Grab: The Super App Dominating Southeast Asia (Ticker: GRAB)

Could this be the next Uber?

YouTube

Spotify

Apple Podcasts

How did Grab get started?

Grab was conceived in 2012 by Anthony Tan and Tan Hooi Ling for a startup competition at Harvard Business School. Both Anthony Tan and Tan Hooi Ling were from Malaysia and they connected early in their time as undergrads at Harvard – both are still a part of the company today.

Anthony grew up as the youngest of three sons in one of Malaysia’s wealthiest families. His grandfather founded Tan Chong Motor, which is a huge multinational auto distributor. So the plan was he’d go off to Harvard Business School and come back and work for the family company. He’d be rich no matter what so there wasn’t this driving financial motivation to do something on his own. He even says in an interview that he was a “rebel without a cause”.

Anyways, Anthony had attended some conference while studying at Harvard that made him think about the potential that ride-hailing services could have in Southeast Asia. He and Tan Hooi Ling talked about the idea frequently, and apparently one of the biggest issues at the time with the taxi system in Southeast Asia was actually safety (particularly for women). I think listeners/readers can imagine the types of issues that happened here.

In fact, it was apparently such a big problem, that Tan Hooi Ling who was working for McKinsey in Malaysia would sometimes take late night taxi rides home and she recalls having to pretend to be on phone calls just so the driver knew that she could report any issues immediately to whoever was on the phone.

So the idea they conceived was called MyTeksi, which was a novel concept in Malaysia at the time. It was a mobile app with GPS enhancements that connected passengers with nearby taxis. The big unlock here for women especially was that the trip was being tracked by GPS, which made them feel much safer. This concept won first runner up in the HBS startup competition and they received $25k as seed funding to help start the business.

So the value proposition from the consumer perspective was obvious. Rides on demand that are much safer. But the hard part was getting taxi drivers on board. I thought this was an interesting snippet from an interview with Anthony Tan:

“To get drivers on board in the early days, Tan was on the ground traveling across Southeast Asia, trying to convince taxi workers to try Grab. Tan noticed that before starting their shift in the morning, drivers in Ho Chi Minh City, Vietnam, would stop at a gas station to drink coffee. So he would show up at around 4 a.m. to give out free coffee to the taxi drivers, which is also when he pitched them to join Grab.”

They were early to this business model in Southeast Asia which helped with adoption, which in turn helped with funding. All in all, they have now raised 27 different rounds including reaching a Series H.

What does the business look like today? Let’s go through each segment:

In 2013, MyTeksi rebranded to GrabTaxi and in 2016 they shortened the name to Grab. The shift away from “Taxi” was primarily because the types of vehicles that were being offered on Grab were changing. They were leaning more and more into private cars, motorcycle rides, and carpools.

Today those vehicles are still a core component of Grab’s Mobility segment, but the business has diversified significantly into other services. Today, you can think of Grab as a combination of Uber, DoorDash, and Instacart in one app (and that doesn’t include any of their Financial Services operations).

Mobility:

Grab’s Mobility segment is its largest contributor to earnings and is very comparable to Uber in how the app functions. There’s a massive supply of drivers in each market (more than 5 million driver-partners in total) and users can select from a variety of on-demand ride types. So there’s GrabCar, XL, Premium, GrabTaxi (metered pricing), etc, but there’s also GrabBike which is a very popular mode of transportation in Southeast Asia.

One big distinction between Grab and North America is that it’s very common for Grab’s driver partners to rent or buy a vehicle from Grab. So in the US, usually when you get an Uber, it’s someone’s personal car. They own it, they insure it, they take care of it, and they use it for ride sharing. This leads to a pretty wide variety of car models that a rider will experience.

But for Grab, depending on the particular market, they actually have pretty strong control over the vehicles. So Grab partners with auto companies like BYD, Hyundai, etc., and either buys or leases a fleet of vehicles that they then rent out or even sell to drivers. So right now they’re really promoting electric vehicles, and you see them talking about this a lot in their conference calls. This has a variety of benefits for Grab.

EV’s are cheaper and it’s a revenue driver. So when the vehicle is a part of the “Grab Fleet” Grab is actually the ones often paying for the charging and maintenance of the vehicle. They have massive commercial charging partnerships. Often the vehicles are the same model, so servicing them is easier (and cheaper).

It’s also cheaper for the drivers. By offering the vehicles, drivers have less up-front costs to get started, which means Grab can get more supply. More supply means lower prices. Lower prices means more rides. And so on.

To summarize, by controlling the fleet, there’s a lot Grab can actually do to either improve volumes or increase margins.

And it’s important to understand, Grab is the clear leader in this space in Southeast Asia. They’ve got 97% market share in Malaysia, 91% in the Philippines, 85% in Thailand, 67% in Vietnam. The only core market for them where it’s still competitive is Indonesia. Now this is the largest market in SEA, as Indonesia has a population of 275 million compared to the ~650 million in all of Southeast Asia. They split the Indonesian market pretty much 50/50 with Gojek, but rumors are swirling that Grab is going to acquire them and they did just raise $1.2 billion in convertible debt which does make it look like they’re pulling together financing for it.

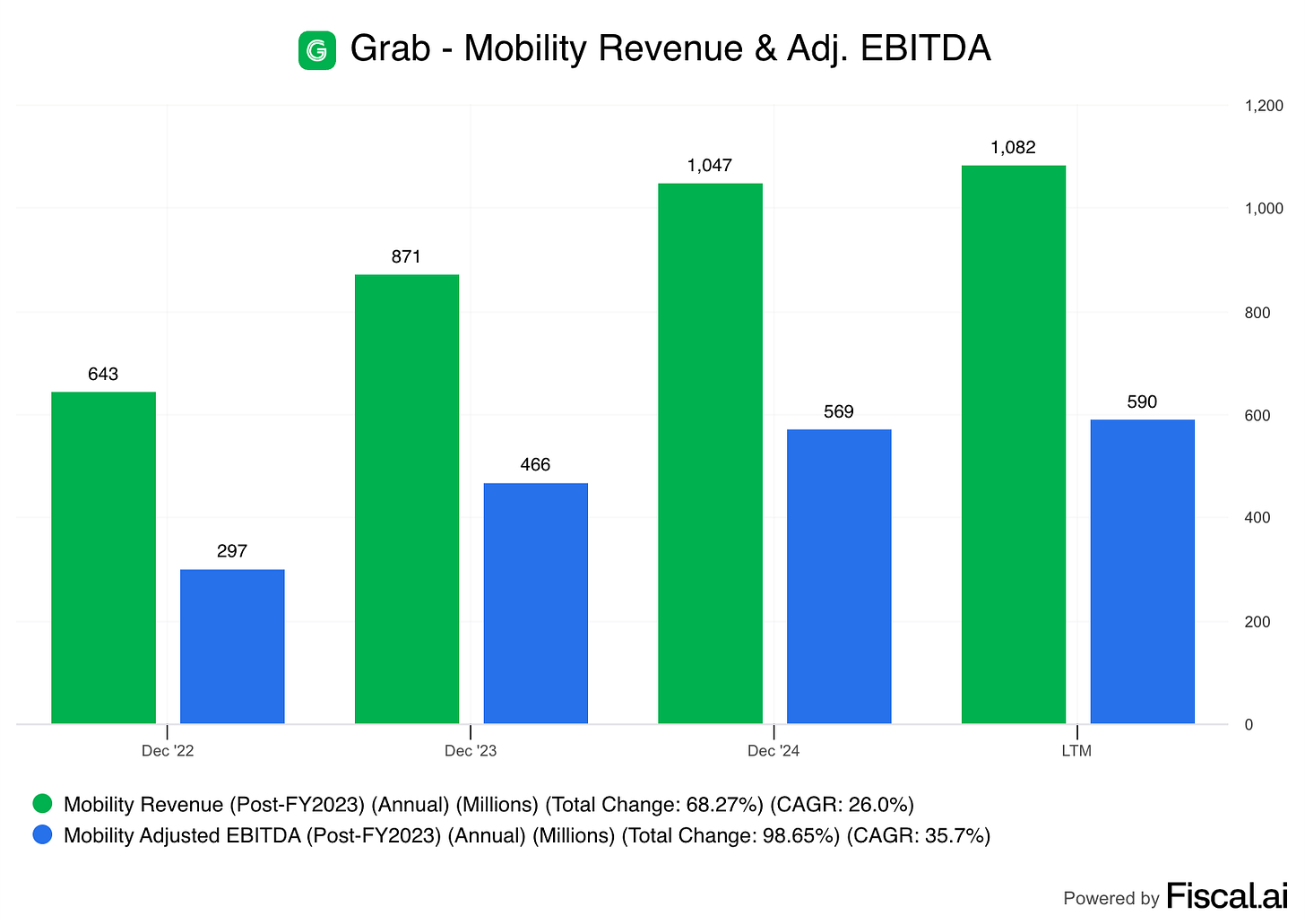

To put some numbers on Grab’s Mobility segment, over the last 12 months, they’ve generated ~$1.1B in revenue and they’ve got ~55% EBITDA margins from this segment.

Delivery:

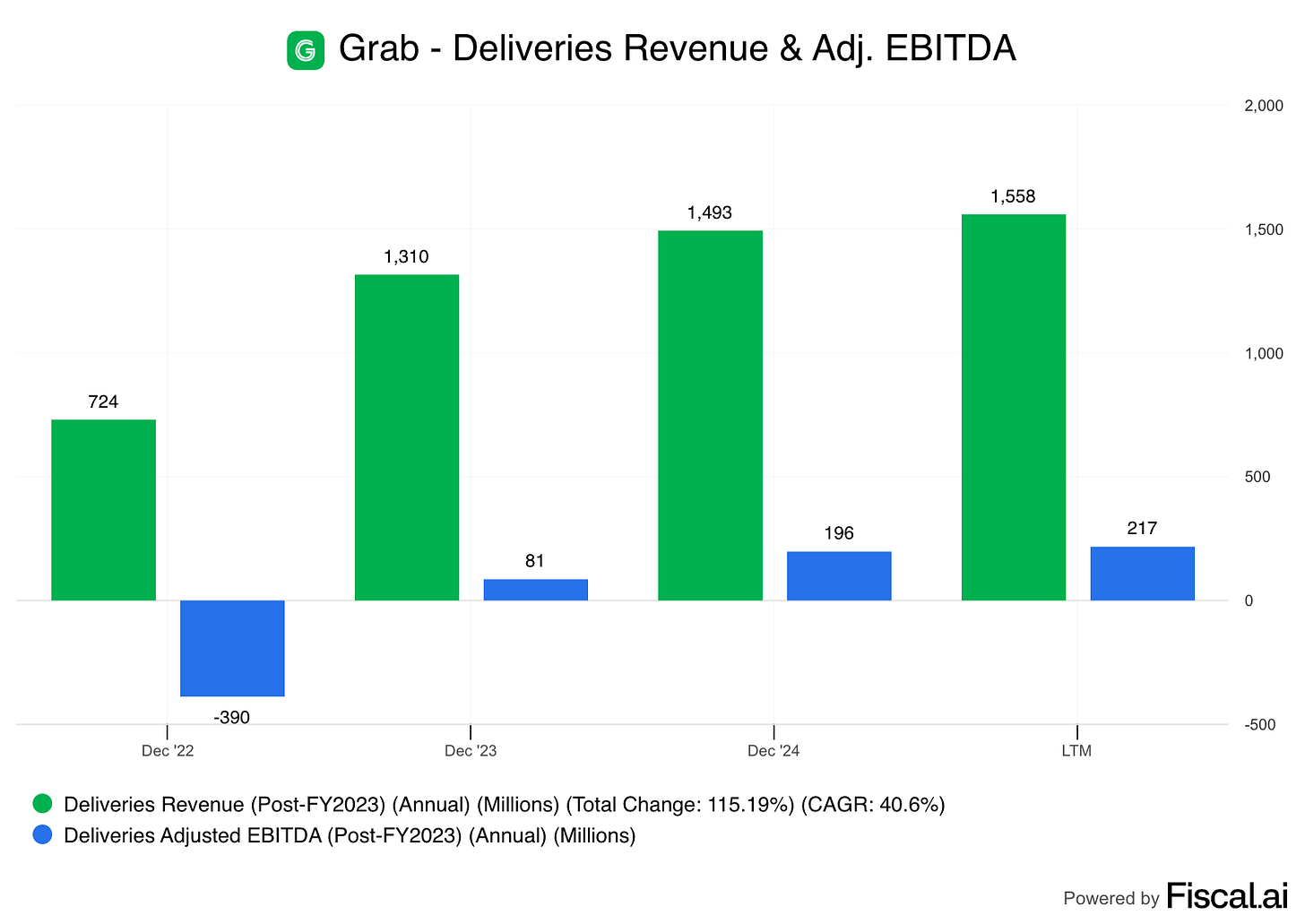

Grab Delivery is similar to Doordash and Instacart. Users can buy food or items from restaurants/grocery stores, and a driver will pick those items up.

The market here is large, it’s bigger than mobility, and Grab is the #1 player in all of their markets except for Vietnam where it’s a close #2.

Beyond just taking a cut for facilitating these transactions, Grab is pretty involved with the merchant side of things. They offer a variety of financial services to merchants like working capital loans and invoice financing. The other element here is they are actually getting into the Merchant side of things themselves.

In 2021, Grab acquired Jaya Grocery which was a large supermarket chain in Malaysia and they’ve acquired some smaller chains since to help expand Jaya’s footprint. I think this was initially designed as a way to increase SKU’s on Grab’s grocery delivery business at a time when that industry was booming, which honestly seems like a fairly smart move in terms of boosting engagement for GrabMart.

So far the results have been good in this segment. Today Deliveries is Grab’s largest business line by revenue and they’ve turned the corner to profitability. In 2022, they had -54% EBITDA margins and today it’s 14%.

Long term, management expects to convert 4% of their GMV to EBITDA from this division.

*Sidenote: Advertising is a huge profit driver for them in this business. Last quarter, management noted: “Advertising revenue as a percentage of Deliveries GMV continued to expand in the 1st quarter to 1.7% from 1.3% in the prior year period.”

Financial Services:

Similar to why they started ride-sharing in the first place, Grab initially got into the financial services space for safety reasons. In the early days, drivers were often paid in cash and would hold a day’s worth of cash in the car, this made them easy targets for theft. So Grab launched GrabPay which allowed for cashless transactions.

However, while it started as a simple rider to driver payments, Grab has moved into a whole world of financial services.

Too many to really talk about here. So instead, here’s a quick list of what Grab offers:

E-Wallet

Rewards Program

GrabPay Card

Buy now pay later

Smartphone financing

Driver Cash Loan/Incentives Advance

Merchant Working Capital Loans

Merchant Invoice Financing

Driver Insurance

Consumer Insurance

Cash Management

And I’m probably missing some. But the 3 categories that I think are the most important are Payments, Banking, and Lending.

The payments business is fairly straightforward. GrabPay can either function as a prepaid wallet where you load money onto it or just as a passthrough payment method, where it’s just linked to a credit or debit card. They offer rewards so it makes sense for people to use GrabPay if they are a regular rider. And as you might assume, GrabPay just takes a small fee from each transaction.

As for the banking and lending, this is where I start to get a little hesitant. They are turning into a full-fledged bank. In 2020, they got a digital banking license in Singapore through a partnership with Singtel. Through that partnership they also got a banking license in Malaysia under the name GXS Bank.

So far on the deposits side, things look pretty good. This quarter they reached $1.4B in customer deposits which is up from $479 million last year. So they’ve tripled deposits in a year largely because they are leveraging the Grab ecosystem.

But here’s where I hesitate. They have grown their total loan portfolio from $196M to $566M in 2 years. And this portfolio is full of all different types of loans, like the ones I just mentioned above. Now they give us the standard context around it of “We continued to maintain a prudent stance on credit risk, with 90-days non-performing loans within our risk appetite.” But for a bank things are always good until they aren’t, and I have zero clue how this portfolio of loans would hold up in a big recession.

Is Grab trying to do too much?

My gut says yes.

I’m a big believer that for public companies, focus matters.

When a company starts to spray its people and resources across too many bets, it can lead to wasted expenses on bets they never should have made.

However, I’ll caveat this by mentioning that most of these bets (not all), but most, are solving problems for their existing customers.

Let’s take smartphone financing as an example. By helping drivers buy a phone, Grab is able to attract more drivers, who can then offer more rides and use more Grab services such as Grab Pay. Additionally, this is help gives a read on the credit worthiness of drivers for other lending products. That to me isn’t going after new markets just for the sake of it, but it’s actually solving clear problems that help grow the rest of the Grab business.

Why didn’t Uber win in these markets?

It wasn’t for a lack of effort on Uber’s part. They invested heavily to try and win in that market, and they actually had gained pretty good traction using a similar model to what they had in North America, constant customer incentives.

By 2018, they were operating the ride-hailing service in 8 different countries and Uber Eats in 3 of them. However, they still didn’t have the dominant position in most of these markets the way they did in others, partly because of the success of Grab.

And if you think about that time for Uber, it was a bit of a transitional period for the company. Kalanick had stepped down as CEO. Dara had taken over, the company was hemorrhaging money, and they were planning to go public, so I think Dara really wanted to clean up their financials and reign in their focus. Also, Softbank and Didi were major investors in both companies, and I imagine they didn’t really want endless price wars between the two companies.

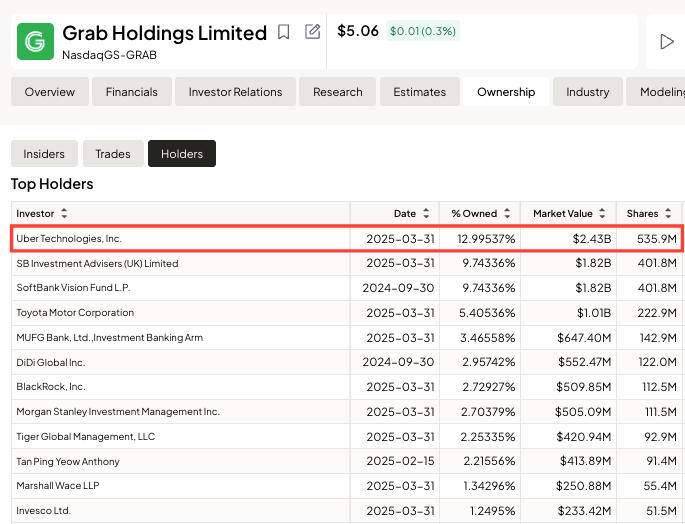

So in March of 2018, Uber sold their Southeast Asian ride-hailing and food-delivery operations to Grab in exchange for a 27.5% stake in the business. This ended up working out really well for Grab (and Uber now as well since they still hold the stake and it’s valued at $2.6 billion), but it worked out for Grab for a couple of reasons.

1) This took out one of their biggest ride-hailing competitors. They gave riders and drivers a 2-week notice that the Uber app would be shutting down and encouraged them to move over to Grab. So they likely gained a ton of drivers in the process greatly expanding supply and they’d no longer be fighting a price war with their richest competitor.

2) This was their entrance into the food delivery space. Prior to this, Grab didn’t have any food delivery presence whatsoever. So when this deal was getting set up, they started to build out a separate app called GrabFood. Grab pre-loaded merchant data into its system and started automatically migrating all the restaurants and delivery partners from UberEats over to GrabFood. Then continuously prompted UberEats customers to download GrabFood instead.

Today, Uber remains the largest outside shareholder of Grab with ~13 of the shares outstanding, and Uber’s CEO Dara Khosrowshahi is a member of Grab’s board. For a ride-sharing business turning the corner to profitability, that’s a good person to have in your corner.

Valuation

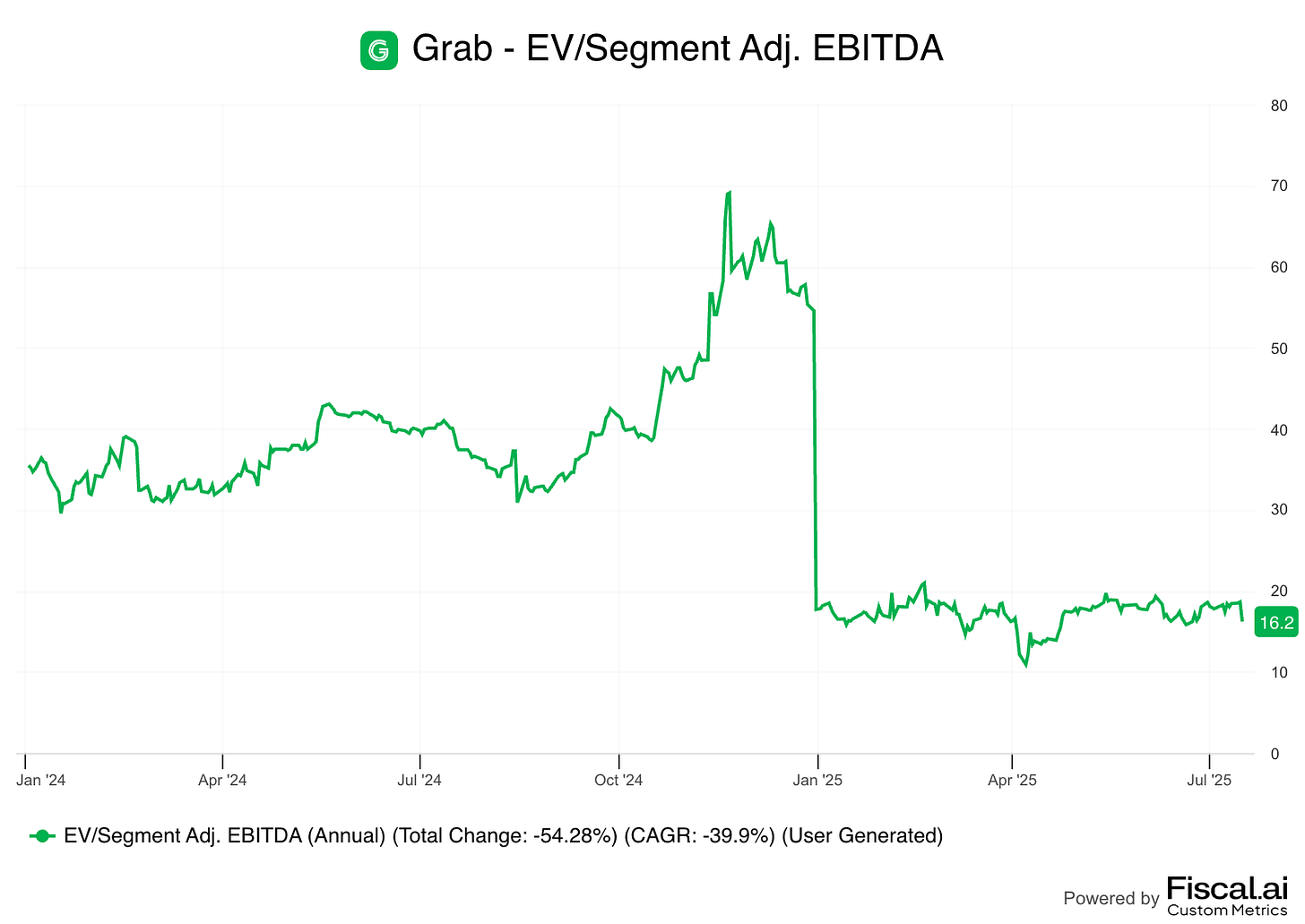

For quick numbers, Grab has a market cap of $20.6B. They have $6.1B sitting in cash and short-term investments on the balance sheet (seems high). So Enterprise Value of $14.5 billion. Over the last 12 months, they earned $700M in “Adj. EBITDA”. So face multiple is an EV/Adj. EBITDA of 18.4x.

Here are the questions I’m thinking about for the valuation.

How much GMV will Grab generate from Mobility and Deliveries in 5 years?

What percentage of that GMV will convert to EBITDA?

How much EBITDA will convert to real earnings?

What is the financial services business worth?

Here’s what I get to:

Here are some of my assumptions:

First off, I think they are really well positioned to grow volume in their mobility and deliveries segments. This year, management’s implied guidance expects Mobility GMV to grow somewhere between 17%-20% and Deliveries is expected to be between 15%-17%. I think the growth rate will continue to come down for both, but it’ll be slower in mobility as they already dominate the market there. I assume GMV for Mobility will grow at an average rate of 13% and Deliveries at 14% over the next 5 years.

Management has already laid out their assumptions for profit margins here. Management expects 9% of Mobility GMV to convert to EBITDA and 4% of Deliveries GMV to convert to EBITDA in the long run. They’re already there for mobility and they seem to be getting there quickly in Deliveries.

All in all, I expect Mobility and Deliveries to produce ~$2.1B in segment level EBITDA in 2029. I don’t expect corporate costs to grow that quickly, so I assume $1.7B in normal EBITDA in 2029.

As for the bank, I’ve got no idea what the true earnings power will look like in 5 years. I kinda call it just a zero on the valuation for now.

But the number to remember is $1.7B in EBITDA. They have a $14.5B enterprise value today, so that would mean they’re trading at 8.5x 2029 EBITDA (my estimates) just from Mobility and Deliveries alone.

Do I trust Anthony Tan?

I like Anthony Tan. He seems like a good CEO and he’s in his prime (43 years old). He owns 3.7% of the shares outstanding and has 63.4% of the voting power.

The big thing for me is that he, along with the rest of the management team broadly, do seem to think long-term and manage the business less for short term margin optimization and more for long run EBITDA & FCF growth. One good example of this is Saver Rides.

They recently launched Saver Rides and continue to promote them. And so far it has been a huge success as Saver Rides now account for 1/3rd of delivery rides and 26% of mobility rides. These are lower margin transactions, but it opens up the amount of people who are willing to use the service.

Am I Buying Grab?

I think I’m putting this at the top of my watchlist for now. There’s a good chance that changes and I end up taking a starter position.

The only thing holding me back would be the banking efforts. It’s just way outside my circle of competence. Not banking specifically, but banking in that region of the world.

I think they are in an awesome spot to continue growing mobility and delivery volume for years to come. In fact, I honestly think they could be generating 15% of their current enterprise value in cash from these two divisions alone in 5 years.

- Ryan