I Bought And Sold Some Stocks Last Week

An internationally diversified portfolio can give you capabilities some may consider to be...unnatural

YouTube

Spotify

Apple Podcasts

Well, that was quite the week, huh? Things are happening rather quickly. I wrote a draft of this newsletter on Thursday and it already feels stale on Sunday. We are in the fog of the Tariff Tantrum, and markets are crashing:

The Nasdaq 100 Index officially entered a bear market on Friday. It may take out 2021 highs tomorrow! Yikes. The S&P 500 is not far behind. Strap in, things are going to be bumpy for quite a while.

The Dollar Index keeps falling:

So far, in 2025, my portfolio has held up reasonably well. I am about flat YTD while the Nasdaq is down 20%. I’ll take it. This divergence began when the DXY started to fall.

I don’t bring this up to brag. Slight outperformance over a few months is nothing to get excited about. Many of you would laugh at the dollar values I am playing with, too.

But there is solace knowing my global diversification strategy is working. Even with Nelnet — 30% of my portfolio — in an 18% drawdown, my portfolio is doing fine. Volatility dampening with a portfolio of globally diversified individual stocks is an intelligent strategy, and I believe in it with high conviction.

But why? It comes back to my diversification away from the dollar that I discussed a few weeks ago:

The conclusion of the article was simple: the US government wants a weaker US dollar. Well, now it is happening.

I believed my portfolio was set up to succeed with a weak US dollar, and it has. Not that I invested in these stocks solely for a currency trade, but it was a nice cherry on top that could help my portfolio do well through a U.S. market downturn.

Philip Morris International, Coupang, Remitly, the Mexican Airports and Mexican Stock Exchange, even Nintendo. These stocks have held up reasonably well in the current market environment, at least so far.

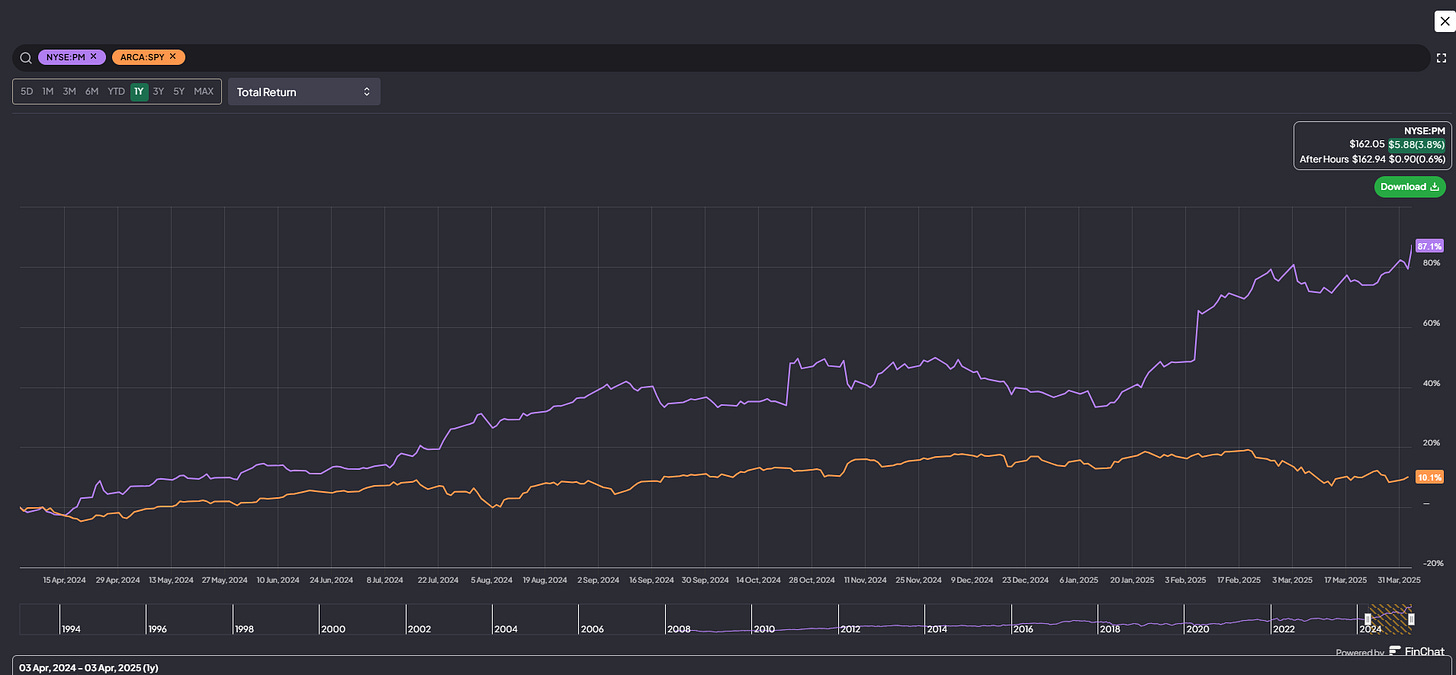

Philip Morris International has been on an absolute tear, posting an 87% total return in the last twelve months:

I fully sold out of the position this week at ~$161. Can I fully defend this decision as a self-proclaimed “never sell” investor? No, I cannot. There are plenty of stocks I am eager to buy with the proceeds, plus, capital gains taxes are not going to be an issue. Look, it just felt like the right thing to do.

The stock trades at an enterprise value of $260 billion, or well over 20x trailing operating income. In an optimistic bull case, I believe the company can double its earnings over the next five years and bring that EV/EBIT down to 10.

If this were a smaller company, perhaps I would hold here. But the juice does not seem worth the squeeze at these prices. Can the EV grow to $500 billion eventually? Sure. Alright, so a double over a decade. Maybe. I can do better than that.

Philip Morris International has been a big winner for me. But the timing of these gains matter even more. Rising so much during a bear market makes the gains that much more valuable, because I can recycle them into other opportunities.

It pays to have a portfolio not 100% correlated to the Nasdaq 100 Index, Mag7, or just the S&P 500. I would not have this opportunity with a portfolio 100% correlated to QQQ. Not that I am opposed to buying the dip on some of the Nasdaq 100 names today, though.

So, what did I decide to buy with the proceeds? Airbnb and Alsea Group are new positions. I nibbled on some Coupang, Remitly, GoGo, and Nelnet as well. My plan is to add as much cash as I reasonably can to my brokerage account and keep buying as people panic. A full portfolio update will likely come later this month on the podcast (if not, I will do one in written form).

Today, I’ll talk about my thesis on Airbnb. It’s pretty simple. Here is what I wrote in my personal journal about the purchase:

I am purchasing shares of Airbnb in my non-taxable Roth IRA. I believe it is a wonderful business trading at a cheap price with a great founder leading the way.

Airbnb’s network effect – the anchor of its competitive advantage – will only grow over the next five years. As more supply joins the platform around the globe, the more valuable it gets for every global traveler. The key metric I am watching is total supply on the Airbnb platform.

Airbnb’s enterprise value is currently ~$66 billion. In 2024, revenue was $11.1 billion. I expect this figure to jump to $20 billion within the next five years or so. Why? Inflation, market share gains, new adjacent products, and new geographies should do the trick. It wouldn’t hurt either if the dollar index keeps collapsing, making international revenue more valuable in US dollar terms.

It is reasonable to expect a 30% operating margin at scale for Airbnb. Marketing expenses should be lower as a % of revenue than Booking Holdings because most Airbnb purchases are made directly through the application (and growing). 30% operating margins on $20 billion in revenue is $6 billion in operating income, or around 10x earnings five years from now. From my seat, that is an attractive price for a high quality business with permanent inflation protection. We aren’t even considering the net interest income earned on customer deposits.

A conservative balance sheet will allow Airbnb to weather any macroeconomic storm. It can repurchase stock or aggressively gain market share in a downturn with no bankruptcy risk. It is an asset-light business and a take-rate on global travel with highly attractive working capital dynamics. It is okay if more and more Airbnb owners go bankrupt for a year or two, that doesn’t impact the terminal value of this business. I have a longer time horizon than that.

Airbnb’s founder Brian Chesky is now a seasoned executive who made it through the COVID-19 pandemic stronger on the other side. While I don’t like his ambitious rhetoric and “Elon Musk” style product announcements, he has proven to be a great manager and I believe he properly understands capital allocation.

For these reasons, I see Airbnb as an attractive stock to buy today with the goal of holding with a permanent time horizon.

I will sell my stock for two reasons that are top-of-mind concerns. Of course, I need to be open to other risks materializing that I am not aware of today. One, if Booking Holdings and other OTAs keep growing faster than Airbnb. Second, if these product diversification strategies end up “diworsifying” the business.

Airbnb is a competitively advantaged business with a great leader, and its stock trades at a reasonable price. Done. I will keep buying if the stock goes lower.

This is the exciting time. This is the time when a few decisions can drastically change the trajectory of your portfolio over the next decade. Keep a clear mind and act when the data aligns with your gut.

-Brett

Brett, good luck. I owned PM for about 30 years and traded out just before the run up! Can’t win them all I guess. You did great with the stock! I joined you in Nintendo finally! I do own ABNB but not my highest conviction stock. Did you buy Alsea on the local exchange?

Great transparency sharing actual trades! The international diversification strategy seems to be working well. What's your framework for deciding when to take profits vs holding for longer-term gains?