Crocs: Breaking My Own Investing Rule (Ticker: CROX)

Plus, thoughts on my portfolio heading into Q3 earnings

“Never invest in apparel”

Apparel is tough. Brands go through boom and bust cycles. You never know when women are randomly going to start wearing baggy pants instead of leggings, breaking a decade-long fashion trend and sending your Lululemon stock down 60% in 2025.

This is why I have made one rule for apparel stocks: never invest.

And yet.

Crocs is now a 4.3% position in my personal portfolio. The brand of odd-looking sandals is undervalued, has an easy path to global growth, and has a management team that just reprioritized rational capital allocation. Plus, some investors I trust are long the stock.

This is an “invest, then investigate” position. More research will be done in the coming months, and I reserve the right to exit the position whenever I want.

But for now, I am aboard the idiocracy train.

Below, you will find some brief thoughts on my Crocs purchase. Then, I will give updated thoughts on my portfolio for the third quarter.

Crocs has an undemanding valuation

Let’s cut right to the chase: Crocs stock is cheap if sales don’t fall off a cliff.

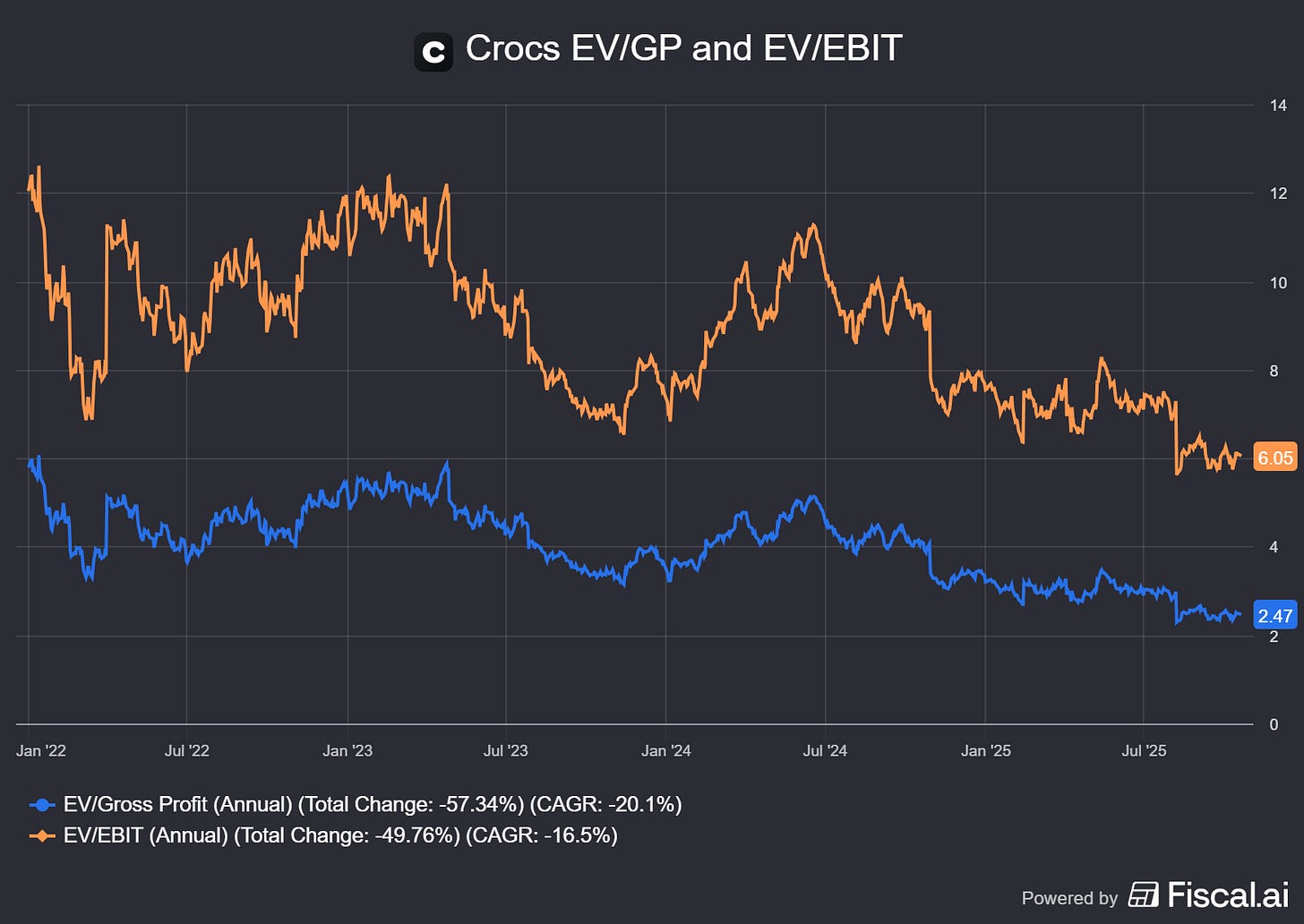

Per our partners at Fiscal.ai, Crocs currently has an EV/EBIT of 6 and an EV/GP of 2.5.

I’m a sucker for discounted multiples. Sue me. And Crocs is trading at a discounted multiple at a time when the S&P 500 has an average P/E ratio above 30.

You cannot research your way to an answer on the “fad risk” for Crocs. However, at an EV/EBIT of just six, I believe there is plenty of margin of safety to compensate for this risk.

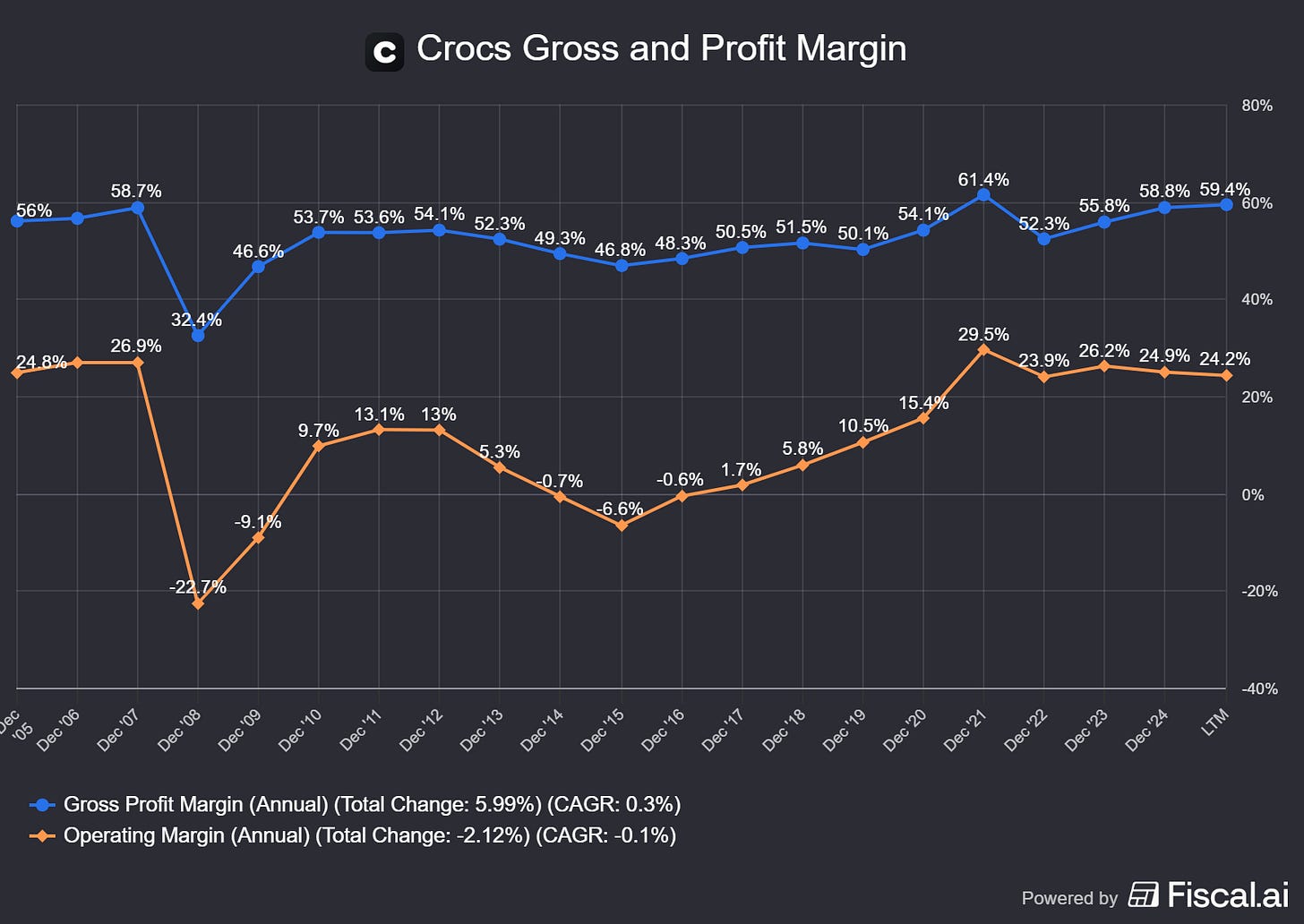

What about margin compression? As you can see in the chart below, Crocs fell out of style in 2008. Gross margin slipped, and the company lost money on an operating basis for two years.

There is a risk this happens again. However, Crocs is better positioned today to retain margin as it has much greater scale (5x revenue compared to 2008), an outsourced manufacturing model, global diversification, and a current margin headwind from HeyDude that is beginning to unwind.

Management is now (hopefully) sober

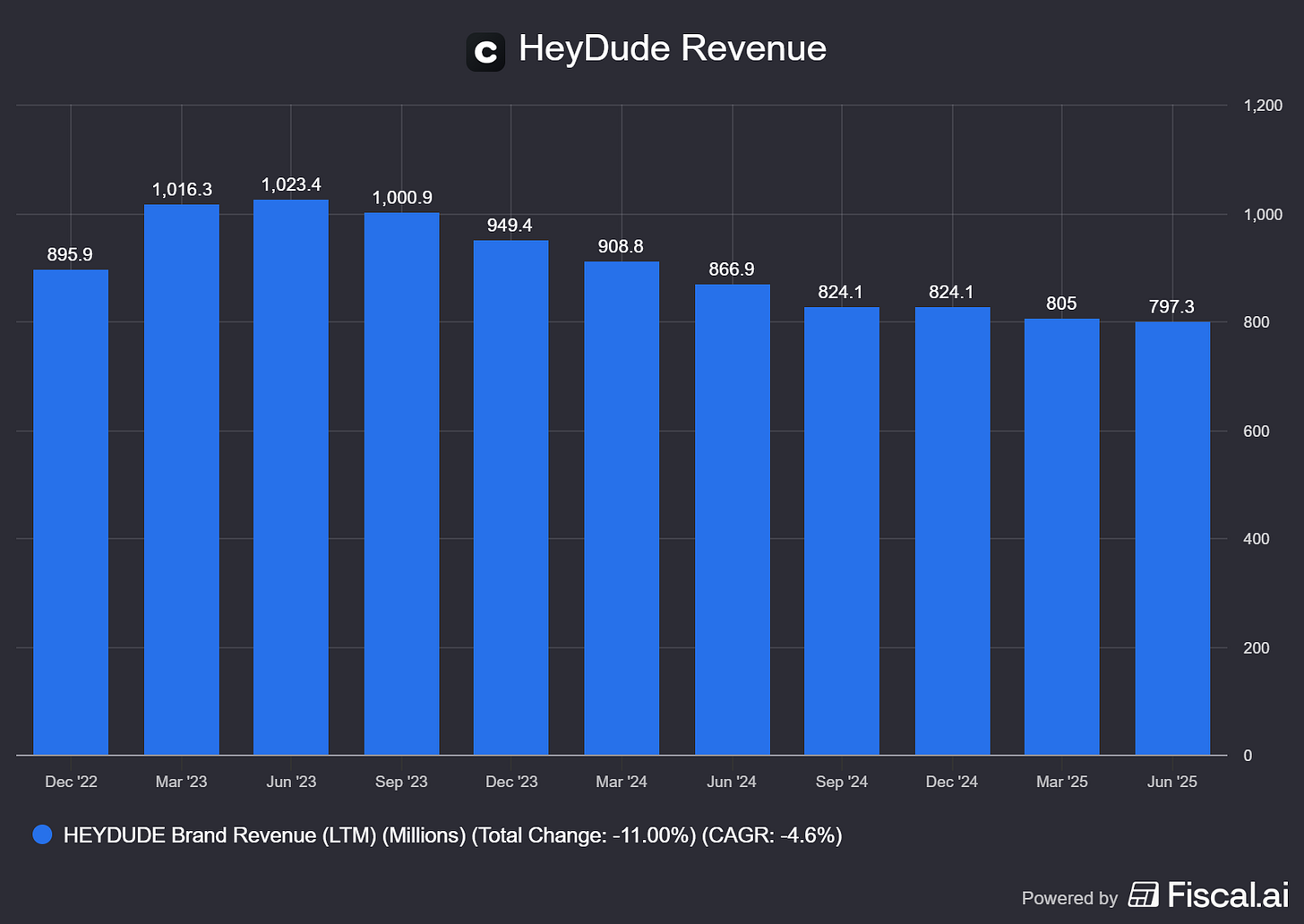

In late 2021, Crocs announced a $2.5 billion acquisition of HeyDude, funded with $2 billion in cash and the rest in Crocs shares. The acquisition has gone horribly, with HeyDude shoes falling out of style. Revenue has gone from $1 billion in in 2023 to around $800 million over the last twelve months for the brand.

Not only did Crocs overpay for HeyDude, it was purchased at a cyclical peak. Crocs has taken major impairment charges and goodwill write-downs on the purchase. Maintaining even this level of revenue decline has been described as “difficult” by management (translation: we are selling inventory at terrible margin).

Today, Crocs admits this HeyDude acquisition was a mistake, and I think it sobered them up. Trevor Scott from Tidefall Capital has discussed this at length. He is a sharp investor with a fantastic five-year track record, and has tweeted that management told him that no large acquisitions are in the mix. I think that is a positive sign.

He has highlighted that Crocs is working to improve its talent on both design and marketing. For example, Crocs lost a marketer named Terence Reilly to Stanley Drinkware in 2020. Reilly crushed it at Stanley, but he has now returned to Crocs and has been back for over a year.

He has likely been integral in bringing in better brand ambassadors. For example, HeyDude now has marketing campaigns with Sydney Sweeney and JellyRole.

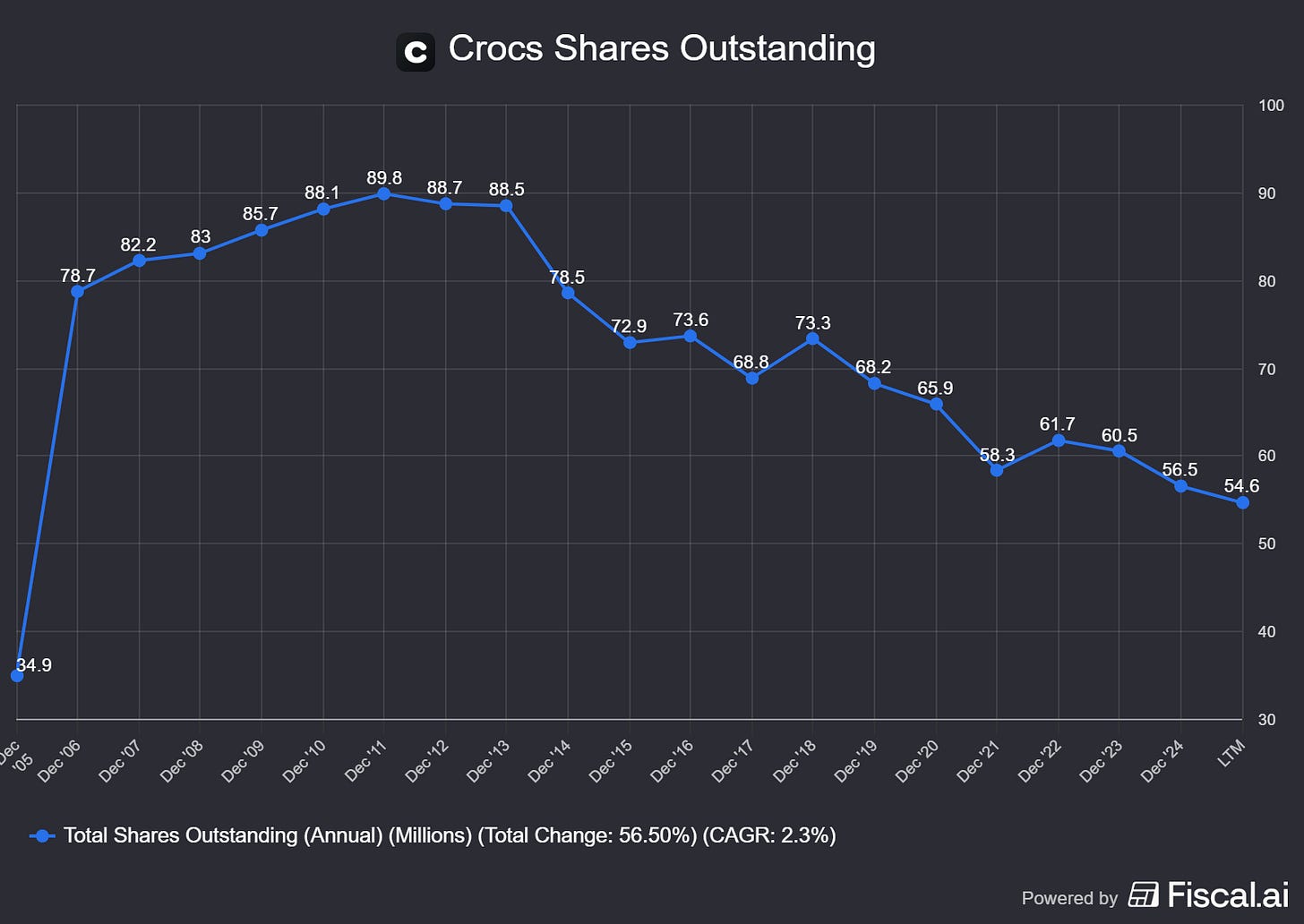

With no acquisitions, Crocs can retain its status as an aggressive share cannibal (as well as bring down its outstanding debt). Shares outstanding have gone from around 90 million in 2011 to 54.6 million today. If management stays sober and keeps repurchasing $500 million+ in stock a year on a market cap under $5 billion, we could see shares outstanding decline at 10% annually.

Optimism on global growth

Last quarter, Crocs brand revenue (excluding HeyDude) grew 4.2% in constant currency to $960 million. However, North America and international are diverging. North American sales declined 6.4% to $457 million, while international sales grew 16.4% to $502 million.

Importantly, Crocs now generates more revenue outside of North America than in the United States and Canada.

I believe Crocs can keep growing internationally. Earlier this year, there was a WSJ article on “How Crocs Conquered China”:

Today, Shanghai subway cars are packed with fashionable Crocs-wearers, often young women in platform clogs studded with charms known as Jibbitz. So many fans of the hole-filled shoes make posts with the hashtag “dongmen”—Chinese slang for Crocs fan—that the company has announced on earnings calls the number of dongmen mentions, which today tally in the hundreds of millions.

Crocs marketing campaigns, such as an ad featuring pop star Tan Jianci in pink platform Crocs riding a pink whale through the sky, are dreamed up in Shanghai, not Colorado. The company recruits the glitziest names in Chinese pop culture as brand ambassadors.

Do I know who Tan Jianci is? No. But I think Crocs is smartly marketing itself with localized celebrities in these international markets.

A Bollywood actress with close to 50 million Instagram followers is now a brand ambassador in India.

Classic Crocs go for $50 in the United States, with extremely high gross margins. In a country like India, Crocs can lower its average selling price while still maintaining strong margins to make the shoes affordable for middle-class Indians. This is something other apparel brands will struggle with due to higher input costs.

All in all, Crocs has a market cap of $4.3 billion and generated around $1 billion in TTM operating income. If they can simply stabilize the business, I think the company generates its entire market cap + debt in cash over the next five years, giving it a Li Lu / Timbaland set-up for the next few years.

Q3 Portfolio Update

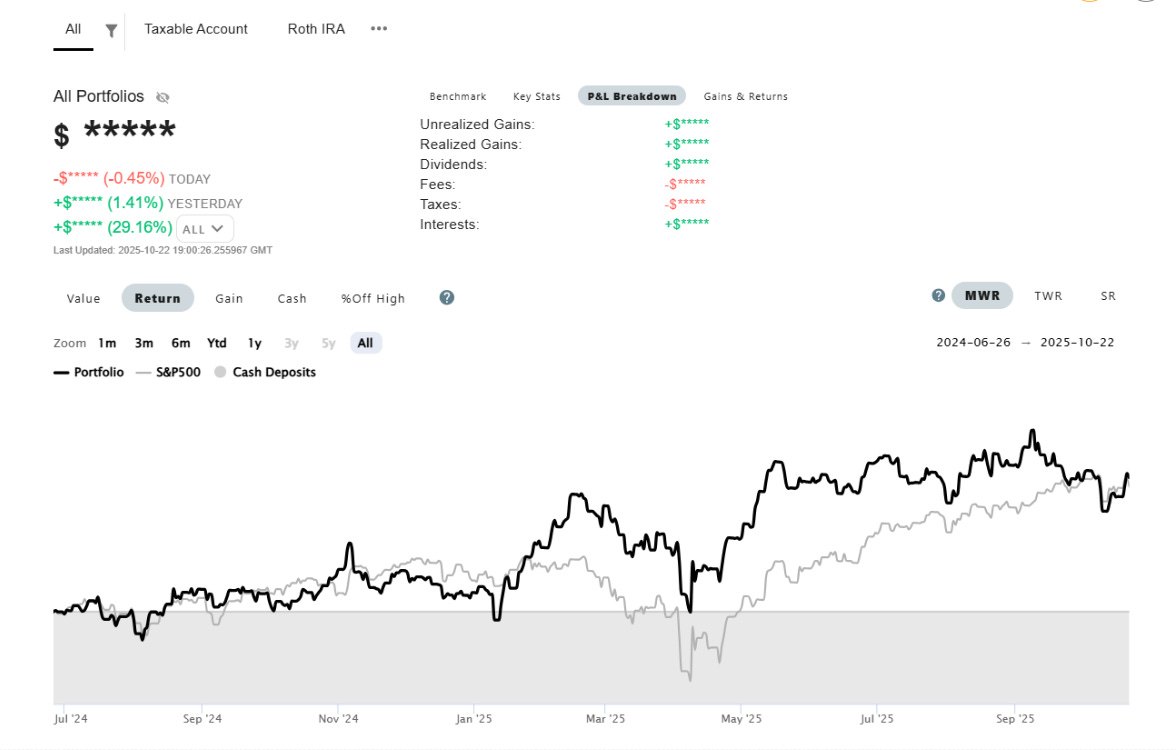

I use Portseido to accurately track my investments. They are a new sponsor to the podcast and have been a game changer for my portfolio analysis. It can actually track your investment returns across multiple brokerage accounts.

Sign-up with our link: https://www.portseido.com/?fpr=ryan63

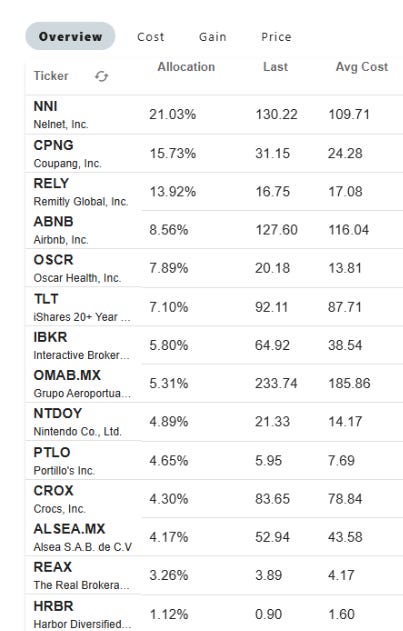

Here is where my portfolio stands as of October 22, 2025:

Funny enough, my consolidated portfolio has converged on the total return of the S&P 500 since I began tracking in July 2024. This is not a goal of my portfolio, simply an observation.

If you look at last two months, you can see that my portfolio began to decline in value while the broad market marched higher. This is because most of the short positions began to move against me. You can see this is in the returns of my taxable account (second screenshot below, and where all of my shorts are held), which has gone into a sharp drawdown since the beginning of September.

I am comfortable with this drawdown. Less than 10% of the portfolio is short, and that is after some blow-off tops in the last few weeks. Excluding the funding shorts (Tesla/Apple), 90% of these stocks will be down 90% five years from now. We may have to watch them rise 100% in a month a few times in the interim, but that is just fine with me.

In early October, I decided to increase my short position in Oklo (sold short at $151) and Rigetti Computing (sold short at $46). Both stocks are in 20% drawdowns already in the last 10 days on some minimal broad market weakness. If we see any more pain, I expect the short book to perform well and provide me with funding to buy high quality stocks on the cheap.

Other transactions in the last few months of course include Crocs, but also Airbnb.

I added to Airbnb at $124, and it is now my fourth largest position at 8.56% of the portfolio (table above). Airbnb is an emerging moat business, trades at a reasonable price vs. its long-term margin potential, is buying back a lot of stock, and is led by a sharp founder. If there is any further weakness in the share price, I plan to add on the dips. This is the beauty of buying into an emerging share cannibal.

Read more analysis on Airbnb as well as links to our interview with Speedwell Research on the stock:

In August, I added to my Portillo’s position after seeing a bunch of insiders buying on the open market. I am committing to restricting myself from doubling down even further, but I remain bullish after our recent interview with Value Investing Degen. It has been my biggest loser in the last year, but I still think it is a ten bagger in the making.

After Q3 earnings, I added to Coupang, averaging up the position. The “big three” of Nelnet, Coupang, and Remitly Global are my highest conviction bets over the long-term, making up around 50% of the portfolio.

Lastly, I want to talk about TLT, the 20+ Year Treasury Bond ETF. Many investors proclaimed long-term bonds dead, which was as good of a time as any to take a position. My cost basis is $87.71, and it now sits above $92, regaining highs set before the tariff tantrum.

Long-term bonds do well in recessions where inflation is not running hot (i.e. deflationary busts like 2008). I am not predicting a 2008 style bust, but I think TLT was and still remains a great hedge for a long-only portfolio like my Roth IRA.

If the market crashes due to a deflationary bust — any student of history knows this is more likely than runaway inflation with high tariffs if you look at what happened in the Great Depression — then TLT should soar in price while the market crashes. This will give me ammo to buy stocks on the cheap while still remaining fully invested in my core long positions today.

Let’s look at some varying scenarios. If the current status quo remains (somewhat high inflation, strong economic growth), then TLT will likely remain at its current yield of 4.2%. I collect a 4.2% dividend every year for this hedge. Runaway inflation is very unlikely because of the demand destruction that happens with tariffs (again, they are not generally inflationary).

However, if inflation stops in its tracks and a recession occurs, long-term bond yields will likely come down, leading TLT’s price to soar. I will then be able buy my existing holdings like Airbnb or Remitly at even cheaper prices, or add new stocks to the portfolio that remain on the watchlist today.

I think it is a low downside, high upside bet. And if TLT crashes 50%, well, the U.S. economy will be in a debt spiral and we have bigger fish to fry.

-Brett

Wow, the 'idiocracy train' bit really stood out; thanks for that honest dive, sometimes the numbers just screem ignore the rules.

The timbaland had me crackin up. Great post. I Just did a deep dive on crocs' moat, check it out if you'd like!