Coupang: Growing Confidence (Q2 Earnings Update) $CPNG

Not enough praise can be heaped on Bom Suk Kim and his team.

The best stock you own will be the one you worry about the least. Confidence arises when you have a widening moat, reasonable valuation, and a management team you can trust. Confidence wanes when the opposite occurs.

It reminds me of the one memorable quote from the otherwise overrated book (blasphemy, I know) Zen and the Art of Motorcycle Maintenance:

“You are never dedicated to something you have complete confidence in. No one is fanatically shouting that the sun is going to rise tomorrow. They know it's going to rise tomorrow. When people are fanatically dedicated to political or religious faiths or any other kinds of dogmas or goals, it's always because these dogmas or goals are in doubt.”

I have felt this way about Nelnet for the last five years. In that time, the stock is up ~100% with minimal drawdowns. I do not worry about the position at all, even though it makes up 20% of my long portfolio.

Coupang is starting to feel similar. Its business is humming along beautifully, an orchestrated machine of commerce, delivery, and retail services that keep compounding in harmony.

Q2 2025 revenue rose 19% year-over-year in constant currency to $8.5 billion. Gross margin expanded to 30%, with positive operating income.

More importantly, Product Commerce gross profit (the core e-commerce business in South Korea) grew 26% year-over-year to $2.4 billion. Product commerce EBITDA margin was 9%.

The company is already close to achieving its long-term goal of 10% EBITDA margins for e-commerce. As advertising ramps up and more scale is achieved in South Korea, EBITDA margins have room to move even higher. Most of this EBITDA can be converted to free cash flow (working capital advantage offsets maintenance capital expenditures).

Growing Potential in Taiwan

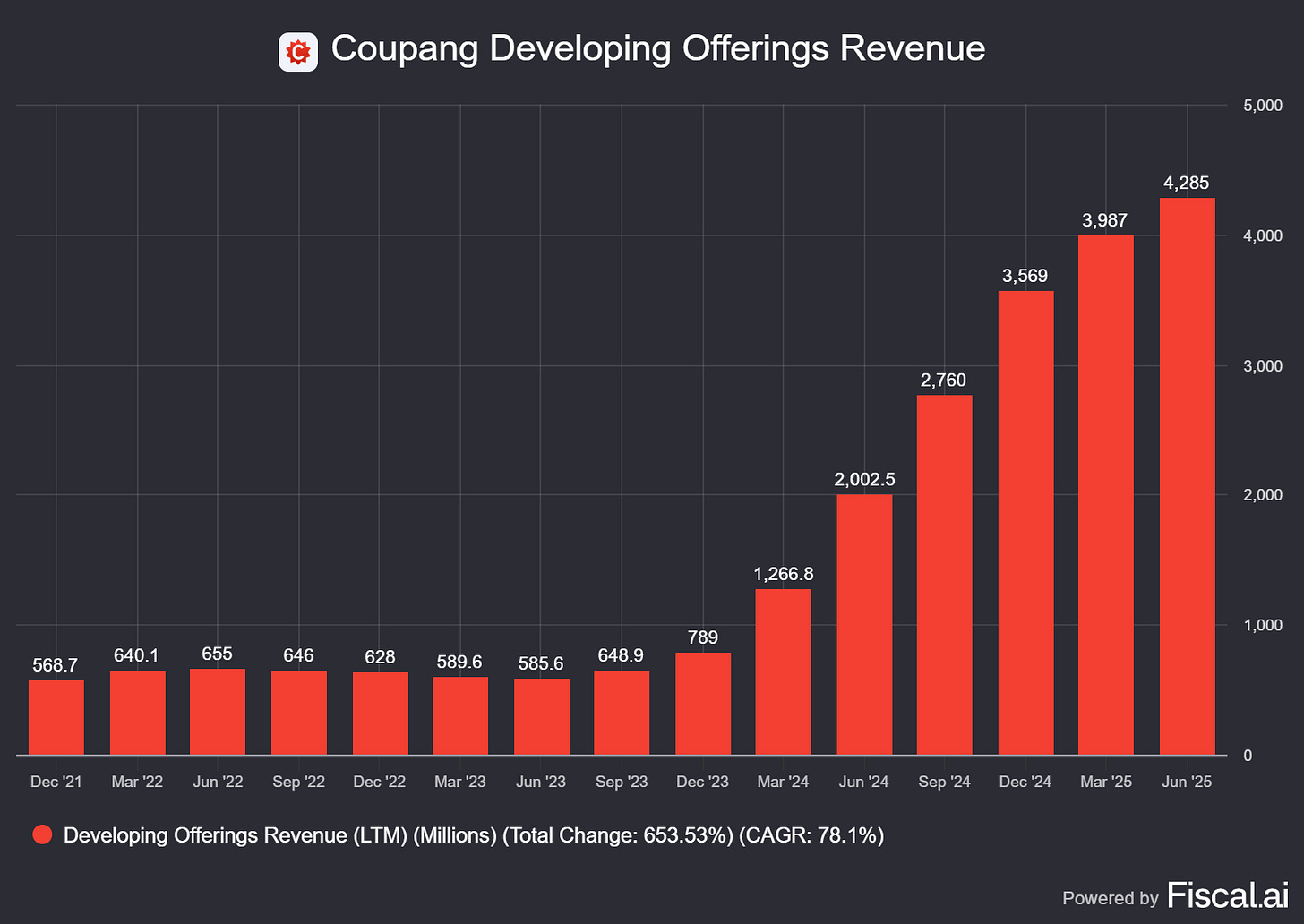

Coupang’s Developing Offerings — Taiwan, Farfetch, food delivery, and other ancillary services — saw a big revenue slowdown to 33% growth in the quarter.

This is mainly due to lapping the Farfetch acquisition last year:

Developing Offerings are now 13.3% of overall revenue. Taiwan revenue is accelerating to a blistering growth rate:

“Our Taiwan offering is growing faster and stronger than even the most optimistic forecast we set at the beginning of the year. After ending last year in Q4, with a quarter -over -quarter revenue growth of 23%, this quarter revenues surged 54% quarter -over -quarter, more than double the pace of revenue growth from just two quarters ago. Year -over -year revenue growth was triple digits in Q2, and we expect that to be even higher in Q3” - Q2 2025 Conference Call

Taiwan is growing revenue 54% quarter-over-quarter, and they expect even more acceleration in Q3. The country is ramping up quickly, meaning the Coupang playbook is working to attract customers, subscribers, and e-commerce spending.

Capital spending will increase in order to replicate Coupang’s South Korean offering in Taiwan. Free cash flow will be hit in the interim. But it will accelerate revenue growth and lead to an increase in long-term cash flows.

Today, Coupang has a market cap of $51 billion, an enterprise value below $50 billion, and generated $32 billion in revenue over the last twelve months. There is a clear path to $50 billion in revenue and potential for $100 billion in annual revenue if this team can execute (I think they can).

Assume a 10% normalized free cash flow margin excluding stock comp, and the stock looks cheap on a five-to-ten year time horizon.

Coupang is a 14.5% position in my personal portfolio today. I have a lot of confidence in the stock. So much so, maybe I need to stop talking about it.

-Brett

Did you look anything on competitors like PDD (TEMU)?