Cava Group: Our Mediterranean Future (Ticker: CAVA)

A full research report on the fast casual chain down 65% from all-time highs.

Below, paying subscribers can read my research report on Cava Group (Ticker: CAVA).

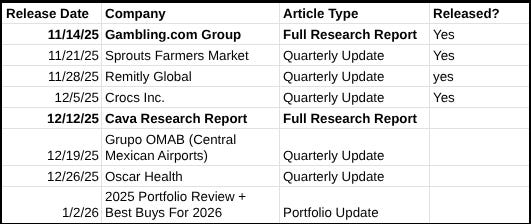

Here is the Emerging Moats Research schedule (including existing reports) through the end of 2025:

You can subscribe here:

“Consumers are excited about each Cava store opening, and the company is opening restaurants quickly. On average, units opened in 2025 are trending above $3 million in annual sales. This is higher than the chainwide $2.9 million average and far ahead of the year-one $2.3 million target, notes Sharon Zackfia of William Blair. Those locations earn back their roughly $1.4 million build costs in about two years on average, an unusually fast payback in the restaurant industry.

That strength is showing up both in legacy markets and brand-new ones. This is why analysts think Cava can grow well beyond 1,000 restaurants.

If the chain eventually matches the store density it already has in the Washington, D.C., area, Zackfia estimates it could support something closer to 2,000 locations nationwide.” – The Wall Street Journal, November 30th, 2025.

Restaurants are a dichotomous sector. We all know the adages: high failure rates, high turnover, and the struggle to consistently generate a profit. Even excluding mom-and-pop shops, restaurant chains are rarely strong businesses, leading some investors (perhaps smartly) to avoid the sector altogether.

But when a restaurant concept works, man, does it work. Domino’s Pizza. Starbucks. McDonald’s. Incredible stock price performance driven by steady store count growth and consistently high ROIC over decades.

I believe restaurants are an area where the individual can compete fairly with institutions. Consistent customer traffic, comparable store sales growth at or above inflation, and a long runway to expand unit count with existing proof of success in multiple regions are the ingredients for a multibagger restaurant stock. Time horizon and patience matter, which is where we have an edge.

Of course, valuation is important. When the narrative turns bullish on a restaurant, investors will price in many years of unit count growth.

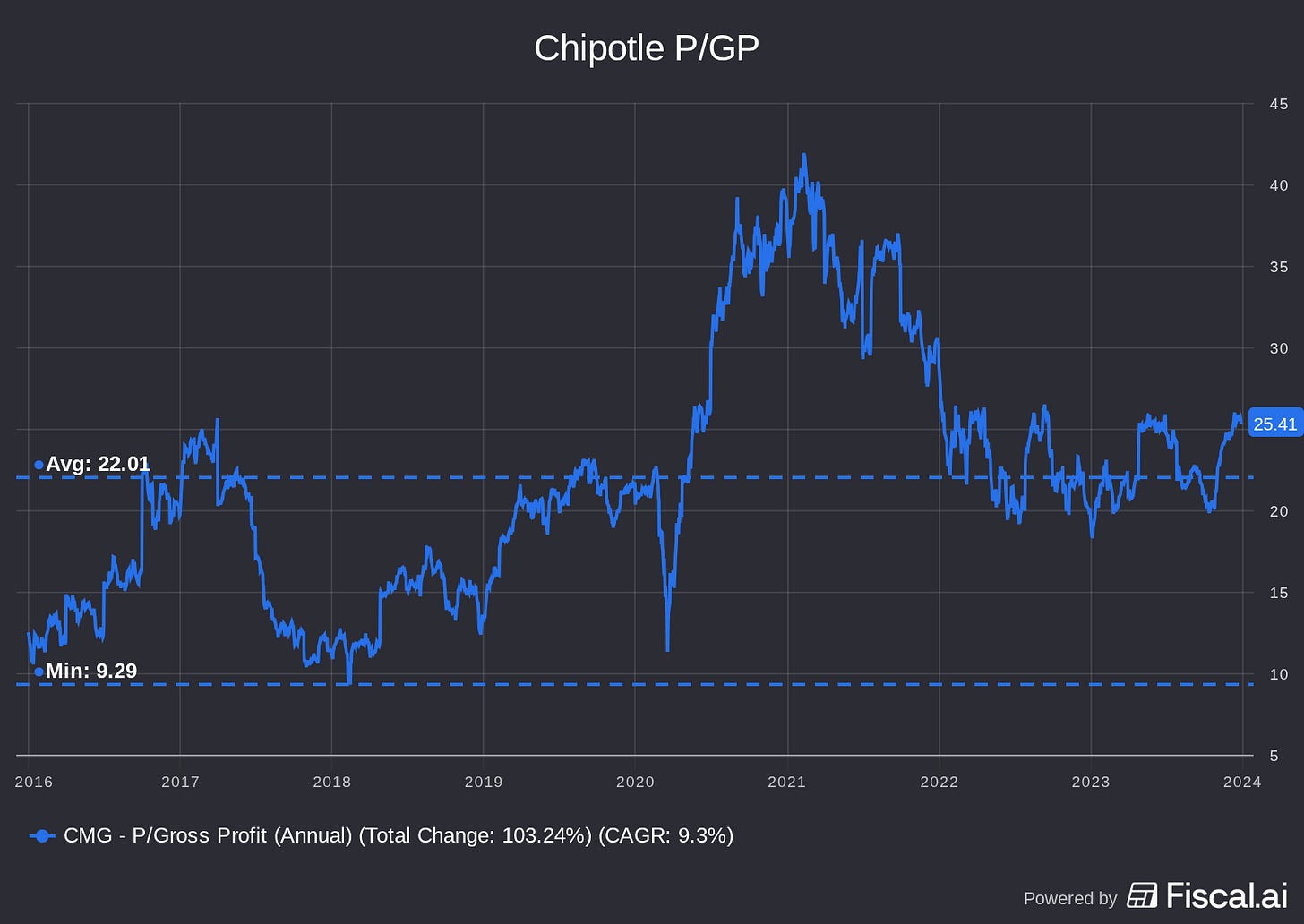

Take Chipotle. It is the textbook restaurant success story of the 21st century, creating the fast-casual category as we know it. Over the last 10 years, it has traded at an average multiple of gross profit of 22 and has barely spent any time trading below a P/GP of 10. Too expensive to buy, right? Even if an investor bought Chipotle stock right before the salmonella outbreak – poor timing when the stock was already expensive – you would have a 200% total return despite the stock’s recent 50% drawdown. For anyone who waited to buy Chipotle at a cheaper earnings multiple, you have a nice market-beating investment.

And if you held the stock from the IPO? You have earned a 20% compounded annual return over 20 years. A durable expansion story persistently underrated by investors.

One might argue perfect hindsight, looking back at Chipotle’s stock chart. But that is the point. If one can identify the financial ingredients that lead to a highly profitable restaurant chain, one can place their bets on emerging concepts that exhibit the same characteristics. Not all of them will work, but some will turn into multibaggers. Losers can be discarded, and your slugging percentage will generate acceptable portfolio returns. At least, that is my theory.

Which is why I have an investment in Portillo’s. And, while not a restaurant, Sprouts Farmers Market.

It is why I am interested in studying Cava. The Mediterranean fast-casual chain went public in 2023 and was deemed “the next Chipotle” in the financial media.

Cava had all the same characteristics as an early Chipotle, and, at the time of the IPO, one could argue it had better growth metrics. As you’ll see below, its comparable store sales were incredibly strong.

With this context, you can understand why investors bid up Cava stock to the moon. It has had an average P/GP of 40 since going public, and traded as high as 70(!) in late 2024.

Today, Cava stock is in a 65% drawdown and trades at a much more palatable 22x trailing gross profit, which inspired me to start researching the name again.

Is the Cava concept durable? Can I trust management? Is the stock finally cheap today?

I think now is as good a time as any to try and answer these questions.

Let’s begin with the origin story.

Serendipitous beginnings

Keep reading with a 7-day free trial

Subscribe to Emerging Moats Research to keep reading this post and get 7 days of free access to the full post archives.