth for 3D at Depth

25% annual revenue growth for batteries

10% annual revenue growth for SAS

Combined that gets us to $205 million in 2030 revenue.

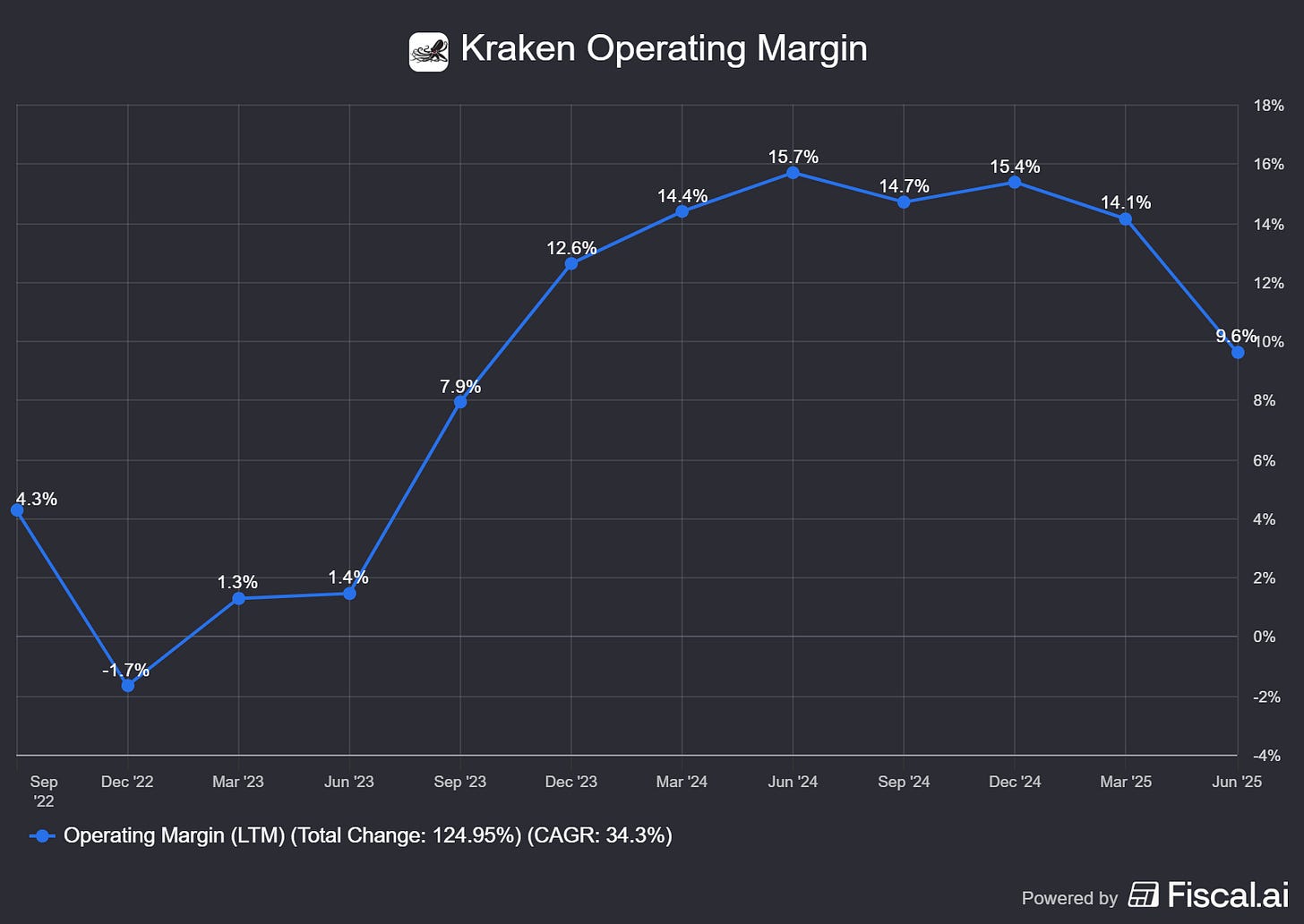

Kraken has already shown the ability to reach 15% profit margins. At greater scale and with improving gross margins, I think a 20% operating margin is entirely feasible.

Okay, but where does that leave the valuation?

Without factoring in shareholder dilution, Kraken is trading at 21x 2030 EBIT based on my estimates. Not particularly exciting.

But am I being too conservative with these growth projections?

For batteries, I think 25% annual revenue growth may prove to be. My estimate calls for $110 million in battery revenue in 2030. Due to all the defense contractors building UUVs and momentum building with militaries, there could be hundreds of millions of dollars in subsea battery sales across the sector by 2030 with Kraken being the premier provider.

Even with the stock up 500% in the last five years, there is still room for a right tail event that could turn this into a hundred bagger from its previous lows. Investors should not discount this probability to zero.

We also need to discuss the potential catalyst in the room: Anduril.

Kraken is one of if not the key subcontractor for Anduril’s UUV program. The company is aggressive and working rapidly to re-arm, modernize, and generally disrupt the current procurement ecosystem for United States defense contractors.

Anduril raised $2.5 billion earlier this year at a $30.5 billion valuation. The company could use cash and/or stock as currency to acquire Kraken Robotics, giving Anduril a key advantage in the UUV space. Other defense contractors would have to go through Anduril in order to get Kraken’s batteries. Or, Anduril could decide to keep the batteries only for its own UUV programs.

This is another right tail scenario that could lead to a fantastic IRR for investors in a short time period.

Will I buy the stock?

My conviction on Kraken’s growth story has grown after my research. I would not be surprised if Kraken eventually reaches $500 million or even $1 billion in revenue.

That doesn’t mean the stock is a buy. Price matters, even if some have forgotten in the middle of the AI bubble boom.

Kraken Robotics trades at 21x 2030 earnings based on my financial projections. I do not believe I am being overly conservative when making these assumptions.

Given my conviction in Kraken’s future growth, I would pay 10x 2030 EBIT for this stock. That is not overly cheap for a five-year forward earnings multiple, either.

Apparently we looked at Kraken as a small-cap of the week a while ago on the podcast. Given what the stock has done since, I think that was definitely when the stock was trading at 10x 2030 EBIT, or lower. Alas, you cannot chase a stock if the valuation doesn’t make sense.

I am keeping Kraken Robotics on the watchlist after finishing my initial research.

If you enjoy my emerging moats research, please share it with someone you think would enjoy it too!

-Brett