Evolus: The Beautification Arms Race (Ticker: EOLS)

A comprehensive research report on a disruptive player in aesthetics

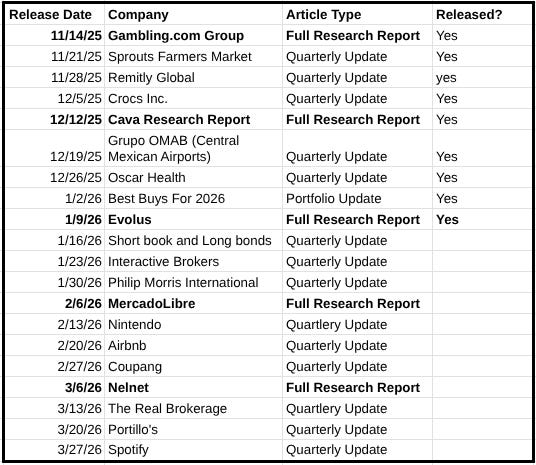

Today, I have a full research report on Evolus (ticker: EOLS). Below, you can see my planned schedule for Q1, as well as the growing archive of reports since the launch of Emerging Moats two months ago. The full archive is available on the website.

After reading this report, you will be up to speed on this stock.

As always, free subscribers can receive one free complimentary report to try out the service. Please contact me if you are interested.

“The millennial is the single largest new user of these procedures in the category. They are fueling the growth of the category. They are twice as likely as their predecessors to consider a procedure like this. The adoption rate of these procedures continues to move down in age, right? The millennial, believe it or not, is already approaching into their early 40s. You see them actually becoming more loyal patients of these products when you get them adopted on them relatively early. They are relatively brand loyal. The lifetime value of these patients is of high value to us.

We continue to see them adopting in younger and younger. We continue to see our brand positioning very well targeted towards these audiences. As they start to use these products, they tend to continue to use these products. The value of that consumer grows over time.” - Former CFO Sandra Beaver, Needham Virtual Healthcare Conference, April 2025

The world is increasingly experienced through images enhanced by technology. People you interact with are using tools – both digital and physical – to make themselves appear more attractive to you. These tools keep getting better.

At the same time, the average person is encountering more images of people every day than someone 100 years ago did in a full year. The people you see on your computer screen are increasingly augmenting themselves with digital filters and physical procedures, making the average scroller feel inferior, thus slowly prodding them to have enhancements done to themselves.

It is a self-reinforcing beautification arms race. For women (who make up 95% of the beauty market), this competition has driven an increase in demand for neurotoxin (Botox) and filler procedures. She’s getting this work done, so why shouldn’t I?

800,000 Botox procedures in 2000 has grown to an estimated 10 million today. Fillers are on a similar trajectory. Global spending on neurotoxins and filler drugs by aesthetic practices totaled $3.7 billion in 2019 and is expected to reach $7.4 billion by 2028.

With low production costs, regulatory protections, and the ability to sell to the end consumer at a premium price, there is a large and growing profit pool in selling aesthetic drugs.

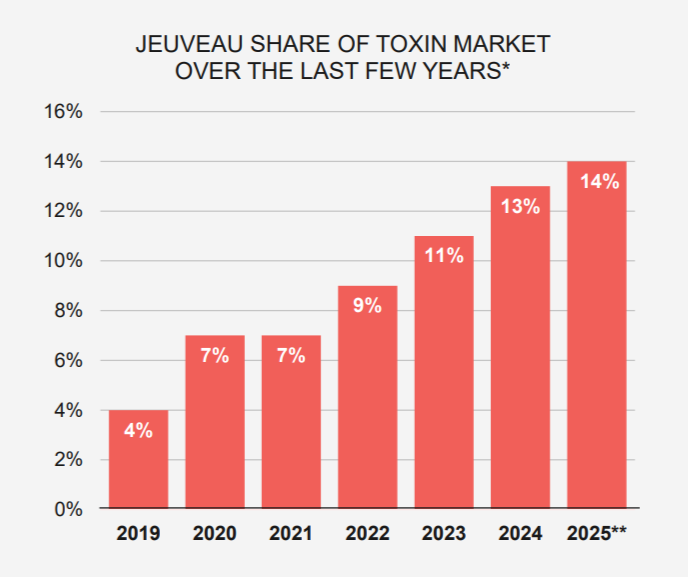

Which brings us to Evolus (NASDAQ: EOLS). It is the newest entrant in the performance aesthetics space, targeting both Botox and fillers, and has gained an impressive level of market share in the United States since 2019.

So why is this stock down since its 2018 IPO?

In this research report, I am going to try and answer that question, as well as:

Are aesthetics still a secular growth category?

Does Evolus itself have an emerging moat?

Is the stock a buy today?

Let’s dig in.

Keep reading with a 7-day free trial

Subscribe to Emerging Moats Research to keep reading this post and get 7 days of free access to the full post archives.